Report by Adv JF Myburgh to the Registrar of Banks on the collapse of African Bank Limited

EXECUTIVE SUMMARY

The rapid decline in the fortunes of Abil and African Bank (the bank)

1. On 10 August 2014 the Governor of the South African Reserve Bank (SARB) announced that the Registrar of Banks (Registrar) and the Minister of Finance had decided to place the bank under curatorship. The Governor said that the Registrar and his team had intensified their active engagement with the management of the bank in late 2012. The concerns they expressed particularly focused on the Bank's liquidity, the bank’s impairment and provisioning policy; the rapid credit growth; and the need for a strategic rethink of the business model.1

2. According to the annual financial statements (afs) just two years earlier, the results for FY2012 Abil and the bank disclosed that:

(i) Abil had made a profit of R2,8 billion (subsequently restated to be R3 billion);

(ii) the bank had made a profit of R1,3 billion (subsequently restated to be R1,6 billion).2

3. But it had not taken two years for the reversal in fortunes: by May 2013, within six months of the announcement of the FY2012 results:

(i) on the 2nd, Abil published its trading statement, in which

shareholders were advised that:

(a) headline earnings and earnings per share for the six months to 31 March 2013 were expected to decline by between 25% and 28% relative to the R1,4 billion reported for the equivalent six months to 31 March 2012;

(b) headline earnings for the bank declined by between 19% and 22%;

(ii) on the 22nd, Abil released its unaudited interim results for the six months ended 31 March 2013. Two of the “features” were that:

(a) headline earnings had declined by 26% to R1,015 billion (2012: R1,370 billion);

(b) there was an economic loss of R47 million (2012: economic profit of R390 million).3

4. The bad news continued. In the annual reports for FY2013:

(i) Abil disclosed a loss of R4,2 billion; and

(ii) the bank disclosed a loss of R4,5 billion.4

5. By late 2013 the bank would have collapsed – a year sooner than it actually did – had it not been for the successful rights issue which raised R5,5 billion.

6. The bank fared no better in 2014:

(i) on 2 May, in a trading statement, shareholders were advised that:

(a) Abil expected a headline loss of between R3,1 billion and R3,3 billion relative to the R604 million restated headline earnings for the equivalent six months to 31 March 2013;

(b) the banking unit (the bank and Stangen) was expected to show a headline loss of between R1,9 billion and R2 billion due to an increase in specific provisions of about R600 million;

(ii) on 6 August, in the quarterly operational update for the quarter ended 30 June 2014, it was announced that:

(a) Mr Kirkinis had resigned;

(b) the banking unit forecasted a basic and headline loss of at least R4,6 billion;

(c) the retail unit (Ellerine Furnishers (Pty) Ltd) (Ellerine Furnishers) forecasted a basic loss of at least R2,9 billion and a headline loss of at least R1,7 billion;

(d) the Group was expected to show a basic loss of at least R7,6 billion and a headline loss of at least R6,4 billion for the full year;5

(e) Abil required a capital raise of about R8,5 billion.

7. On the following day, 7 August 2014, Abil and the bank announced that Ellerine Furnishers had commenced with business rescue proceedings.6

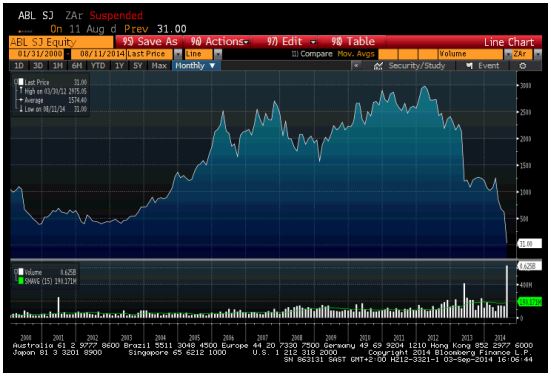

8. The share price dropped to 31c on 6 August 2014. This is the graph of the share price:

9. According to the latest information provided by the Curator:7

(i) the loss the bank made in FY2013 of R4,5 billion might be increased (when the FY2014 afs are published) by at least R1,3 billion to at least R5,8 billion;

(ii) for the period pre-FY2013 (and the bank disclosed a profit in the financial years 2008 to 2012) the afs might be restated to reflect an additional cumulative charge of at least R2,5 billion;

(iii) the impact on the pre-FY2013 financial years of the cumulative charge of at least R2,5 billion would reduce the cumulative profits and might have the effect of converting disclosed profits in some of those years to losses.

The impact of the collapse of the bank

10. In a report prepared by SARB of 12 March 2014 it was said that the bank was regarded as systemic to the South African banking system, mainly on the basis of its extensive client base (over 3 million customers), its role in financial inclusion, the negative impact on the socio-political environment, should it fail, and the effect on foreign investor confidence, in light of the fact that part of its wholesale funding was sourced offshore.8

11. The prejudice or potential prejudice suffered by stakeholders of the bank was the following:

(i) the jobs of the 5 700 bank employees were placed at risk;

(ii) the 13 000 investors in Eyomhlaba and Hlumisa were black individuals who included employees, former employees, customers, the general public and depositors. They all lost their initial investment. Based on a share price of R28,15 Eyomhlaba lost R1,3 billion in value and Hlumisa lost R729 million;

(iii) thousands, if not hundreds of thousands, of ordinary South Africans invested their savings in Abil shares through asset managers. The asset managers, some of whom were major shareholders in Abil, informed the Commission that the losses incurred on Abil shares were billions of Rand: eg Coronation – R3,52 billion; Stanlib – R706,5 million; PIC – R4 billion; Allan Gray

– R893 million. The dividends that clients of the asset managers received were: Coronation – R5,7 million; Stanlib – R468 million; PIC – R1 billion; Allan Gray – R1,2 million and 229 000 shares in lieu of dividends;

12. Mr Kirkinis, the CEO of Abil and the bank, was unrepentant and unapologetic: according to him, in 2013 and 2014 the bank had faced “a perfect storm”; but had survived; and if it had not been wrongly placed under curatorship, it would have had a rosy future in 2015 and beyond.

