Extracts from the Draft Employment Equity Regulations 2014, as signed by Minister of Labour, Mildred Nelisiwe Oliphant, Minister of Labour, February 17 2014, and issued in the Government Gazette no. 37338, February 28 2014

SECTION B: Unfair Discrimination

Equal Pay for Work of Equal Value Criteria

Eliminating unfair discrimination

(1) An employer must, in order to eliminate unfair discrimination, take steps to eliminate differences in terms and conditions of employment, including remuneration, of employees who perform work of equal value if those differences are directly or indirectly based on a listed ground1 or any arbitrary ground that is prohibited by section 6(1) of the Act.

(2) Without limiting sub regulation 1, an employer must ensure that employees are not paid different remuneration for work of equal value based on race, gender or disability.

2. Meaning of work of equal value

For the purposes of these regulations, the work performed by an employee -

(a) is the same as the work of another employee of the same employer, if their work is identical or interchangeable;

(b) is substantially the same as the work of another employee employed by that employer, if the work performed by the employees is sufficiently similar that they can reasonably be considered to be performing the same job, even if their work is not identical or interchangeable;

(c) is of the same value as the work of another employee of the same employer In a different job, If their respective occupations are accorded the same value in accordance with regulations 3 to 5.

The grounds that are listed in section 6(1) of the Employment Equity Act. 1998 are: race, gender, sex. pregnancy. marital status, family responsibility, ethnic or social origin, colour, sexual orientation, age, disability, religion, HIV status, conscience, belief, political opinion, culture, language and birth or any other arbitrary ground

3. Methodology

When, applying s6 (4) of the Act -

(a) it must first be established

(i) whether the work concerned is of equal value in accordance with regulation 4; and

(ii) whether there is a difference ¡n terms and conditions of employment, including remuneration; and

(b) it must then be established whether any difference in terms of sub regulation (a) (ii) constitutes unfair discrimination, applying the provisions of section 11 of the Act.

4. Assessing whether work Is of equal value

(1) In considering whether work is of equal value, the relevant jobs must be objectively assessed taking into account the following criteria:

(a) the responsibility demanded of the work, Including responsibility for people, finances and material;

(b) the skills, qualifications, including prior learning and experience required to perform the work, whether formal or informal;

(c) physical, mental and emotional effort required to perform the work;

(d) to the extent that it is relevant, the conditions under which work is performed, including physical environment, psychological conditions, time when and geographic location where the work is performed.

(2) In addition to the criteria specified in sub regulation I any other factor indicating the value of the work may be taken into account in evaluating work, if the employer shows that the factor is relevant to assessing the value of the work.

(3) The assessment undertaken in terms of sub regulations 1 and 2 must be conducted in a manner that is free from bias on grounds of race, gender or disability, any other listed ground or any arbitrary ground that is prohibited in terms of section 6(1) of the Act.

(4) Despite sub regulations 1 and 2, an employer may justify the value assigned to an employee's work by reference to the classification of a relevant job in terms of a sectoral determination made by the Minister of Labour in terms of section 55 of the Basic Conditions of Employment Act, 1997 (Act No. 75 of 1997 ) which applies to the employer.

5. Factors justifying differentiation in terms and conditions of employment

(1) If employees perform work that Is of equal value, a difference in terms and conditions of employment, including remuneration, is not unfair discrimination if the difference is fair and rational and is based on any one or a combination of the following grounds:

(a) the individuals' respective seniority or length of service;

(b) the individuals respective qualifications, ability, competence or potential above the minimum acceptable levels required for the performance of the job;

(c) the individuals' respective performance, quantity or quality of work, provided that employees are equally subject to the employer's performance evaluation system, that the performance evaluation system is consistently applied;

(d) where an employee is demoted as a result of organisational restructuring or for any other legitimate reason without a reduction in pay and fixing the employee's salary at this level until the remuneration of employees in the same job category reaches this level;

(e) where an individual is employed temporarily in a position for purposes of gaining experience or training and as a result receives different remuneration or enjoys different terms and conditions of employment

(f) the existence of a shortage of relevant skill, or the market value in a particular job cIassification

(g) any other relevant factor that is not unfairly discriminatory in terms of section 6(1).

