Market Sentiment Index (MSI) - February 2008

MSI drops dramatically to its lowest point since mid-2003

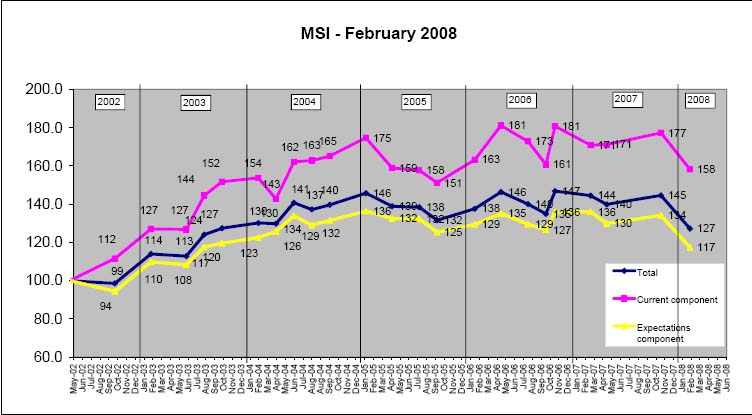

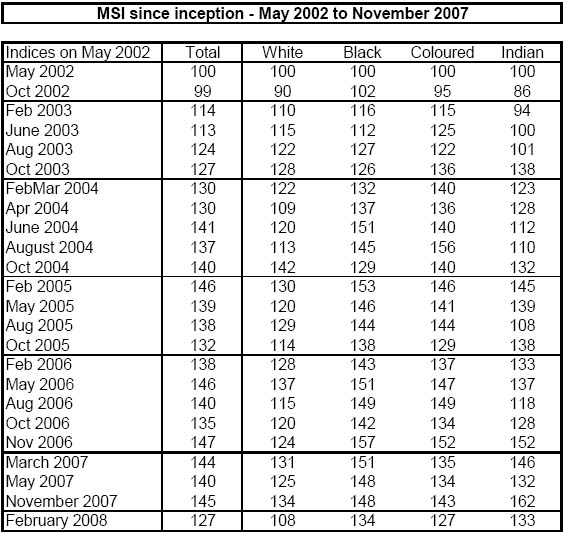

TNS Research Surveys has released their Market Sentiment Index (MSI) results for metropolitan adults for February 2008 (the study was conducted from 7 to 17 February). The Index dropped 18 points from 145 in the last quarter of 2007 to 127 in February 2008 to reach its lowest point since mid-2003 (base = 100 in May 2002). The index stood at 144 in February 2007. The drop of 18 points is the largest ever drop in the index since the MSI has been tracked (May 2002).

This is against a backdrop of increasing food inflation (14.1% year on year in February) and transport inflation (also 14.1% in February) after seven consecutive fuel price increases. The increase in South Africa's consumer price index excluding mortgage rate changes (CPIX) for metro and other areas, used by the SA Reserve Bank (SARB) for its inflation target, was 9.4% year-on-year in February. There have been nine consecutive prime rate increases, each of 0.5%, starting mid-2006.

In addition, December and January saw the advent of widespread power outages caused by load-shedding by Eskom, as well as the ANC's Polokwane conference.

What fuelled this drop?

Almost all components of the index showed declines in February, with the largest being -

• serious concerns about business conditions in six months' time (-19 points);

• an expectation that people's personal economic circumstances will be much worse in six months' time(-19 points); and

• a swing to a pessimistic stance (from a largely optimistic stance in November 2007) in terms how people were feeling about both business condition and personal economic circumstances In February (-14 points).

Compared with this time last year, the main dynamics are -

• a vastly more pessimistic view about all aspects of the economy (business conditions and unemployment) for the remainder of 2008;

• a strong decline in expectations for the rest of 2008 about personal economic circumstances; and

• a strong decline in perceptions about business conditions in February 2008.

Who changed?

Drops were recorded for all race groups.

Our take-out

People are already showing a much lower level of confidence in the economy and have a vastly more pessimistic view of business prospects for the remainder of 2008, as well as feeling personally financially threatened by this perceived negative effect on the economy.

Whilst very high food and fuel inflation, as well as rising interest rates, are, no doubt, key contributor to this feeling of negativity, other research conducted by TNS Research Surveys in February shows that January's load shedding has not only affected two-thirds of people financially, but it is also perceived to be having a negative effect on the economy. In addition, we see President Mbeki's approval rating continuing to drop, and there are serious concerns over Jacob Zuma becoming South Africa's next President. This uncertainty is likely also to have been a contributor.

Given that this research was conducted just after the January round of load shedding but before the increased electricity prices were publicised and before the new round of load shedding, it is unlikely that the Index will improve in the short term.

Background to the MSI

"Sentiment" is said by many to be one of the key drivers in many markets - financial, consumer, durables, the stock market and so on. TNS Research Surveys has developed a Market Sentiment Index (MSI) ideally suited to SA conditions (as a developing country) to provide decision-makers in all parts of the economy with some idea of people's sentiment towards the economy and, hence, their future well-being.

This index examines people's current and future perceptions of the economy in terms of job availability, business conditions, general economic conditions, prices and inflation, likely income, and the effects of AIDS and crime on the economy. These two constructs - "where are we now?" and "where are we going?" are then combined into an overall index. The future perceptions measure, in particular, can be a leading indicator of changes in people's spending patterns if it changes over time by any material amount. The index is calculated via a survey every two to three months of 2 000 metropolitan adults aged 18 years and over, sampled from the major metropolitan areas of South Africa. In the latest reading, 1 265 blacks, 385 whites, 235 coloureds and 115 Indians/Asians were questioned. The overall margin of error is less than 2.5%. The index was first measured in May/June 2002.

*Neil Higgs is a director of TNS Research Surveys