The business model of the bank, and the risks associated with that model

13. The bank was a mono-line bank in that it offered and earned monies from only unsecured loan finance. It did not provide, and earn, fees from any transactional services. It funded its business from wholesale funding. The bank provided loans and credit cards to mainly formally employed and banked customers.9

14. The risks that were associated with the bank, so the Commission was told, included the following:-

(i) credit risk: the extent to which impairments on bad business eroded gross lending margins;

(ii) funding risk: the extent to which wholesale funders were prepared to fund the lending activities of the bank;

(iii) solvency risk: the extent to which there was a sufficient capital buffer to protect the interests of funders in the event of a sharp deterioration in the lending environment;

(iv) concentration risk: where revenues were dependant on one product line (unsecured lending) with little diversification in the form of more stable transactional;

(v) liquidity risk: the risk that the bank could not obtain the required funding in the market;

(vi) operational risks: direct or indirect losses resulting from inadequate or failed internal processes, systems or external events.10

The board 11

A. The executive directors

15. During the crisis years of 2012, 2013 and 2014, the executive directors who served on the Abil and bank boards were:

2012: Messrs Kirkinis, Nalliah, Fourie and Sokutu; 2013: Messrs Kirkinis, Nalliah, Fourie and Sokutu;

2014: from February to August: Messrs Kirkinis and Nalliah.

Mr Fourie

16. Mr Fourie became an executive director of the bank in November 2003.

By his own admission at that time he had no technical banking skills. He was employed for other skills and experience he said he possessed. In early 2008 he became CEO of Ellerines. Mr Fourie's role at the bank was confined to strategy. He was not involved operationally in any way. From the time he was appointed CEO of Ellerines Mr Fourie: did not do any work for the bank; did not attend bank Exco meetings; and could not contribute to resolving any of the operational issues that the bank faced, as he was not qualified to make any contribution.

17. So, of the four executives, during the years of 2012 and 2013, one of them , Mr Fourie:

(i) had a full-time job managing Ellerines, which was itself having major problems; and

(ii) could not contribute to resolving any of the operational issues that the bank faced.

Mr Sokutu

18. Mr Sokutu was of the firm belief that he was managing director (MD) of the bank for eleven years. He was never MD of the bank: for a short time he was MD of Retail Lending, one of the money lending divisions of the bank.

19. Mr Sokutu was Chief Risk Officer of the bank from 2004 to 2014. Mr Kirkinis said that Mr Sokutu was not a traditional Chief Risk Officer: he was appointed “…to deal comfortably in the regulatory environment, had deep relationships with the various regulators and had a deep [affinity] for the business given his early years involved and mired in poverty.” Mr Kirkinis added in his Submissions that Mr Sokutu had a highly competent team of individuals beneath him and that that was taken into account by the Registrar when considering the appointment of a chief risk officer.

20. Mr Sokutu conceded that he was not a banker by training. He said he was appointed as a director of Abil and the bank because he was a senior person who could lead people.

21. Mr Sokutu was not qualified to be the Chief Risk Officer of the bank.

The justification for his appointment that Mr Sokutu had to deal with significant risks in the "regulatory space" and that he was supported by a competent team:

(i) implicitly accepts that Mr Sokutu was not qualified in the conventional sense to be the Chief Risk Officer of the bank;

(ii) does not make up for his lack of qualifications:

(a) the chief risk officer of a bank has many risks to assess, not only "regulatory" risks;

(b) he is not meant to act as a conduit for the input of his subordinates;

(c) in order to discharge his responsibilities Mr Sokutu needed a good understanding of the underlying processes and principles of risk management in a bank, which he did not have.

So, for the whole period of ten years that Mr Sokutu had the title of Chief Risk Officer, there was in effect no Chief Risk Officer as one would understand that title in the banking industry. And this was the bank which needed an experienced, qualified, person to occupy that position:

22. Mr Sokutu had a severe drinking problem. His behaviour at the May 2013 Chelsea Flower Show was an embarrassment. The “fxxx the poor” article, published 15 months after the Chelsea Flower Show incident, painted the picture of a drunk fat cat who had made a pile of money when many thousands of investors had lost money. Both the journalist and Mr Sokutu got it wrong: he did not make R40 million or R50 million: on the sale of share options and LTIP he received in total R89 million. And to crown it all, Mr Sokutu appeared to be under the influence of liquor when he was interviewed by the Commission. He even admitted to having been drinking before the interview.

23. So, in the crisis years 2012 and 2013 of the four executive directors, one, Mr Sokutu, was unable to make when sober, or incapable of making when under the influence of liquor, any contribution to resolving the crises the bank faced.

Mr Nalliah

24. Mr Nalliah was an executive director of the bank and financial director (FD) of Abil.

25. He was not one of the inner circle which ran the bank, the members of which were Messrs Kirkinis, Roussos and Chemel.

