Business trading conditions worst since 2008/09 recession, according to Sakeliga-ETM report

21 November 2019

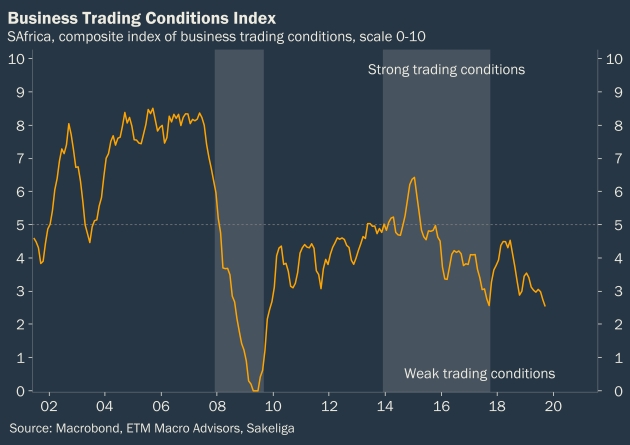

Business trading conditions remained weak in the third quarter of 2019 and South Africa’s business conditions currently are at the worst levels since following the 2008 recession, according to Sakeliga-ETM’s Economic Update for Business Decision Makers.

“Business trading conditions in South Africa are in the worst position since the 2008/09 recession. In practice SA reached ‘junk status’ years ago,” says Gerhard van Onselen, senior analyst at Sakeliga. “Although there are currently few signs of a major global downturn,” Van Onselen continues, “operating and earnings conditions in South Africa are very difficult. Harmful policies and red tape have resulted in economic de-development, hampering private investment and entrepreneurship. This situation can be turned around by reducing substantially the role of the state in determining how resources are allocated and distributed.”

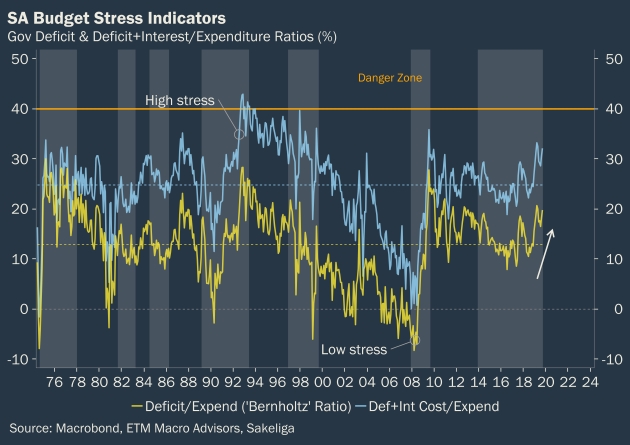

According to Van Onselen, businesses struggled to improve their profitability during the third quarter. Demand among consumers and companies was sluggish. In addition, rising state debt is increasing future taxation risk as government maintains high expenditure and runs enormous fiscal deficits.

“There are some rays of hope in the report, in particular relatively low oil prices and lower inflation in general. Low oil price inflation contributes to curbing input costs for many companies and eases pressure on consumers’ budgets,” Van Onselen said.

The report says that whether or not Moody’s downgrades its official credit rating for South Africa’s government debt is ultimately not going to make a huge difference. The current realities on the ground are more important. The challenge for the Ramaphosa administration is to reverse the damage to the economy that has been factored in by investors already. This damage is already reflected in a weaker rand, higher interest rates, more cautious banks and the flight of people and capital. Furthermore, Van Onselen argues, Eskom is the major risk and should receive most attention.

Turning around state institutions such as the SAA and Eskom has already drawn strong political opposition from the ANC’s alliance partners. Eskom has received numerous large bailouts with the credibility of the restructuring plan remaining to be seen.

Sakeliga has noted the remarks by the minister of finance during the mini budget speech when he announced that state institutions should be turned around and government spending at all levels should be cut. Unfortunately, it is clear that adequate cuts are unlikely to come from the state’s salary account. With projected deficits in the order of R300 billion per annum, government’s fiscal strain is increasing at a worrying pace. Taxpayers should prepare themselves for further tax pressure in the years ahead.

“Government has maintained sizeable fiscal deficits over many years. This means that South Africa will enter the next global recession, when it arrives, on a much weaker footing than in 2008/09.”

Sakeliga’s advice to business decision makers is to understand their specific business risks in the context of de-development. Businesses should look for opportunities to find international exposure, income stream diversification beyond the rand and business models that work with smaller volumes.

Read the complete report at the following link.

Issued by Gerhard van Onselen, Senior Analyst: Sakeliga, 21 November 2019