What are the electoral politics of the Multi-Party Charter?

26 January 2024

The Multi-Party Charter, or MPC, currently comprises 10 political parties:

The Democratic Alliance (DA), Inkatha Freedom Party (IFP), Freedom Front Plus (FF Plus), African Christian Democratic Party (ACDP), Action South Africa (ASA), United Christian Democratic Party (UCDP), United Independent Movement (UIM), Ekhethu People’s Party (EPP), Spectrum National Party (SNP), and the Independent South African National Civic Organisation (ISANCO).

The charter itself, a substantive agreement to which all of these parties are signatories, says it does not seek to bring the ANC below 50% (it presumes this is inevitable: “the parties recognise that the ANC will fall below 50% in the 2024 elections, both nationally and in a number of provinces”). Rather, it says it is designed to demonstrate a “new compelling vision that shows South Africans how we stand for them”.

To this end, it sets out a number of shared policy positions, principles and values.

However, the purpose of this essay is not to interrogate the policy or principles of the charter, but to focus strictly on the electoral mechanics at play.

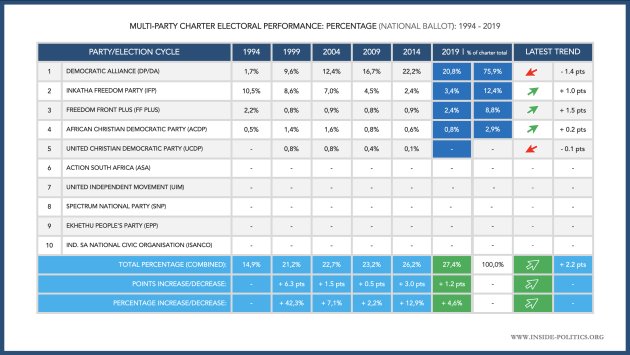

To that end, let us start with the national electoral history of the 10 member parties. Five have stood in national elections before, four in 2019. The table below sets out their percentage performance, individually and collectively.

Together, in 2019, those four parties won 27,4% of the vote. On face value, it is immediately apparent how dominant the DA is, as of the last election. The DA’s 20.8% comprises 76% of all existing MPC votes. The other three parties (the IFP, FF+ and ACDP) are worth 6,6% of all votes in 2019 or 24% of all MPC voters.

As a collective, the existing members of the MPC have systematically increased their combined vote share over time but, outside of 1999 (collective growth of 42%), there has never been a seismic jump. The MPC has grown by: 7% (2004), 2% (2009) and 13% (2014).

Finally, and most recently, the MPC did grow as a collective in 2019, in percentage terms (5% growth); but, importantly, this was entirely on the back of the IFP, FF+ and ACDP. The DA went backwards marginally but the collective growth of those smaller parties was enough to secure a general increase.

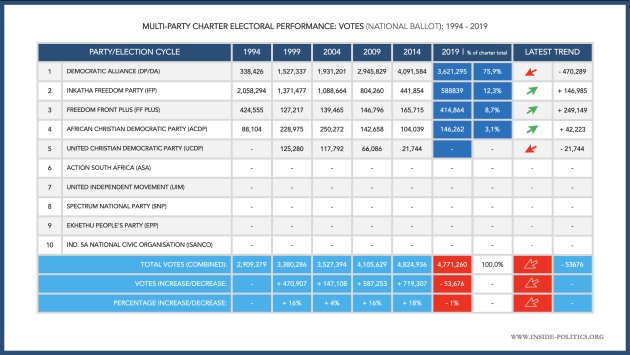

If we look at their collective performance in terms of absolute votes, as per the table below, the situation is obviously similar, but not identical.

In 2019, collectively, the MPC won 4,771,260 votes. The DA still dominates in 2019 – its 3,621,295 votes are again worth 76% of all MPC votes, the rest: 1,149,965 votes, or 24% of all charter votes.

However, in terms of absolute votes, as a collective and unlike its percentage performance, the MPC went backwards in 2019. Its growth in absolute terms is more impressive and consistent than in percentage terms: 16% (1999), 4% (2004), 16% (2009) and 18% (2014). But then, in 2019, it declined as a collective: down 1% or 53,676 votes. In this case, the DA’s decline could not be overcome by the growth of the smaller parties.