26. He was not involved in the operations of the bank.

27. On a number of occasions Mr Nalliah agreed with Deloitte and Mr Raubenheimer, and disagreed with Mr Kirkinis, on accounting issues:-

(i) Deloitte and Mr Raubenheimer were of the view that the bank’s practice of fixing the point of impairment at CD4 was aggressive and should be CD1, in line with the banking industry. Mr Nalliah agreed that it should not be CD4, and that it should be brought forward from CD4, but not to CD1.12 But he said, his view did not prevail: Mr Kirkinis conferred with Mr Woollam, and “[Mr Kirkinis'] experience and wisdom often prevailed.”13

(ii) Deloitte and Mr Raubenheimer were of the view that cash flows attributed to accounts that had reached an in duplum status should be discounted at the original effective interest rate. Until 2013, however, the bank had discounted those in duplum accounts at zero. Deloitte had since 2009 pointed out to management that the bank’s accounting practice in this regard was not in compliance with the requirements of IAS39. Mr Nalliah, the Financial Director of Abil, had, in the years 2009 to 2012, acted contrary to the views of Deloitte. When Mr Nalliah was interviewed, however, he said that he was “not comfortable” with the bank’s treatment of in duplum accounts. He agreed with what Mr Raubenheimer had told Deloitte at a meeting on 30 September 2013 that the in duplum issue needed to be corrected.14

(iii) The bank’s practice was “to bring the written off book at fair value…onto the balance sheet.”15 Mr Nalliah disagreed with that: he stated that the normal practice in business was that once you have written off a loan it stayed off balance sheet, and you accounted for any cash recoveries as and when you receive the cash.16 It was another practice that he had inherited.17

(iv) Mr Nalliah testified that he had on many occasions told the board

and Mr Kirkinis that the credit policy needed to be tightened, and the loan size needed to be reduced. Mr Kirkinis disagreed: his view was that “you cannot do that radically, you will damage the brand, which I accepted…But my view was that we needed to start the journey to make those changes, which subsequently had happened.”18

(v) In March 2013, so said Mr Nalliah, he had debated extensively

with Mr Kirkinis whether the additional provision should be R450 million, which Mr Nalliah wanted, or R350 million, which Mr Kirkinis wanted. Mr Kirkinis was of the view that in his experience “which I could not challenge” that the second half of the year was always better.19

(vi) Mr Nalliah said that he was of the view that the bank should not subsidise Ellerines, but Mr Kirkinis said ‘we will get credit right, we will get it fixed…we will crack it and the board…with the experience he has got as the founder of the business, rightly so, gave more credence to his views than mine.”20

28. Mr Nalliah said in his Submissions that he expressed his disagreement, manifesting independence, even if his views did not carry the day, and it was reasonable not to have been overly dismissive of Mr Kirkinis' experience in light of his success in the past.

29. Accepting that he might have needed time to settle in at Abil, by the time he was appointed Financial Director on 5 May 2009, Mr Nalliah should have felt confident and qualified enough to express his views – even if they conflicted with those of Mr Kirkinis – to the Group Audit Committee and the boards of Abil and the bank. The directors would have expected nothing less. Had his views not prevailed, so be it.

Mr Kirkinis

30. Mr Kirkinis was one of the founders of Abil and the bank. From inception until 6 August 2014 he was the CEO of ABil. At the same time he was CEO of the bank for that period except for the short period when Mr Woollam was managing director.

31. His annual remuneration from 2006 was modest in relation to the other executives of Abil and the bank. He took the view, so he said, that he was adequately compensated by way of dividends due to the success of the business. The total of dividends received by him and his family trusts was R286 million.

32. Mr Kirkinis was described by his executive colleagues as “a very amicable guy…he struggled with delegation, he struggled with keeping people accountable; he struggled with managing such a large organisation…the thing became too big and too complex for him to handle effectively”; he was too nice a person; he did not have the ability to dismiss people; he was a very hands on CEO; by nature he was very optimistic; “…extremely charismatic…he was not dominant but he was influential in his approach and in his mannerisms and had the ability to rally the troops…Leon was extremely hands on, very operationally focussed; he was and wanted to be involved in most of the decision making process…so he was very, very hands on in the process, very knowledgeable…”.

33. Mr Kirkinis was the dominant personality in management and on the boards of Abil and the bank:-

(i) He was one of the founders of Abil and the bank.

(ii) He was CEO of the holding company, Abil, and for most of the time, of the bank, from inception until 6 August 2013.

(iii) He held a substantial shareholding in Abil.

(iv) He was the director who had the most operational experience of the bank; there was no other director, including Mr Schachat, who knew as much about the bank as Mr Kirkinis did.

(v) Until early 2013 on the disclosed figures he seemed to have a magic touch: the bank was thriving; shareholders were receiving generous dividends; funders were being repaid; loans were being advanced to some 3 million consumers who may not have had access to funds in the past; the bank was an employer of 5700 employees.

(vi) There was no material decision taken prior to August 2014 which did not carry his support. He was the person who had to be persuaded, whether it was about in duplum accounting or the extent of the credit impairment or the need for the rights issue in 2013, to give a few examples.

34. An insight into how closely Mr Kirkinis identified himself with Abil is the application which he made for the approval of the Ellerines acquisition of 8 August 2007. The application is dealt with in later in the Executive Summary. For present purposes it is sufficient to say that the application was made in the name of Abil when the board had neither considered nor approved the acquisition. Either Mr Kirkinis regarded himself as Abil or he assumed the board would meekly go along with the recommendation of management that the acquisition be made.

