SANRAL distorts figures to conceal tolling sins

1 MAY 2015

The City of Cape Town has noted that SANRAL is trying its very best to paint its Winelands Tolling Project in a positive light, either by placing disingenuous full page advertisements in local newspapers or by misrepresenting figures. Read more below:

SANRAL has in its papers before the Western Cape High Court presented figures about the Winelands Tolling Project in a way which has the effect of distorting the financial picture and obscuring the implications of tolling.

This is in line with SANRAL’s conduct thus far in the City’s review application and their appetite for secrecy in matters of great public importance.

Instead of playing open cards with the public about the real costs of the proposed tolling of the N1 and N2 freeways, SANRAL tries to conceal it with accounting practices.

One example of this is that SANRAL bundles cost groupings, which makes it difficult to see their true nature.

For instance, the Protea Parkways Consortium (PPC’s) profits and taxes are lumped under ‘development and finance costs’ and not separately accounted for. In this way SANRAL presents PPC’s pre-tax profits as being included in the costs of ‘infrastructure operations and maintenance’, which it describes as a ‘non-toll expenditure’.

SANRAL has not considered the option of constructing the upgrades to the N1 and N2 freeways by using public money, even though it is much more efficient and that is how the majority of roads in South Africa are financed.

The only alternative to PPC’s private tolling scheme presented by SANRAL is a privately financed non-tolling scheme. However, a private non-tolling scheme is unprecedented in South Africa and nobody has ever suggested that as an option.

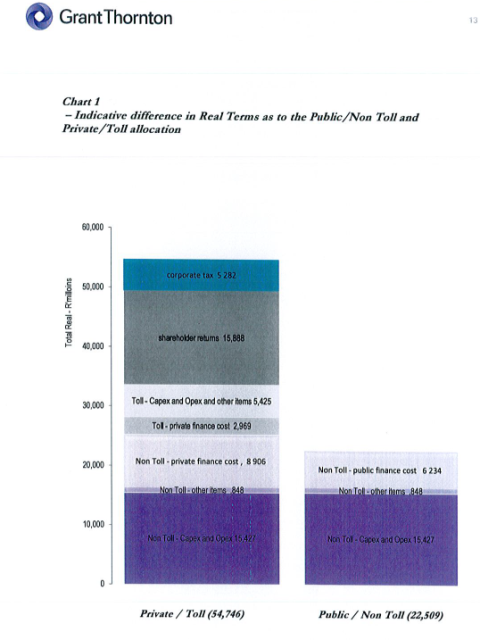

SANRAL’s figures also do not consider the fact that public finance costs are substantially cheaper than PPC’s proposal.

Another way in which SANRAL distorts the figures is through the use of discounting.

While discounting is commonly used in accounting, SANRAL applies it in a way which emphasises construction costs and de-emphasises toll payments and profits. This makes it difficult to understand the comparison of construction costs, toll payments and private profits.

Discounting is used to account for the principle that money in the future is worth less than money now.

Tolls will be paid for a period of 30 years and will increase each year by the CPI, which measures inflation. The actual cash spent on toll payments in the future is called the nominal amount. The ‘real values’ remove the effect of inflation and are the figures which the City uses. SANRAL however uses ‘present values’ by applying a further discount, which is 14% on nominal. This is relatively high and produces anomalous effects when the finances of a tolling project are analysed.

To avoid the distortions of SANRAL’s approach, the City’s figures are presented as ‘real values’ and accounts separately for the pre-tax profits. See the chart below from the Grant Thornton Report, attached (included in the City’s replying affidavit):

It is of great concern that SANRAL, as a public entity, is not committed to the founding principles of our constitutional democracy such as openness, transparency and accountability.

Note to editors: The Grant Thornton Report about the Winelands Tolling Project forms part of the City’s replying affidavit and is available on request.

Statement issued by Councillor Brett Herron, Mayoral Committee Member: Transport for Cape Town, City of Cape Town, May 1 2015