GOVERNMENT GAZETTE, 8 JUNE 2011 No. 34350

NATIONAL TREASURY

No. R. 502 - 8 June 2011

PREFERENTIAL PROCUREMENT POUCY FRAMEWORK ACT, 2000:

PREFERENTIAL PROCUREMENT REGULATIONS, 2011

I, Pravin J. Gordhan, Minister of Finance, acting in terms of section 5 of the Preferential Procurement Policy Framework Act, 2000 (Act No. 5 of 2000), hereby make the Regulations set out in the Schedule.

Signed at Pretoria on this 6th day of June 2011.

PRAVIN J. GORDHAN

MINISTER OF FINANCE

PART ONE

DEFINITIONS AND APPLICATION

Definitions

1. In these Regulations, any word or expression to which a meaning has been assigned in the Act has the meaning so assigned, and, unless the context otherwise indicates-

(a) "Act" means the Preferential Procurement Policy Framework Act, 2000 (Act No. 5 of 2000);

(b) "all applicable taxes" includes value-added tax, pay as you earn, income tax, unemployment insurance fund contributions and skills development levies;

(c) "B-BBEE" means broad-based black economic empowerment as defined in section 1 of the Broad-Based Black Economic Empowerment Act;

(d) "B-BBEE status level of contributor" means the B-BBEE status received by a measured entity based on its overall performance using the relevant scorecard contained in the Codes of Good Practice on Black Economic Empowerment, issued in terms of section 9(1) of the Broad-Based Black Economic Empowerment Act;

(e) "Broad-Based Black Economic Empowerment Act" means the Broad-Based Black Economic Empowerment Act, 2003 (Act No. 53 of 2003);

(f) "comparative price" means the price after the factors of a non-firm price and all unconditional discounts that can be utilized have been taken into consideration;

(g) "consortium or joint venture" means an association of persons for the purpose of combining their expertise, property, capital, efforts, skill and knowledge in an activity for the execution of a contract;

(h) "contract" means the agreement that results from the acceptance of a tender by an organ of state;

(i) "designated sector" means a sector, sub-sector or industry that has been designated by the Department of Trade and Industry in line with national development and industrial policies for local production, where only locally produced services, works or goods or locally manufactured goods meet the stipulated minimum threshold for local production and content;

(j) "firm price" means the price that is only subject to adjustments in accordance with the actual increase or decrease resulting from the change, imposition, or abolition of customs or excise duty and any other duty, levy, or tax, which, in terms of the law or regulation, is binding on the contractor and demonstrably has an influence on the price of any supplies, or the rendering costs of any service, for the execution of the contract;

(k) "functionality" means the measurement according to predetermined norms, as set out in the tender documents, of a service or commodity that is designed to be practical and useful, working or operating, taking into account, among other factors, the quality, reliability, viability and durability of a service and the technical capacity and ability of a tenderer;

(l) "imported content" means that portion of the tender price represented by the cost of components, parts or materials which have been or are still to be imported (whether by the supplier or its subcontractors) and which costs are inclusive of the costs abroad, plus freight and other direct importation costs, such as landing costs, dock dues, import duty, sales duty or other similar tax or duty at the South African port of entry;

(m) "local content" means that portion of the tender price which is not included in the imported content, provided that local manufacture does take place;

(n) "non-firm prices" means all prices other than "firma prices;

(o) "person" includes a juristic person;

(p) "stipulated minimum threshold" means that portion of local production and content as determined by the Department of Trade and Industry;

(q) "rand value" means the total estimated value of a contract in South African currency, calculated at the time of tender invitations, and includes all applicable taxes and excise duties;

(r) "sub-contract" means the primary contractor's assigning, leasing, making out work to, or employing, another person to support such primary contractor in the execution of part of a project in terms of the contract;

(s) "tender" means a written offer in a prescribed or stipulated form in response to an invitation by an organ of state for the provision of services, works or goods, through price quotations, advertised competitive tendering processes or proposals;

(t) "total revenue" bears the same meaning assigned to this expression in the Codes of Good Practice on Black Economic Empowerment, issued in terms of section 9(1) of the Broad-Based Black Economic Empowerment Act and promulgated in the Government Gazette on 9 February 2007;

(u) "trust" means the arrangement through which the property of one person is made over or bequeathed to a trustee to administer such property for the benefit of another person; and

(v) "trustee" means any person, including the founder of a trust, to whom property is bequeathed in order for such property to be administered for the benefit of another person.

Application

2. (1) These regulations apply to organs of state as contemplated in section 1 (iii) of the Act and all public entities listed in schedules 2, 3A, 3B, 3C and 3D to the Public Finance Management Act, 1999, Act No. 1 of 1999, (as amended by Act 29 of 1999) and municipal entities.