35. Deloitte, the external auditors, drew a distinction between “prudent” and “aggressive” accounting practices adopted by the bank; eg:

(i) the bank’s “impairment practices were aggressive in comparison with the banking industry as a whole”;

(ii) the bank used a 7 day emergence period whereas the big four banks generally use a 30 day emergence period: “This is another important aspect in relation to which the bank’s impairment practices were aggressive compared to the banking industry as a whole”;

(iii) “Deloitte cautioned that the treatment [in relation to the impairment point at CD4] was aggressive and overall, less prudent than generally accepted banking practice”;

(iv) “The final assessment of Deloitte was…that although within an acceptable range, management’s evaluation of credit impairments was still towards the less prudent side of that acceptable range.”

36. Mr Kirkinis disputed that a practice described by Deloitte as one of “the banking industry” was in fact one of the banking industry: he contended that the practice was one adopted by the big four banks only and not the banking industry as a whole. He also did not believe that African Bank should be compared to the big banks.

37. While it is true that African Bank was not the same size as the big four banks, it was undoubtedly a “big bank”: by 2013 it had a book of some R60 billion Rand, 3 million customers and about 5700 employees.

38. Above all, it was a bank providing unsecured lending: its accounting policies should have been prudent rather than aggressive.

39. On 5 August 2014 the board eventually stood up to Mr Kirkinis; additional R3 billion in impairments were announced on 6 August 2014, Mr Kirkinis was asked to resign; and the bank was placed under curatorship on the 10th. Mr Kirkinis, both in his affidavit and in his evidence:

(i) expressed his strong disagreement with the board and PWC (who had recommended the additional R3 billion impairment); and

(ii) contended that, but for the announcement of 6 August 2014, the bank could have continued to conduct business.

40. Mr Kirkinis’ view that the impairment point should be CD4 was not supported by Deloitte; PWC; the Financial Director of Abil, Mr Nalliah; and senior executives of the bank, Mr Swanepoel and Mr Raubenheimer.

41. In considering the personality of Mr Kirkinis the word “hubris” comes to mind: “Hubris often indicates a loss of contact with reality and an overestimation of one’s own competence, accomplishments or capabilities, especially when the person exhibiting it is in a position of power.”

42. Mr Kirkinis believed that: he was right; everyone else was wrong; the impairment point should be CD4 and not CD1; the bank had a future; the R3 billion additional impairment should not have been announced; and the capital requirement was no more than R5 billion (whereas R8,5 billion was announced).

43. But by early August 2014, Mr Kirkinis enjoyed no support from either the boards of Abil and the bank, the Governor of the Reserve Bank or the Registrar of Banks, and had lost their confidence. By then the bank had faced a financial crisis since early 2013; the share price of Abil had declined dramatically; the market had lost confidence in Abil and the bank; the Governors’ committee had been monitoring the situation since May 2013 (an indication of the extent of the crisis); and by early August 2014 the bank faced a capital and liquidity crisis.

44. Mr Kirkinis is mistaken if he believes either that the bank had a future or that he could remain CEO of the bank.

B. The non-executive directors

45. The non-executive directors in the period 2012 to 2014 were:

- for the whole of that period: Messrs Mogase, Adams, Symmonds, Ms Gumbi, Ms Langa-Royds and Mr Koolen;

- from 16 September 2013 Mr Mthombeni;

- to mid-September 2013, Mr Sithole.

46. On 10 June 2014 Stanlib, a major shareholder, wrote to Mr Mogase, giving ‘strong advice’ that the two independent board appointments “ be credible appointments with the requisite skills and experience in banking, particularly in the risk function.” In its submission to the Commission, Coronation stated that one of the “key risks” they identified in Abil was that “Abil’s board did not have sufficient depth and required strengthening.” Mr Mogase, the chairman of the board, testified, in dealing with the Stanlib letter “…we wanted to bring more people onto the board specifically to deal with those matters…obviously with all the stuff that was happening in the market that would have been a perception that the risk function needs to be strengthened and so I think it was fair comment.”

47. Having said that Mr Kirkinis was the dominant person on the board, he did not dominate all the members of the board all the time:-

(i) Mr Sithole, at the time an independent non-executive director (NED) and chairman of the Group Audit Committee, wrote the letter of 30 June 2013, which reflected is disagreement with a number of material aspects of the management of the bank.

(ii) In early 2014 Ms Gumbi, an independent NED, requested Mr Kirkinis to resign: “I thought that the bank under his leadership had lost the confidence of the market, and whatever plan or story we can put before the market will not be accepted, only because it was him presenting it.”21

(iii) Ms Gumbi also said that during the latter part of 2013 and early

2014 she felt that she was bringing a lot of negative energy on to the board. She agreed with some of the reasons advanced by Mr Sithole for stepping down.22

(iv) Mr Mthombeni, an independent NED, was of the view that the lack of transactional banking services was a strategic weakness.23 Mr Kirkinis had always been strongly opposed to the bank offering transactional services: Mr Chemel said that that was a “no-go area” for Mr Kirkinis.24

C. The board as a whole

48. The composition of the Abil and bank boards was identical and they held meetings at the same time. That was acceptable until the bank began providing financial assistance to Ellerines, such as loans, the value share and guarantees. When that happened the board of the bank and the board of Abil were conflicted: what might be in the best interests of Abil, the owner of the Ellerines furniture business, would not necessarily be in the interests of the bank.

49. The issue of conflict was canvassed with all the directors: with the exception of Mr Mthombeni, they disputed that there was a conflict. They said they were able to discharge their fiduciary duties to the bank, while at the same time discharging their fiduciary duties to Abil. The proof is in the pudding.

50. One example will suffice. By the time that Ellerines was placed in business rescue, Ellerines owed the bank R1,4 billion.