There are a number of parties in the MPC whose vote share we do not know, as they have never stood before, or have collapsed. For the most part, their contribution (the UCDP, UIM, EPP, SNP, ISANCO), will likely be negligible. The MPC will be looking for them to scrape together a few percent between them.

The problem the MPC has on this front, is that the cut off for a seat in parliament is typically around 0,2%. While these small parties might be able to get this collectively, individually they are going to battle. So their individual contributions might well come to nought.

Really they need to amalgamate to stand a realistic chance of getting a seat because percentages are nice symbolically, but no seats is of no help to anyone.

Then there is ASA. It can add some substantial heft to the MPC, all things being relative. We don’t know its full potential. If it mirrors its 2021 performance it can get 3%. If it doubles that, 6%. That is probably a reasonable rough range.

Of course a chunk of those votes will come off the DA. So if ASA grows, it is not necessarily to the benefit of the MPC as a whole. Regardless, on a good day, the MPC is definitely capable of breaking into the 30%-40% band. What it would take for the charter to get to 50% will be the subject of a separate analysis, but it would require it to effectively double its current vote share, and that is extremely difficult to do.

What does the MPC mean in terms of political capital? Three things are important here.

From the DA’s perspective, it allows some of the attacks on it – particularly from the FF+ and ASA – to be partially neutralised, and therefore strengthen its electoral potential. The DA is perhaps the primary benefactor of the arrangement, when seen in this light.

From the smaller parties’ perspective, it allows them to benefit disproportionally should any power-sharing arrangement actually arise. This is obviously a powerful upside. But it is also a risk, especially nationally. Such an arrangement is most likely in Gauteng, then perhaps KwaZulu-Natal. But nationally it is a far more unlikely situation. So the risk is: it helps the DA grow nationally and can still get enough support to be a role player in provincial power sharing arrangements, but their own national impact is diluted.

Perhaps most importantly – turnout, which benefits all comers. The greatest electoral benefit of any opposition agreement is its potential effect on turnout. Opposition voters love the idea of working together for a common goal. If credible and convincing, it can drive opposition voters turnout up in a way no individual party ever can. When it is coupled with a realistic prospect of actually winning, it is enormously powerful. And, for the ANC to fall below 50%, the charter must work to it full potential.

The turnout potential of the MPC is likely the glue that binds. Whatever the MPC says about the ANC and 50%, this is a real and primary reason for its formation.

Whether the MPC can do all this credibly and convincingly, we shall see. At the moment it seems more forced than authentic, and its members more cautious rather than committed, most likely for the reasons above. Voters can sense that. Rather than a sum of all parts, it feels like all the parts of a potential sum.

If the MPC does win a government, what are the electoral consequences?

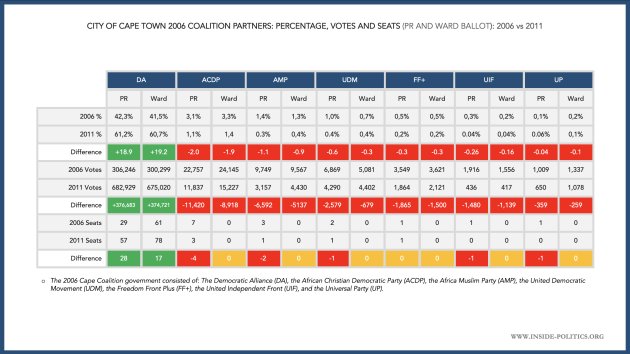

There is not much data on this, due to the absence of long-term stable coalitions. But there is one example we can look at: The Cape Town Coalition of 2006, which famously gained control, when the ID voted with the ANC, and the PAC abstained to give six parties power by a single vote.

That coalition, with Helen Zille as mayor, held for a full term. But there were electoral consequences for the smaller parties in that coalition. Below is a table that shows the support of all the Cape Town coalition partners, on the PR and Ward ballot, when they won in 2006, and how they all performed in the next local government election, in 2011.

As you can see, it was electorally devasting for the smaller parties. But enormously profitable for the DA, as the majority partner. Every single party in that coalition, outside of the DA, lost support, on both ballots and in terms of their percentage and absolute votes, in 2011.