(2) An organ of state contemplated in sub-regulation (1) must, unless the Minister of Finance has directed otherwise, only apply a preferential procurement system which is in accordance with the Act and these regulations.

PART TWO

PLANNING AND STIPULATION OF PREFERENCE POINT SYSTEM TO BE UTILIZED, EVALUATION OF TENDERS ON FUNCTIONAUTY, PREFERENCE POINT SYSTEM AND BROAD-BASED BLACK ECONOMIC EMPOWERMENT STATUS, AWARD OF CONTRACTS TO TENDERERS NOT SCORING THE HIGHEST NUMBER OF POINTS AND THE CANCELLATION AND RE-INVITATION OF TENDERS

Planning and stipulation of preference point system to be utilized

3. An organ of state must, prior to making an invitation for tenders-

(a) properly plan for, and, as far as possible, accurately estimate the costs of the provision of services, works or goods for which an invitation for tenders is to be made;

(b) determine and stipulate the appropriate preference point system to be utilized in the evaluation and adjudication of the tenders; and

(c) determine whether the services, works or goods for which an invitation for tenders is to be made has been designated for local production and content in terms of regulation 9.

Evaluation of tenders on functionality

4. (1) An organ of state must indicate in the invitation to submit a tender if that tender will be evaluated on functionality.

(2) The evaluation criteria for measuring functionality must be objective.

(3) When evaluating tenders on functionality, the-

(a) evaluation criteria for measuring functionality;

(b) weight of each criterion;

(c) applicable values; and

(d) minimum qualifying score for functionality,

must be clearly specified in the invitation to submit a tender.

(4) No tender must be regarded as an acceptable tender if it fails to achieve the minimum qualifying score for functionality as indicated in the tender invitation.

(5) Tenders that have achieved the minimum qualification score for functionality must be evaluated further in terms of the preference point systems prescribed in regulations 5 and 6.

The 80/20 preference point system for acquisition of services, works or goods up to a Rand value of R1 million

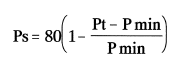

5. (1) (a)The following formula must be used to calculate the points for price in respect of tenders (including price quotations) with a Rand value equal to, or above R 30 000 and up to a Rand value of R1 000 000 (all applicable taxes included):

Ps = Points scored for comparative price of tender or offer under consideration;

Pt = Comparative price of tender or offer under consideration; and

Pmin = Comparative price of lowest acceptable tender or offer.

(b) Organs of state may apply the formula in paragraph (a) for price quotations with a value less than R 30 000, if and when appropriate:

(2) Subject to sub-regulation (3), points must be awarded to a tenderer for attaining the B-BBEE status level of contributor in accordance with the table below.

|

B-BBEE Status Level of Contributor |

Number of Points |

|

1 |

20 |

|

2 |

18 |

|

3 |

16 |

|

4 |

12 |

|

5 |

8 |

|

6 |

6 |

|

7 |

4 |

|

8 |

2 |

|

Non-compliant contributor |

0 |

(3) A maximum of 20 points may be allocated in accordance with sub-regulation (2)

(4) The points scored by a tenderer in respect of B-BBEE contribution contemplated in sub-regulation (2) must be added to the points scored for price as calculated in accordance with sub-regulation (1).

(5) Subject to regulation 7, the contract must be awarded to the tenderer who scores the highest total number of points.

The 90/10 preference point system for acquisition of services, works or goods with a Rand value above R1 million

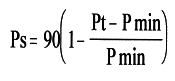

6. (1) The following formula must be used to calculate the points for price in respect of tenders with a Rand value above R1 000 000 (all applicable taxes included):

Where

Ps = Points scored for comparative price of tender or offer under consideration;

Pt = Comparative price of tender or offer under consideration; and

Pmin = Comparative price of lowest acceptable tender or offer.

(2) Subject to sub-regulation (3), points must be awarded to a tenderer for attaining their B-BBEE status level of contributor in accordance with the table below:

|

B-BBEE Status Level of Contributor |

Number of Points |

|

1 |

10 |

|

2 |

9 |

|

3 |

8 |

|

4 |

5 |

|

5 |

4 |

|

6 |

3 |

|

7 |

2 |

|

8 |

1 |

|

Non-compliant contributor |

0 |

(3) A maximum of 10 points may be allocated in accordance with sub-regulation (2).

(4) The points scored by a tenderer in respect of the level of B-BBEE contribution contemplated in sub-regulation (2) must be added to the points scored for price as calculated in accordance with sub-regulation (1).