51. The directors of African Bank:

(i) owed a fiduciary duty and a duty of care and skill to the bank;

(ii) owed a duty to the bank to act bona fide for the benefit of the bank;

(iii) were obliged to exercise the powers and functions of director:

(a) in good faith and for a proper purpose;

(b) in the best interests of the bank;

(c) with the degree of care, skill and diligence that may reasonably be expected of a person-

- carrying out the same functions in relation to the bank as those carried out by that director; and

- having the general knowledge, skill and experience of that director.

52. In approving the loans from the bank to Ellerines, the directors of the bank board:

(i) acted in breach of their fiduciary duty to the bank;

(ii) did not exercise the required care and skill;

(iii) did not act for the benefit of the bank;

(iv) did not act in the best interests of the bank.

53. The reasons for those findings are the following:-

(i) The loans grew from about R450 million in September 2012 to about R900 million in September 2013 to R1,4 billion in July 2014.

(ii) The aggregate amounts of the loans increased at the very time that the bank was producing poor results in 2013 and 2014.

(iii) The bank was a micro-lender: it lent modest amounts of money to (3 million) mainly salaried employees: it did not lend hundreds of millions of Rand to corporates.

(iv) At the time of the acquisition of Ellerines in 2007/2008 it was not envisaged that the bank would lend money to the retail business, let alone that it would advance hundreds of millions of Rand to the retail business. In the application of 8 August 2007 to the Registrar in the Abil pro forma balance which was attached to the application, it was indicated that about R2 billion would be provided by external funders.25

(v) No reasonable banker would have lent R450 million or R900

million or R1,4 billion to a furniture business which was unprofitable or barely profitable in an industry which was struggling, without security: and no security was given.

(vi) A reasonable banker would not have granted loans in any amount, let alone R450 million, R900 million or R1,4 billion, without being satisfied that the loans would be repaid.

(vii) A reasonable banker would not have been satisfied that the loans would be repaid: -

(a) The expectation that a loan of those dimensions would be recouped from a potential purchaser of the furniture business was pure fantasy. On what hard facts was that expectation based? There were none. The furniture industry was not one to instil confidence in any potential investor. Abil was not able to find a purchaser. And when a written proposal was eventually made in July 2014 it was Abil who would have had “to pay” the purchaser money – not the other way round – and the amount was a mere R3 billion!

(b) The notion that the bank would have been repaid when the furniture industry recovered or when Ellerines had successfully “turned around” (in 2019?) is laughable. The directors should have had regard to the past performance of Ellerines rather than future unrealistic forecasts.

(viii) The contention that it was in the best interests of the bank to continue to advance hundreds of millions of Rands of loans to Ellerines because of the "symbiotic" relationship between the two and that their fates were interwoven is rejected. The question is whether a reasonable banker in those circumstances would have nevertheless advanced large sums of money without security and with no realistic prospect of repayment. This answer is 'no'.

D. The acquisition of Ellerines

The s52 application of 8 August 2007

54. In terms of s52(1)(a) of the Banks Act a bank shall not without the prior written approval of the Registrar establish or recognise a subsidiary. Section 52(2) provides that to obtain the prior approval of the Registrar there shall be lodged with the Registrar a written application.

55. The s52 application of 8 August 2007:

(i) was made in the name of Abil;

(ii) Abil was identified as the acquirer;

(iii) brief reasons for the acquisition were given;

(iv) key features of the transaction related to shareholdings and control; terms of the acquisition; major suspensive conditions to the acquisition; funding; price exposure to loss; acquisition costs as a percentage of shareholders' capital and size of Ellerine in relation to the Abil Group; main activities to be conducted; management;

(v) various undertakings were given; and

(vi) it was stated that Abil would conduct a due diligence on Ellerine prior to completing the transaction.

56. There was no Abil board meeting between 20 July 2007 and 8 August 2007.

57. Mr Kirkinis could not, therefore, have been given authority by the Abil board at a board meeting.

58. Mr Kirkinis could not have been given "informal" authority by the Abil board. The board had no power to "informally" authorise any acquisition let alone one of this magnitude.

59. In any event, for the Abil board to have given Mr Kirkinis 'informal' authority the members of the board would have had to know, as a minimum, that it was EHL that was to be acquired; what the "key features" of the transaction would be; and that the price was R9,8 billion. There is no evidence that the directors of the Abil board possessed such knowledge prior to 8 August 2007.

60. On a fair reading of the s52 application of 8 August 2007, the Registrar must have assumed that the Abil board:

(i) had properly considered the terms of the proposed offer;

(ii) had agreed to all the terms;

(iii) had decided to make an offer on those terms.

61. The truth, however, is that as at 8 August 2007, the board of Abil had not:

(i) considered the terms of the proposed offer;

(ii) agreed that it was EHL that would be acquired;

(iii) decided to make an offer on the proposed terms, including the purchase consideration of R9,8 billion.

The board meeting of 13 August 2007

62. According to the minute of the meeting management, based on the mandate given by the board at the 20 July 2007 meeting, considered various options. It was resolved that:

“The board unanimously supports the proposed acquisition of [EHL]. Abil will submit a letter to the board of [EHL] expressing interest in acquiring the entire ordinary share capital of [EHL].”

63. This was the only meeting of the Abil board at which approval of the acquisition of EHL was given.

64. Six of the fourteen directors attended the meeting ‘via teleconference’.

The inference is that the meeting was not a scheduled meeting and was called without sufficient notice to allow the directors to attend in person.

65. The decision to acquire EHL – taken at the meeting of 13 August 2007 – was taken without a due diligence having been concluded.

