Statement by Minister Malusi Gigaba on Mango and the South African aviation sector

In the wake of on-going statements from the Comair Group pertaining to Mango SOC Ltd, I am compelled to set the record straight. The allegations made by Mr Venter, CEO of Comair Ltd, including citing Mango as the cause of 1Time's demise with over 1000 employees as collateral damage, are serious in nature and designed to cause commercial harm to Mango as an entity, and by default the State, with an apparent expectation of impunity to recourse.

We are disheartened by the demise of 1Time and the subsequent job losses incurred. It is not only employees that are directly impacted but also their families along with up and downstream community economies. 1Time's exit is regrettable given the partnership between public and private entities to create employment and economic growth. After all, aviation serves as one of the building blocks a successful and developing economy.

Mango remains, as from day one, an entity operating independently from its Shareholder (South African Airways) - created to have the lowest cost base of any South African carrier and comparable to leading low cost operators globally. We appreciate Mr Venter's classification of Mango as an efficient airline that serves to lower the cost of ticket prices in the hands of the public - being the exact mandate of the entity. The systematic attempt however at disaggregation of competitively sensitive information such as cost composition, beyond what Comair is willing to disclose itself to its own Shareholders, comes across as hypocritical and self-serving.

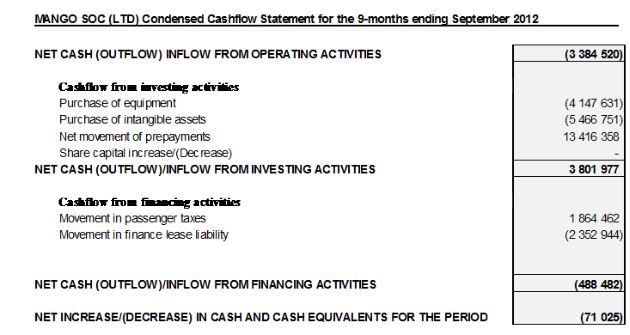

In good faith and in the spirit of transparency however, I have elected to make Mango's current, calendar-year-to-date cash flow statement (movement) available, intentionally covering SAA's fiscal year-end. Reflected in this statement, interested parties will read that Mango is in cash positive, neutral movement position, ergo, that the airline is a model of stability within a sector plagued by continuous economic challenges in a contracting market. Salient points include:

- There have been no changes to the entity's Share capital during the period under review nor have there been any changes in this regard since the entity settled its Shareholders loan in 2007, as clearly reported in the published annual reports of South African Airways at a Group level for every year subsequent. What should be clear from this is that Mango did not benefit from any capitalisation or guarantee issued in favour of its parent company, SAA, and in this regard there could not have been a market-distorting effect as insinuated;

- Within a business dominated by cash flow and a local Industry characterised by losses during recent times regardless of nature of ownership or geographic location, including interim losses reported by Comair itself, Mango maintained a cash-neutral position during the review period. Whilst, generally speaking, cash flow cycles are cyclical, Mango has been substantially cash-positive since inception and no expectations exist that the entity would require any form of related Shareholder assistance in the years to come.

Additionally, other pertinent performance indicators applicable to Mango's current financial year include:

- Unit Revenue (RASK) growth of 28.2%, with working capital changes positively affected by robust growth in passenger forward sales;

- Passenger load factors maintained at above 80% (exceeding the Domestic Market average by an average of 3 percentage points);

- Aircraft asset utilisation, at 9.1 hours per day, and people productivity between 3,400 and 3,600 passengers per employee per annum, substantially leading the Domestic Industry;

- Asset efficiency, expressed as number-of-passenger-per-aircraft-per-year, of between 300,000 and 400,000 passengers/aircraft, ranking amongst the best globally.

The fundamentals of Low Cost aviation, namely scale growth, positive cash generation and high asset utilisation and productivity reflect strongly within Mango - an entity that operates under a strict governance framework and structure that includes the Company being subject to accepted Accounting (with a major auditing firm as external auditors and, incidentally, Mango's internal audit function being performed by the same audit Group that is responsible for Comair's external audit function), Safety (inter-alia as applied through the Civil Aviation Authority) and Regulatory (inter-alia Competition regulations) prescripts.

These attributes, intrinsic to Mango as a stand-alone company, contributes to financial sustainability of the entity, even in tough economic times characterised by increasing cost, declining demand and increased price-sensitivity.

In this regard Mango, subsequent to a loss realised in its maiden full fiscal (which, contrary to competitor rhetoric, was fully disclosed in the SAA Group's financial statements for the year ending March 2008 - refer www.flysaa.com), has maintained bottom-line profitability through the challenges posed by record fuel prices in 2008 (break-even FY2008), depressed demand associated with the Global Economic Crisis of 2009 (R10.9m profit) a stable year in 2010 (R13.7m profit) and a challenging 2011 (R300k profit).

With the combination of high fuel cost, increases in regulatory charges, suppressed demand and excess supply (following the further entry of Velvet Sky in 2011) fully accounted for and reflected in Mango's FY2012 loss (amounting to approximately R58 per passenger, or roughly equivalent to the increases in regulatory charges), the Company is again on track to return a profit for the current fiscal. The assertion that Mango has realised excessive losses since its inception is accordingly factually incorrect.