(5) Subject to regulation 7, the contract must be awarded to the tenderer who scores the highest total number of points.

Award of contracts to tenderers not scoring the highest number of points

7. (1) A contract may be awarded to a tenderer that did not score the highest total number of points, only in accordance with section 2 (1) (f) of the Act.

Cancellation and re-invitation of tenders

8. (1) (a) In the event that, in the application of the 80/20 preference point system as stipulated in the tender documents, all tenders received exceed the estimated Rand value of R1 000 000, the tender invitation must be cancelled.

(b) If one or more of the acceptable tenders received are within the prescribed threshold of R 1 000 000, all tenders received must be evaluated on the 80/20 preference point system.

(2) (a) In the event that, in the application of the 90/10 preference point system as stipulated in the tender documents, all tenders received are equal to, or below R1 000 000, the tender must be cancelled.

(b) If one or more of the acceptable tenders received are above the prescribed threshold of R 1 000 000, all tenders received must be evaluated on the 90/10 preference point system.

(3) An organ of state which has cancelled a tender invitation as contemplated in sub-regulations (1)(a) and (2)(a) must re-invite tenders and must, in the tender documents, stipulate the correct preference point system to be applied.

(4) An organ of state may, prior to the award of a tender, cancel a tender if-

(a) due to changed circumstances, there is no longer a need for the services, works or goods requested; or

(b) funds are no longer available to cover the total envisaged expenditure; or

(c) no acceptable tenders are received.

(5) The decision to cancel a tender in terms of sub-regulation (4) must be published in the Government Tender Bulletin or the media in which the original tender invitation was advertised.

PART THREE

LOCAL PRODUCTION AND CONTENT, B-BBEE STATUS LEVEL CERTIFICATES, CONDITIONS, DECLARATIONS, REMEDIES, TAX CLEARANCE, REPEAL OF REGULATIONS AND SHORT TITLE AND COMMENCEMENT

Local Production and Content

9. (1) An organ of state must, in the case of designated sectors, where in the award of tenders local production and content is of critical importance, advertise such tenders with a specific tendering condition that only locally produced goods, services or works or locally manufactured goods, with a stipulated minimum threshold for local production and content will be considered.

(2) The National Treasury will issue instructions, circulars and guidelines to all organs of state, with specific reporting mechanisms to ensure compliance with sub-regulation (1).

(3) Where there is no designated sector, an organ of state may include, as a specific tendering condition, that only locally produced services, works or goods or locally manufactured goods with a stipulated minimum threshold for local production and content, will be considered, on condition that such prescript and threshold(s) are in accordance with the specific directives issued for this purpose by the National Treasury in consultation with the Department of Trade and Industry.

(4) Every tender issued in terms of regulation 9 must be measurable and audited.

(5) Where necessary, for tenders referred to in sub-regulations (1) and (3), a two stage tendering process may be followed, where the first stage involves functionality and minimum threshold for local production and content and the second stage price and B-BBEE with the possibility of price negotiations only with the short listed tenderer/s.

Broad-Based Black Economic Empowerment Status Level Certificates

10.(1) Tenderers with annual total revenue of R5 million or less qualify as Exempted Micro Enterprises (EMEs) in terms of the Broad-Based Black Economic Empowerment Act, and must submit a certificate issued by a registered auditor, accounting officer (as contemplated in section 60(4) of the Close Corporation Act, 1984 (Act No. 69 of 1984) or an accredited verification agency.

(2) Tenderers other than Exempted Micro-Enterprises (EMEs) must submit their original and valid B-BBEE status level verification certificate or a certified copy thereof, substantiating their B-BBEE rating.

(3) The submission of such certificates must comply with the requirements of instructions and guidelines issued by the National Treasury and be in accordance with notices published by the Department of Trade and Industry in the Government Gazette.

(4) The B-BBEE status level attained by the tenderer must be used to determine the number of points contemplated in regulations 5 (2) and 6 (2).

Conditions

11. (1) Only a tenderer who has completed and signed the declaration part of the tender documentation may be considered.

(2) An organ of state must, when calculating comparative prices, take into account any discounts which have been offered unconditionally.

(3) A discount which has been offered conditionally must, despite not being taken into account for evaluation purposes, be implemented when payment is effected.

(4) Points scored must be rounded off to the nearest 2 decimal places.

(5) (a) In the event that two or more tenders have scored equal total points, the successful tender must be the one scoring the highest number of preference points for B-BBEE.

(b) However, when functionality is part of the evaluation process and two or more tenders have scored equal points including equal preference points for B-BBEE, the successful tender must be the one scoring the highest score for functionality.