66. The Draft Report contained the statement that the resolution of the board was not subject to a due diligence being conducted. Mr Tugendhaft and Mr Kirkinis took great exception to that statement, and referred, for example to the s52 application of 8 August 2007 and the SENS announcements of 20 August and 5 September 2007. The fact of the matter is that the resolution of 13 August 2007 did not26, provide that the acquisition was conditional upon, or subject to, a due diligence being conducted. And the resolution of 13 August 2007 was not revisited at the board meeting on 19 September 2007 when "a high level summary of key finding arising from the Ellerines due diligence exercise was presented to the board"27

67. At best for the Abil board, by implication, its decision was subject to a high level due diligence investigation being done, in the words of the September 2007 report, with the aim of:

(i) identifying any show stoppers that would in isolation or in combination with others result in an unforeseen financial impact of more than R250 million (post tax) on the June 2007 NAV of the business, and therefore require an adjustment to the offer price; and

(ii) identifying any major reputational/compliance issues imbedded in the business that needed to be factored into the thinking prior to a firm offer being made.

68. No independent due diligence was done. The reason, so the Commission was told, was that it was unnecessary as Abil and the bank had all the necessary skills to conduct a due diligence: a third party, such as a firm of auditors, could not have done a better job.

Non-disclosure

69. In the s52 application of 8 August 2007 Mr Kirkinis did not disclose to the Registrar his view that the R1 billion of profit disclosed by Ellerines in its afs for FY2007 was "an overstatement of profit".

70. In his Submissions Mr Kirkinis denied that the adjustment arose as a result of "overstatement of profits" : "it arose as a result of EHL's policy of up-front income recognition, whereas ABIL preferred to recognise the relevant insurance income over time. The take-on net-asset value would therefore be reduced in ABIL's books and the goodwill increased in ABIL's books."

71. This is, however, what Mr Kirkinis said in evidence:

"The billion rand profit [disclosed by Ellerines in the FY2007 afs] is an overstatement of profit … The billion rand profit that you are referring to is not really a sustainable billion rand profit once you change the accounting policies… They have made a billion rand profit under the accounting policies that they had at the time … we changed those accounting policies when we took over Ellerines."28 (The underlining is provided).

72. At the Abil board meeting on 3 March 2008, two months after Abil had taken over Ellerines, Mr Fourie described the Ellerines business inter alia as follows:

(i) Ellerines was “over-branded, over-stored and over-structured”;

(ii) the cost structure was high;

(iii) the market share of the group had declined over the past few years;

(iv) productivity ratios were worse than the direct competitor;

(v) debtors’ costs had increased significantly over the past year and the forecast looked poor;

(vi) credit granting policy had changed due to the NCA;

(vii) sales and margins were under pressure and below budget;

(viii) trading profit was below budget and was anticipated would be below budget to year-end;

(ix) head office costs were high and were planned to be reduced by consolidation of the various offices across the country over time;

(x) supply chain and logistics was a challenge and a top logistics person needed to be recruited;

(xi) there were leadership and skills challenges within the business, especially in the area of merchandise, logistics and at the divisional level.

73. According to the minutes of the meeting Mr Woollam summarized the concerns regarding the Ellerines insurance division in these terms:-

(i) the accounting methods used to bring income into account in the insurance company post NCA was legally flawed and required correction back to June 2007;

(ii) this method of income recognition was agreed by Ellerines’ auditors and insurance advisers;

(iii) this was also raised at the time of the due diligence as an issue;

(iv) the correction of income recognition would have a material effect on the financial numbers of the Ellerines division for the half year; the amounts were about R200 million for the period June to August 2007 and R900 million for the period September to December 2007;

(v) the R900 million would be accounted for as an adjustment to the purchase price in the books of Abil;29

(vi) the financial statements of the insurance companies for the year end 31 August 2007 would need to be withdrawn and restated;

(vii) the various regulators, including the JSE and the FSB, would need to be informed;

(viii) the communication to the market needed to be carefully worded.

74. The evidence of the directors of Abil at the time of the acquisition of Ellerines was that the facts disclosed at the meeting of the board were known to them prior to the acquisition.

75. Those facts, in that amount of detail, where not disclosed in the SENS announcement of:

- 20 August 2007;

- 5 September 2007;

- 21 September 2007.

76. In his Submissions30 Mr Kirkinis stated that the risks identified by management were publically disclosed to investors, shareholders, the Registrar and SARB in that the SENS announcement of 20 August 2007 invited investors to download a slide presentation from Abil's website. If investors had done so they would have seen from slide 12 that the "Risks of the acquisition" were disclosed:

"- Lack of retail skills, competencies and acknowledged in ABIL

- Cultural fit or lack of management buy-in

- Different business models: Balance sheet structures, profit levers, credit cycle

- Inability to separate Finco from Opco without hurting either business

- Potentially excessive client overlap

- NCA compliance issues

- Management capacity and expertise at ABIL."

77. This is what the SENS announcement of 20 August 2007 disclosed:

(i) The "Benefits from the Transactions", such as greater critical mass for the financial services business and the combined group; a greater distribution footprint; the ability to introduce Abil's greater price and risk differentiation underwriting models into the Ellerines distribution channel; improved product offerings and feasibility for Ellerines clients.31

(ii) Under the heading "Conference Call" it was stated:

"Leon Kirkinis, Abil CEO, will conduct a conference for investors on Tuesday, 21 August 2007. Participants are invited to download a slide presentation from the company's website prior to the conference call at www.africanbank.co.za".