Turning to other matters of unsubstantiated allegations:

Cross-subsidisation of services

Mango receives three types of major services from its parent Company, SAA:

1. Central Treasury services, to the extent that surplus, non-operational cash gets consolidated for purposes of Group application and optimisation - a common and logical practice within a Group context. In this regard Mango receives an effective interest rate on positive cash balances of Prime less 3.3 basis points, a rate lower than that obtainable through commercial banks and accordingly a competitive impediment at Mango level;

2. Aircraft maintenance services from SAA Technical, in the same vein as services provided to Comair brands BA and Kulula. The effective rate applicable to this service, on a like-for-like aircraft type, is marginally higher for Mango than for Comair - a matter that transpired due to normal free-market functioning and a desire on the part of SAA Technical to grow its customer base;

3. Aircraft sub-leases, representing a transfer of existing SAA Group aircraft at the end of their lease terms to Mango at rates directly negotiated by Mango. In this regard it is prudent to point out that a State-owned Company such as Mango, whilst conceivably benefiting from a lower cost of capital due to the nature of its ownership, conversely is penalised by the unintended financial effect of the National Industrial Participation Program (NIPP), resulting in the company paying a marginally higher rate for capital assets such as aircraft than private enterprise competitors who are not subject to NIPP obligations.

The above represents the full extent of material intra-Company services between Mango and its parent company, with matters such as fuel procurement being a function of independently negotiated contracts directly between Mango and its fuel suppliers.

The above are matters of fact, which can only be evidenced by contractual review, noting that not even a publically listed entity such as Comair discloses aircraft maintenance rates in its own financial statements (whether in aggregate at a Group level or at a separate Brand level). In this regard it is further worth pointing out that the supply arrangement between SAA and Mango has been reviewed by the Competition Commission prior to the inception of the entity - a fact known but conveniently suppressed by Mango's competitors.

Mango's alleged complicity in 1Time's demise

Comair chooses, at a time of material global and local Industry crisis and, more specifically, a time of human hardship for 1Time employees, to assert underhanded practices on the part of Mango, when in fact:

Comair competed with 1Time on every one of the 1Time's eight Domestic routes, whereas Mango competed on three routes only;

The only Competition Commission complaint lodged by 1Time during its existence was aimed at Kulula, relating to alleged exclusionary practices pertaining to the Lanseria port;

A cursory search of public-domain coverage (Google), pre-dating Mango's launch (2004 - 2007), indicate the extent of animosity and rivalry that existed from Comair towards 1Time, given that the founders of 1Time were ex-Comair executives;

The extent to which 1Time suffered losses after eventually being allowed to enter the Lanseria-Durban and Lanseria-Cape Town routes, where Kulula holds a dominant position with more than 65% of departures.

Whilst it cannot be postulated that activity by carriers such as Velvet Sky, Mango, Kulula etc would not have had some effect on 1Time, it is an undeniable fact, propagated by Comair and a plethora of market commentators and Industry experts, that 1Time operated a fuel inefficient fleet that would see the commercial viability of the entity compromised during times of escalating fuel prices.

In this regard 1Time's financial fortunes showed a clear correlation with movement in energy cost, a consequence of operating technology that is four decades old. It is further not true that 1Time was starved from the cash necessary to upgrade its fleet due to Mango's entry:

- 1Time recorded its largest profits in the years following Mango's launch, reporting revenue gains of 36% and 56% in the two years immediately following Mango's inception;

- 1Time generated R224m in cash from operations for the 2009 fiscal (bearing in mind that Mango was started with a Shareholder loan of R100m), funds it apparently directed to establishing a maintenance facility as opposed upgrading of fleet.

Whilst 1Time's exit remains regrettable it would be unjust, and illogical, to assign blame to a single market participant or competitor without reference to the underlying sustainability of 1Time, given its fleet choice, the opportunity cost of capital investment decisions taken by the entity itself and the general impact of supply changes or activity on the majority of routes operated by 1Time, as well as the consequence of robust competition.

In conclusion:

Mango has achieved profitability in 3 out of 5 full fiscals - with bottom-line performance disclosed during the very first full fiscal year and subsequently on an ad-hoc basis (a greater level of segment reporting than is afforded to the Shareholders of the remaining airline group in SA);

Mango has never, and is unlikely ever to, participate in any benefit of capitalisation of its parent company - if not for the simple fact that the Company is substantially cash positive. The disclosure of an abridged airline cash-flow at individual airline brand level - done in this release - represents a level of disclosure never before afforded to any South African airline shareholder, whether public or private;

Mango is legally and organisationally ring-fenced from SAA, with a clear mandate to: (1) be financially self-sufficient and sustainable and (2) to reduce the cost of air travel to all South Africans (leading to Comair's statement: "Mango may be an efficient airline, but just sells tickets too cheaply.");

Mango leads the Market in core performance metrics, including asset and people productivity as well as innovation, leading to a reduction in the cost of air travel to the benefit of South Africans;

Mango's conduct in the Market has been such that both its listed private competitors still managed record profits whilst Mango had been active in the Market.

The South African economy requires a strong and vibrant aviation Industry in order to prosper, a situation to which the Department of Enterprises has expressed its commitment through nurturing successes such as Mango and by taking decisive action, as is currently in progress through the recalibration of South African Airways.

As its shareholder, the Department of Public Enterprises has mandated Mango to manage any queries arising from this statement.

For media enquiries contact:

Hein Kaiser

Mango Communication

Statement issued by: the Ministry of Public Enterprises, November 6 2012

Click here to sign up to receive our free daily headline email newsletter