(2) A differentiation in terms and conditions based on one or more grounds listed in sub regulation I will be fair and rational if it is established, in accordance with section 11 of the Act, that -

(3) Its application is not biased against an employee or group of employees based on race, gender or disability or any other ground listed in section 6(1) of the Act; and

(4) It is applied in a proportionate manner.

6. Consultation over elimination of unfair discrimination ¡n terms and conditions of employment

(1) A designated employer must consult, to the extent and in the manner required by section 16 of the Act, on the elimination of unfair discrimination due to differences in terms and conditions of employment of employees who are performing work of equal value that unfairly impact on employees from a designated group.

(2) A designated employer and the representatives contemplated by sectionl6(I) of the Act may agree to engage in consultations on the elimination of unfair discrimination due to differences in terms and conditions of employment in any manner other than that contemplated by sub regulation I

(3) Every employer that has not consulted in the manner contemplated by sub regulation 1 or 2 must, if requested by a representative consulting party contemplated by sub regulation 4 enter into consultations on the elimination of unfair discrimination due to differences in terms and conditions of employment of employees who are performing work of equal value that unfairly impact on employees from a designated group.

(4) For the purposes of sub regulation 3, a representative consulting party means -

(a) one or more registered trade unions representing more than half of an employer's workforce and

(b) ¡f there are no such trade unions, representative of its employees representing more than half of an employer's workforce and reflecting the interests of employees in accordance with the requirements of section 16(2) of the Act.

(5) An employer must, for the purpose of consultations in terms of this regulation, disclose any information that will allow those parties to consult effectively.

(6) Section 16 of the Labour Relations Act applies, with the changes required by the context, to a dispute over the disclosure of any information during any consultation held in terms of this regulation.

SECTION C: Duties of a designated employer

1. CollectIng information and conducting an analysIs

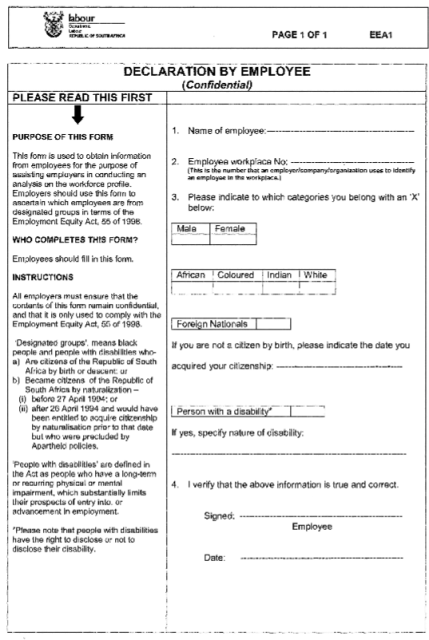

(1) When a designated employer collects information contemplated in section 19 of the Act, the employer must request each employee in the workforce to complete a declaration using the EEAI form.

(2) An employee may add information to the EEA1 form.

(3) Where an employee refuses to complete the EEAI form or provides inaccurate information, the employer may establish the designation of an employee by using reliable historical and existing data. People with disabilities have the right to declare or not to declare their disability.

(4) A designated employer must use section B of the EEA2 form to develop the profile of the employers workforce as required by section 19(2) of the Act.

(5) When a designated employer conducts the analysis as required by section 19 of the Act, the employer may refer to -

(a) EEA8, a guide on the applicable national and regional economically active population (EAP); and

(b) EEA9, which contains a description of occupational levels.

(6) A designated employer must refer to the relevant Codes of Good Practice issued in terms of section 54 of the Act as a guide when collecting Information and conducting the analysis required by section 19 of the Act.

(7) A designated employer must conduct an analysis as required by section 19 of the Act in terms of the EEAI2 by reviewing its workforce profile and employment policies, practices, procedures and the working environment in order to identify employment barriers which adversely affect people from designated groups from being equitably represented across all occupational levels,

2. Duty to prepare and implement an employment equity plan

(1) A designated employer must refer to the relevant Codes of Good Practice issued in terms of section 54 of the Act when preparing an employment equity plan contemplated in section 20 of the Act.