This may seem counter-intuitive; after all, if a coalition delivers – which Cape Town did – it makes sense all partners should benefit proportionally? But it doesn’t work like that in real terms. In real terms the mayor becomes the de-facto symbol for the coalition, dominates media coverage and becomes a synonym for coalition delivery. In turn, supporters of that party do the sum: “If my party is happy in a coalition, and the coalition is delivering and well-managed by the mayor and the majority party, I might as well just vote for the majority party.”

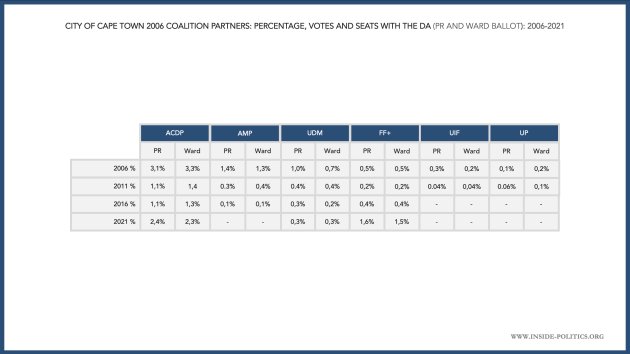

So the DA vote exploded in Cape Town in 2011. It secured a healthy majority, and although it left the door open to future coalitions, it really didn’t need them anymore. As for the smaller parties, it took them years to recover. The table below shows their support in 2011, 2016 and 2021.

Some of those smaller parties vanished altogether, the more substantial of them – the ACDP and FF+ – only began to approach or surpass their 2006 levels in 2021, some 20 years later.

That outcome is not set in stone. But it is fairly common for coalitions. It is the great risk to those smaller parties in the MPC. And they are very wary of it. It is, for example, the reason why ASA demanded, as part of their current Tshwane arrangement, the new post of deputy mayor be created. It is entirely unnecessary, so far as the actual government goes, but, as a junior partner, ASA needs some public prominence, and deputy mayor is one way to help.

A lot of people may balk at that, it is after all public money, but these are the sort of compromises coalitions require to be stable, and South Africans need to mature to that.

We will have to see how the MPC addresses the electoral challenges coalitions risk for smaller parties, if and when any formal arrangement comes to pass.

The key takeaways of this analysis are:

The MPC, currently comprising 10 parties, managed 27,4% of the vote collectively in 2019, and 4,771,260 votes.

Four of the charter parties actually stood in 2019, the other six did not. Of the other six, five are unlikely to reach the 0,2% threshold typically needed to win a seat in parliament, in2024. They may stand a better chance if they amalgamate. But really they are symbolic.

ASA, however, can add something relatively substantive to the charter’s electoral performance.

It is quite possible for the MPC, on a good day, to collectively break into the 30%-40% bracket. 50% and above will be much more difficult.

The MPC is dominated by the DA. 76% of all its support comes from that party. And so the MPC’s collective performance is fundamentally determined by the DA’s performance.

In 2019, the MPC’s collective growth in percentage terms was negligible and in absolute terms it declined marginally, both as a consequence of the DA’s decline. Regardless, from 1999 onwards, there has never been a seismic increase in its support, in either terms of percentages or absolute votes.

The DA seems to be best placed to benefit from the MPC electorally. It will help neutralise attacks from the smaller parties. If it can win a government though, the smaller parties are set to be disproportionately important, and to benefit from that.

The most important element of the MPC, electorally, is its potential effect on turnout. If it can be delivered to opposition voters consistently, credibly and over time, along with the realistic prospect of it actually winning, it can fundamentally impact opposition turnout and disproportionally benefit all members of the charter. It still need to be seen if that can be done to its full potential.

The Cape Town coalition government of 2006 suggests a big electoral risk for smaller parties, if a MPC coalition is formed. If the coalition government is experienced by the public as no more than an extension of the dominant party, smaller parties tend to fade away, and battle to recover.

How the MPC deals with this problem remains to be seen. Compromise is needed, and maturity from the public in understanding and accepting those compromises.

All numbers in this essay are drawn from the Independent Electoral Commission website: https://www.elections.org.za/pw/

This essay is the 8th in an on-going series on Election 2024, for all other editions of this series, please click here: Election 2024