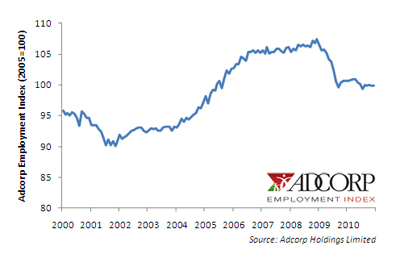

Adcorp Employment Index, December 2010

Salient features

- The Adcorp Employment Index declined by an annualized 0.13% in December. The number of permanent workers decreased by 0.21%; the number of temporary workers increased by 0.07%; and the number of agency workers increased by 3.84%.

- The retail and wholesale trade sector experienced in an increase in employment of 9.58%, and the trade-supporting transport, storage and communication sector increased employment by 4.60%. This suggests that the year-end retail season was somewhat more buoyant than many analysts had predicted.

- Significant job losses occurred in the construction sector, where employment fell by 10.93%, and moderate job losses occurred in the financial services sector, where employment fell by 4.46%. This suggests that South Africa's economic recovery remains patchy and uneven, isolated in particular sectors.

- Employment of high-skilled workers (notably managers and professionals) as well as sales and service workers increased significantly, by 3.64% and 8.70% respectively. Unemployment for the month was focused among low-skilled and manufacturing workers, where employment declined by 5.75%.

- The risks to South Africa's employment outlook remain acute. Substitution of capital for labour rose steadily between 1970 and 2010, and the ease of replacing workers with machines is currently at the highest level in history.

Analysis

One of the striking features of the unemployment debate in South Africa is that high wage levels have been sidelined as a possible cause of unemployment. Many other factors have been promoted, directly or indirectly, as causes of unemployment, including a supposed pervasive skills shortage and a purported bias against the employment of black graduates and professionals.

Naturally, it has been politically expedient to treat the employment consequences of high wage levels as marginal or negligible, since doing so diverts attention from organized labour's monopoly over the wage setting process. Increases in total remuneration during 2010 reached 16.8%, which far exceeded both the increase in the cost of living (3.5%) and the growth of labour productivity (-0.4%). Real remuneration is now increasing at an unprecedented rate.

Trade unions are permitted to act as labour cartels by the highest law in the country. As such, collusion to bring about higher wages is an inalienable right for workers. Additionally, collusion between workers is deeply embedded in South Africa's labour market institutions. The Labour Relations Act (1995), in particular, ensures that wage levels can only rise, irrespective of an employer's underlying economic vitality, with the result that retrenchments (as opposed to, say, wage freezes or reduced benefits) are an inherent outcome of the labour relations system.

What is interesting, in this anti-competitive arrangement, is why employers agree to workers' escalating wage demands. To date, there has been no adverse shareholder response to high wage settlements reached between managers and workers. Employers' starting wage offers in the collective bargaining process (typically ranging between 5% and 11%) have been far above the level justified by labour productivity or the cost of living. Employers in both the private and public sectors have demonstrated a high degree of aversion to industrial action such as strikes and work stoppages, apparently preferring to make quick and easy concessions when wage disputes arise.

Unemployment is a natural consequence of excessively high wage demands. Following a sharp rise in wages, employers retain only those employees whose higher productivity justifies the higher wage level, laying off the remainder.

Employers replace these workers with physical capital and technological innovations which raise the productivity of those workers who remain employed. Inevitably, retrenchments are concentrated among low-skilled workers, especially youth, who do not possess the education, training, or experience - that is to say, the productivity - to qualify for jobs at the higher wage level and who do not possess the qualifications or skills to adapt to a rapidly mechanising workplace.

The inevitable conclusion is that private sector employers, by acceding to excessive wage demands, do not intend to raise their employment levels. Instead, employers' behaviour reveals that their long-term plans are to replace workers with machinery and technology, which are not subject to the monopoly pricing inherent in the employment of labour. Additionally, labour costs are ongoing (and rising), whereas capital investments are written off as permitted by the tax system, with negligible maintenance and incremental replacement costs.

The key factor driving these intentions is a high degree of substitution between labour and alternatives to labour, such as machinery and technology. The potential for labour/capital substitution has been rising sharply in South Africa. Between 1970 and 2010, the elasticity of substitution (that is, the ease with which an organization could switch from labour to capital or vice versa) increased from 0.43 to 0.71 - an increase of 65%. High returns on capital combined with high and rising labour costs are driving employers to replace workers with machines including, since the 1990s, information processing machines.

The net result is that South Africa's employment outlook is exceedingly grim. For reasons connected to the current stage of the business cycle, businesses remain tentative about their growth prospects. As a result, the retrenchment of permanent workers is likely to continue during 2011, and their substitution by temporary workers is likely to surge. For reasons connected to collusive practices in the wage-setting process, the diminished use of full-time workers and their replacement with part-time workers is likely to continue, as an attempt to boost on-the-job productivity and reduce unnecessary labour costs. We continue to believe that the unemployment rate will rise to 45.5% by 2020.

Additional Data

Employment by Type

|

Occupation |

Employment Nov 2010 |

Percentage change vs. Nov 2010* |

|

Typical (permanent, full-time) |

9,079,761 |

-0.21 |

|

Atypical (temporary, part-time) |

3,783,462 |

0.07 |

|

- of which agencies |

979,539 |

3.84 |

|

Total |

12,863,223 |

-0.13 |

* Annualized

Employment by Sector

|

Sector |

Employment Nov 2010(000s) |

Percentage change vs. Nov 2010* |

|

Mining |

312 |

3.86 |

|

Manufacturing |

1,416 |

-1.69 |

|

Electricity, gas and water supply |

86 |

-13.79 |

|

Construction |

544 |

-10.93 |

|

Wholesale and retail trade |

1,641 |

9.58 |

|

Transport, storage and communication |

524 |

4.60 |

|

Financial intermediation, insurance, real estate and business services |

1,608 |

-4.46 |

|

Community, social and personal services |

2,579 |

-1.39 |

* Annualized

Employment by Occupation

|

Occupation |

Employment Nov 2010 (000s) |

Percentage change vs. Nov 2010* |

|

Legislators, senior officials and managers |

1,016 |

3.55 |

|

Professionals |

661 |

3.64 |

|

Technical and associate professionals |

1,529 |

-2.35 |

|

Clerks |

1,459 |

2.47 |

|

Service workers and shop and market sales workers |

1,806 |

8.70 |

|

Skilled agricultural and fishery workers |

103 |

0.00 |

|

Craft and related trades workers |

1,453 |

-5.75 |

|

Plant and machine operators and assemblers |

1,041 |

-5.74 |

|

Elementary occupation |

2,429 |

-3.45 |

|

Domestic workers |

810 |

-1.48 |

* Annualized

Employment by Province

|

Province |

Employment Nov 2010 (000s) |

Percentage change vs. Nov 2010* |

|

Western Cape |

1,716 |

-2.09 |

|

Eastern Cape |

1,276 |

-2.81 |

|

Northern Cape |

289 |

8.36 |

|

Free State |

738 |

1.63 |

|

KwaZulu-Natal |

2,420 |

-0.50 |

|

North West |

805 |

1.49 |

|

Gauteng |

3,623 |

-0.33 |

|

Mpumalanga |

855 |

2.81 |

|

Limpopo |

853 |

1.41 |

* Annualized

Issued by Adcorp, January 10 2011

Click here to sign up to receive our free daily headline email newsletter