78. The SENS announcement of 20 August 2007:

(i) did not in the body of the announcement disclose:

(a) the "Risks" that were considered by the Abil board at its meeting on 13 August 2007;

(b) the "overstatement of profit" of R900 million referred to by Mr Kirkinis;

(ii) was misleading if the intention was to make disclosure of the risks in slide 12 of the slide presentation: only participants in the conference call were invited to down-load the slide presentation;

(iii) did not state that the risks were to be found in the slide presentation.

Ellerines

79. Abil bought Ellerines for R9,1 billion in late 2007/early 2008. The purchase consideration included R5,3 billion for goodwill. In September 2010 the bank bought the financial services division of Ellerines for R7,3 billion. The bank paid R4 billion for goodwill, which was subsequently written off. From then until early August 2014 Ellerine Furnishers continued to conduct the furniture (retail) business.

80. By the end of 2010 Abil had been running the retail division, i.e. the furniture business, of Ellerines for three years. The financial results of the retail business from 2010 to 2014 were the following-

80.1 Profit/loss

(i) 2010: a profit of R124 million; 2011: a profit of R190 million; 2012: a profit of R257 million;

2013: a loss of R284 million.

(ii) The value share that the banking unit (the bank and Stangen) paid in each year to Ellerines as at 30 September was:

2010: R176 million

2011: R561 million

2012: R633 million

2013: R537 million.32

(iii) But for the value share, Ellerines would have made a loss in the “profitable years” according to Mr Nalliah as follows:

2010: R3 million

2011: R214 million

2012: R199 million

(iv) But for the value share the loss in 2013 would have been R671 million.

80.2 Economic loss

(i) This is the economic loss including the goodwill in Abil that Ellerines made each year:

2010: R924 million

2011: R211 million

2012: R139 million

2013: R706 million

80.3 Budget

(i) In not one of the FY years 2010 to 2013 did Ellerines make the forecasted profit.

81. Abil took the decision to sell Ellerines in May 2013. It was not, however, able to dispose of the retail business. It is unclear what steps were taken in that regard in 2013, but in 2014 a number of potential buyers were approached. Nothing came of those approaches. In about July 2014 a consortium led by Mr Christo Wiese “…came to the conclusion that Abil would have to forego its loan [of R1,4 billion] and make a further amount of R1,6 billion available to EHL…”

82. It was to this ailing furniture business that the bank provided the following financial support:-

(i) The bank advanced loans to Ellerines customers, who were a greater credit risk than the bank’s customers.

(ii) The bank lent Ellerines in total R1,4 billion. The loans were unsecured.

(iii) The banking unit (the bank and Stangen) paid the value share to Ellerines of R1,9 billion in aggregate in the period 2010 to 2013.

(iv) The bank bought the financial services of Ellerines in 2010 for R7,3 billion.

(v) In the period April to July 2014 Abil signed guarantees for the facilities Ellerine Furnishers had with Standard Bank (R150 million), FirstRand Bank Limited (R200 million),33 ABSA Bank Limited (R100 million) and Investec Bank Limited (R100 million) Those guarantees were underpinned by the assets of African Bank.

83. According to the Curator, an impairment of the loan to EHL of R1,4 billion was processed in FY14. The debate is whether the balances existing at 30 September 2013 and 2012 of R529m and R461m respectively were already impaired on those dates and should have been booked in the afs for those years. The Curator was still in the process of deliberating this within the bank.34

Impairments35

84. Mr Kirkinis told a Project Phoenix meeting on 20 March 2014 that June/July 2013 were the low points for the bank in terms of liquidity; impairments rose: “these were the key reasons behind the loss making situation”. In Abil’s capital and liquidity plan of 4 May 2014 it was said that “the sole reason” for the disappointing results at interim in March 2013, final in September 2013 and interim March 2014 was “the credit impairment losses and provisions may exceed expectations”.

85. The credit impairments were: FY2011: R7,4 billion

FY2012: R9,8 billion

FY2013: R10,6 billion

31/3/14: R15,7 billion

30/6/14: R14,9 billion 6/8/14: R17,9 billion.36

86. In his Submission Mr Nalliah criticized the Draft Report for “…its failure to attribute any significance at all to the fact that the auditors, Deloitte, at the most critical moments, after all was said and done, and all views and counters expressed, formed the opinion that the accounting policies of the bank were within the acceptable range, were compliant with the necessary standards, and were such to allow an unqualified audit report. This was the view formed by Deloitte as late as the meeting of 6 May 2014 with respect to impairments and does not in itself appear to be challenged by the report.”

87. The primary responsibility for the fair presentation of financial statements, however, is that of the directors of a company. That was in fact acknowledged by Abil and the bank in their annual reports. For example, the FY2013 annual report of Abil, signed by Mr Mogase, chairman, and Mr Kirkinis, CEO, the directors' responsibilities were said to include "selecting and applying appropriate accounting standards" and "maintaining adequate accounting records and an effective system of risk management". In the bank's FY2013 annual report, signed by Mr Kirkinis, CEO, and Mr Nalliah, Director, the directors' responsibilities were said to include "selecting and applying appropriate accounting policies" and "making accounting estimates that are reasonable in the circumstances".

88. The auditor, Deloitte, in the words of the bank's FY2013 annual report, "… is responsible for reporting on whether the annual financial statements are fairly presented in accordance with the applicable financial reporting framework" and in the words of the FY2013 annual report of Abil, the auditor "… is responsible for reporting on whether the annual financial statements are fairly presented in accordance with International Financial Reporting Standards and the Companies Act".