(c) Should two or more tenders be equal in all respects, the award shall be decided by the drawing of lots.

(6) A trust, consortium or joint venture will qualify for points for their B-BBEE status level as a legal entity, provided that the entity submits their B-BBEE status level certificate.

(7) A trust, consortium or joint venture will qualify for points for their B-BBEE status level as an unincorporated entity, provided that the entity submits their consolidated B-BBEE scorecard as if they were a group structure and that such a consolidated B-BBEE scorecard is prepared for every separate tender.

(8) A person must not be awarded points for B-BBEE status level if it is indicated in the tender documents that such a tenderer intends sub-contracting more than 25% of the value of the contract to any other enterprise that does not qualify for at least the points that such a tenderer qualifies for, unless the intended subcontractor is an exempted micro enterprise that has the capability and ability to execute the sub-contract.

(9) A person awarded a contract may not sub-contract more than 25% of the value of the contract to any other enterprise that does not have an equal or higher BB BEE status level than the person concerned, unless the contract is subcontracted to an exempted micro enterprise that has the capability and ability to execute the sub-contract.

(10) A person awarded a contract in relation to a designated sector, may not subcontract in such a manner that the local production and content of the overall value of the contract is reduced to below the stipulated minimum threshold.

(11) When an organ of state is in need of a service provided by only tertiary institutions, such services must be procured through a tendering process from the identified tertiary institutions.

(12) Tertiary institutions referred to in sub-regulation (11) will be required to submit their B-BBEE status in terms of the specialized scorecard contained in the BB BEE Codes of Good Practice.

(13) (a) Should an organ of state require a service that can be provided by one or more tertiary institutions or public entities and enterprises from the private sector, the appointment of a contractor must be done by means of a tendering process;

(b) Public entities will be required to submit their B-BBEE status in terms of the specialized scorecard contained in the B-BBEE Codes of Good Practice.

Declarations

12. A tender must, in the manner stipulated in the tender document, declare that( a) the information provided is true and correct;

(b) the signatory to the tender document is duly authorised; and

(c) documentary proof regarding any tendering issue will, when required, be submitted to the satisfaction of the relevant organ of state.

Remedies

13. (1) An organ of state must, upon detecting that:

(a) the B-BBEE status level of contribution has been claimed or obtained on a fraudulent basis;

or

(b) any of the conditions of the contract have not been fulfilled, act against the tenderer or person awarded the contract.

(2) An organ of state may, in addition to any other remedy it may have against the person contemplated in sub-regulations (1)-

(a) disqualify the person from the tendering process;

(b) recover all costs, losses or damages it has incurred or suffered as a result of that person's conduct;

(c) cancel the contract and claim any damages which it has suffered as a result of having to make less favourable arrangements due to such cancellation;

(d) restrict the tenderer or contractor, its shareholders and directors, or only the shareholders and directors who acted on a fraudulent basis, from obtaining business from any organ of state for a period not exceeding 10 years, after the audi alteram partem (hear the other side) rule has been applied; and

(e) forward the matter for criminal prosecution.

Tax clearance

14. No tender may be awarded to any person whose tax matters have not been declared by the South African Revenue Service to be in order.

Repeal of Regulations

15. The Preferential Procurement Regulations, 2001, as published in Government Gazette No R. 725 of 10 August 2001, are hereby repealed as from 07 December 2011.

Short title and commencement

16. These Regulations are called the Preferential Procurement Regulations, 2011 and shall come into effect on 07 December 2011.

Issued by The Treasury, June 9 2011. Transcribed from PDF. Please check against the original.

Not: These regulations have been extended to apply, inter alia, to the following parastatal institutions:

SCHEDULE 2 MAJOR PUBLIC ENTITIES

1. Air Traffic and Navigation Services Company Limited

2. Airports Company of South Africa Limited

3. Alexkor Limited

4. Armaments Corporation of South Africa Limited

5. Broadband Infrastructure Company (Pty) Ltd

6. CEF(Pty)Ltd

7. DENEL (Pty) Ltd

8. Development Bank of Southern Africa

9. ESKOM

10. Independent Development Trust

11. Industrial Development Corporation of South Africa Limited

12. Land and Agricultural Development Bank of South Africa

13. South African Airways (Pty) Limited

14. South African Broadcasting Corporation Limited

15. South African Express (Pty) Limited

16. South African Forestry Company Limited

17. South African Nuclear Energy Corporation Limited

18. South African Post Office Limited

19. Telkom SA Limited

20. Trans-Caledon Tunnel Authority

21. Transnet Limited

All subsidiaries of the above major public entities

Source: Treasury.gov.za

Click here to sign up to receive our free daily headline email newsletter