(2) The employment equity plan must contain, at a minimum, all the elements contained in the EEAI 3 template of these regulations.

(3) A designated employer must retain their employment equity plan for a period of five years after the expiry of the plan.

(4) A designated employer must refer to the EEA9 in the regulations for guidance on how to differentiate between the various occupational levels.

3. Duty to report

(1) A designated employer must submit a report in terms of section 21 of the Act annually on the first working day of October or on such other date as may be prescribed using the EEA2 form to the Director General and the report must be addressed to the Employment Equity Registry, Department of Labour, Private Bag XII 7, Pretoria, 0001.

(2) A designated employer may also submit an employment equity report electronicaHy using the online reporting system available on the departmental website, wwwlabour.gov,za by the prescribed date.

(3) An employer, who becomes designated on or after the first working day of April, but before the first working day of October must only submit its first report on the first working day of October in the following year or on such other date as may be prescribed.

(4) A designated employer that is a holding company with more than one registered entity may choose to submit a consolidated report.

(5) A designated employer who chooses to submit a consolidated report contemplated in sub regulation 3(4) must have a consolidated plan which is supported by individual employment equity plans for each registered entity included in the consolidated report.

(6) The method of reporting for the duration of the plan should remain consistent from year-to-year and from reporting period to reporting period.

(7) An employer must inform the Department in writing immediately of any changes to their trade name, designation status, contact details or any other major changes, including mergers, acquisitions and insolvencies.

(8) A designated employer who is unable to report by the first working day of October must notify and provide reasons in writing to seek the approval of the Director-General by completing and submitting the EEAI4 form before the last working day of August in the same year of reporting.

(9) A designated employer must retain a copy of the report for a period of five years after it has been submitted to the Director-General.

(10) In terms of Section 22, every designated employer that is a public company must publish a summary of a report required by Section 21 reflecting progress in their annual financial report by using the EEAIO annexure for guidance. Furthermore when a designated employer within any organ of state has produced a report in terms of Section 21 the Minister responsible for that employer must table that report in Parliament.

(11) An employment equity report (EEA2), except for the Income Differential Statement reflected in the EEA4 form, submitted to the Department of Labour is a public document A request for a copy of such a report may be made by the public by completing and submitting the EEAII form.

4. Duty to inform

The notice contemplated in section 25(1) of the Act must be in the form of the EEA3.

5. Income differentials and discrimination

(1) A designated employer must submit an income Differential Statement In terms of section 27 of the Act using the EEA4 form to the Employment Conditions Commission, which must be addressed to the Employment Equity Registry, Department of Labour, Private BagXll7, Pretoria, 0001, unless the employer is completing the prescribed forms on the Department of Labour's EE Online Reporting System.

(2) A designated employer must retain a copy of the statement of income differentials contemplated in sub regulation 5(1) for a period of five years after it has been submitted.

SECTION D: Enforcement Mechanisms

1. Requesting an undertaking

A labour inspector may request and obtain a written undertaking using the EEA5 form.

2. Compliance order

A labour inspector may issue a compliance order to a designated employer using the EEA6 form.

3. Determination of national and regional demographics for equitable representation

(1) In setting numerical goals and targets, employers can use the demographic profile of the national and regional economically active population applicable to them.

(2) A designated employer employing 150 or more employees should use the national economically active population (EAP) for the upper three levels (viz Top Management, Senior Management and Professionally Qualified), and an average of the national and regional economically active population for the lower levels (viz. Skilled Technical, Semi-skilled and Unskilled) as a guide in setting their numerical goals and targets in their employment equity plans.

(3) A designated employer with 149 or less employees should use the national economically active population for the upper two levels (viz. Top Management and Senior Management), and the regional economically active population for the lower levels (viz. Professionally Qualified, Skilled Technical, Semi-skilled and Unskilled) as a guide in setting their numerical goals and targets in their employment equity plans.

4. Review by Director-General (DG Review)

The Director General may require designated employers who have been identified for the DG Review process to fully and accurately complete the DG Review Assessment form (EEA7) and furnish the required documents.

The full document including annexures can be accessed here - PDF.

Click here to sign up to receive our free daily headline email newsletter