89. There were broadly three categories of credit impairments:

(i) the in duplum impairments which came to R2,2 billion in 2013;

(ii) the CD1/CD4 impairment which made up the bulk of R3 billion impairment which was announced on 6 August 2014;

(iii) the impairments which are described herein as “the bad debt impairments.”

90. The first two categories (in duplum and CD1/CD4) are classic examples of the chickens coming home to roost. Deloitte had advised management and the board for years:

- that management’s practice of reducing the effective interest rates of the non-performing loan (NPL) portfolio which were in duplum to 0% did not comply with IAS39;

- that the managements’ impairment event of CD4 was not prudent and should be CD1.

91. The increase in bad debts and NPLs was ascribed by some board members inter alia to the poor economy; competition; and labour unrest (which Capitec Bank also experienced). Prudent management should have foreseen that any one of those events could occur at some stage. The risk of that occurring should have been properly managed. In particular, Abil and the bank board should have made prudent, appropriate provisions from time to time.

92. A major cause of the bad debt impairments was the rapid growth of the book in 2012 from R33,4 billion to R44,8 billion, a growth which was conceded to be too rapid.

93. The poor quality of the loans granted, the difficulty in collecting repayments, and the growth in NPLs, can squarely be laid at the door of the bank. The bank had a sophisticated lending procedure. To whom it lent was entirely under its control.

s45 of the Companies Act

94. In terms of s45(3)(b) of the Companies Act a board of directors may not authorise any financial assistance unless the board is satisfied that:

(i) immediately after providing the financial assistance, the company would satisfy the solvency and liquidity test;

(ii) the terms under which the financial assistance is proposed to be given are fair and reasonable to the company. On 26 and 29 June 2014, the board of the bank resolved, in effect, to provide financial assistance to EHL. It should not have appeared to the board and the bank on those dates that the bank would be able to pay its debts as they became due and payable in the ordinary course of business for a period of 12 months after June 2014.37

Report in terms of the letter of appointment

Is it in the interests of the depositors or other creditors of the bank that it remains under curatorship?

95. Yes

Is it in the interests of depositors or other creditors of the bank that the Registrar, in terms of s68(1)(a) of the Banks Act, applies to a competent court for the winding up of the bank?

96. No

Does it appear that any business of the bank was conducted recklessly or negligently or with the intent to defraud depositors or other creditors of the bank or any other person, or for any other fraudulent purpose, in particular whether the business of the bank involved questionable management practices or material non-disclosure?

97. There was no evidence that the business of the bank was conducted with the intent to defraud depositors or other creditors of the bank or any other person or for any other fraudulent purpose.

98. The business of the bank was conducted negligently in the following respects:-

(i) the retention of Mr Fourie as an executive director of the bank after he had been appointed CEO of Ellerines in early 2008;

(ii) the appointment of Mr Sokutu as

- executive director of the bank and Abil;

- MD of Retail Lending;

- Chief Risk Officer of the bank;

(iii) from the time that the bank began providing financial assistance to Ellerines, the bank board and the Abil board were conflicted;

(iv) by not making prudent, appropriate provisions from time to time;

(v) in not properly managing reasonably foreseeable risks such as a poor economy, competition and labour unrest;

(vi) by aggressively growing the book;

(vii) by allowing themselves to be dominated by Mr Kirkinis.

99. The business of the bank was conducted recklessly in making loans to Ellerines in aggregate R1,4 billion:

(i) without security;

(ii) when there was no reasonable prospect of the loans being repaid.

100. Abil and the bank acted negligently in underestimating the financial implications of issues such as bad debts; impairments; the cost of funding Ellerines; the risk of the market losing confidence in Abil and the bank and the funders failing to continue to support Abil and the bank.

Who was a party to the conduct of the business of the bank or Ellerines in the manner described above?

101. The boards of Abil and the bank, generally, were a party to the conduct described in the findings that:

(i) the directors of the bank acted in breach of their fiduciary and other duties to the bank (s53);

(ii) the business of the bank was conducted negligently (s98);

(iii) the business of the bank was conducted recklessly in making loans to Ellerines in aggregate of R1,4 billion;

(iv) Abil and the bank acted negligently (s100);

(v) the board of the bank acted in breach of s45 of the Companies act (s95).

102. In expressing that opinion, save as appears in the Report, the Commission does not make a finding that all the board members were responsible – equally or otherwise – for such conduct. The Commission did not have the time nor the capacity to investigate each board member's individual conduct in the period 2007 to 2014 in order to ascribe individual responsibility. But it must be borne in mind that in terms of s66 of the Companies Act, the business and affairs of the bank had to be managed by or under the direction of its board, which had the authority to exercise the powers and perform any of the functions of the bank.

Issued by the SA Reserve Bank 12 May 2016. The rest of the report can be found here.

Footnotes:

1 Chapter 4

2 Chapter 8

3 Chapter 8

4 Chapter 8

5 Chapter 8

6 Chapter 8

7 Chapter 20

8 Chapter 3

9 Chapter 3

10 Chapter 3

11 This section is based on Chapters 6 and 19

12 T821

13 T814,816

14 T821, T835

15 T833

16 T833

17 T834

18 T822

19 T826

20 T850

21 T124

22 T128-9

23 T55

25 SARB(2)73,74

26 AB(23)353

27 AB(23)356

28 T672-3

29 In his Submissions, Mr Nalliah stated that the minute should read “purchase price allocation”.

30 E(2)126-7

31 SARB(2)84

32 E(8)375

33 AB(50)96

34 Chapter 20

35 This section is based on chapter 17

36 Chapter 17

37 Chapter 21