Piet le Roux, Senior Researcher at the Solidarity Research Institute, for the Trade Union Solidarity Remarks on the Medium Term Budget and Policy Statement 2013 delivered to a joint sitting of the Standing Committee on Finance and the Select Committee on Finance in the National Assembly, October 29 2013

It never was and never will be the case that all that is worth pursuing and worth having can be bought on the market. It is part of our human condition that we must often give without expecting something back, that we can receive without offering payment. In fact, not only is it unavoidable, but people seem to purposefully direct their resources toward non-commercial ventures all the time. Yes, humanity benefits greatly from market exchanges - where profit helps guide us toward sensible resource allocations - but it improves also by resource allocations not aimed at showing monetary profit.

Chairman, the world is a better place because people act charitably and philanthropically - for public benefit - as well as commercially - usually combined. Solidarity is a testimony to the philanthropic spirit among people, an example of how people can freely commit to collective action, for personal and non-personal benefit.

Nevertheless, it has become established and widely accepted practice - among many citizens as well - that states tax their inhabitants. Tax is the primary source of revenue in the 2013 MTBPS we consider today.

The 2013 MTBPS is a fiscal framework by which it is proposed that the South African state should operate for public benefit. In this framework, we find items of revenue and items of expenditure. While tax is the primary source of government revenue, taxpayers don't provide it all. To finance its substantial budget deficit the government runs up debt, expecting future generations to pay for current expenses.

Even though they do not have a choice in the matter, hard-working South Africans are - by and large - willing to pay tax. The reason that keeps them willing, is that they believe that paying tax can be for the public benefit. And since they want to contribute to the public good, they accept taxation.

However, among tax-paying, hard-working South Africans a conviction is growing that their taxes are contributing increasingly little to the public good. My goal here today is to convey this sentiment of scepticism, a sentiment real and a sentiment swelling.

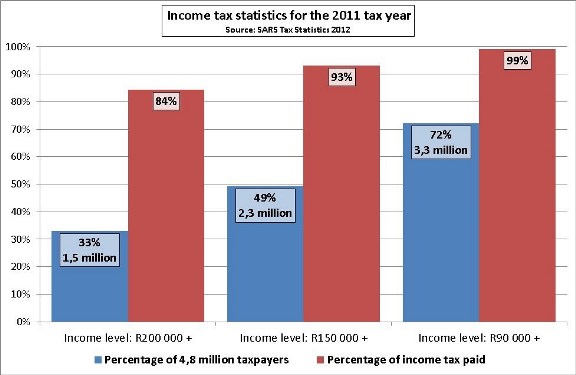

Certain things aggravate such tax scepticism. When Finance Minister Pravin Gordhan, in delivering his MTBPS speech, thanks everyone from President Zuma to SARS to the SARB and many other public office holders, but spares no word for the 3,3 million people who pay 99% of all income tax in South Africa and the bulk of other taxes, then taxpayers hear that they are being taken for granted. When they hear no apologies about how their hard-earned money - money the loss of which they had consoled themselves with in the belief that it would be availed to public benefit - has been wasted, and given no reason to believe that next year won't be business as usual, then their scepticism is encouraged.

When Minister Gordhan announces "tax relief", but taxpayers then inspect the numbers and see that real tax revenue continues to rise, they feel affronted. When Minster Gordhan announces cuts on government's liquor bills, credit cards, and so on - estimating that R2 billion may so be saved - taxpayers welcome it, but they immediately wonder how such lavish practices came to be established in the first place. When taxpayers then do the math and realise that this R2 billion amounts to less than 0,2% of total state expenditure, they are reassured that there is no real commitment to cut back on what has become an oversized bureaucracy.

When taxpayers read the newspaper and see - as they do in today's Beeld - that the National Intelligence Agency appears to have been operating on a R14 billion a year budget without the requisite financial oversight for three years now, they wonder if their money really contributes to the public good. When they see how the Department of Correctional Services finances its court cases to defend a policy of making their workforce representative of the national race demographics on every level and at every site, they wonder: could it be that the money we pay in taxes does not contribute to the public good, but actually to the public bad?

Personal income tax is the single largest expense in the budgets of many employees and virtually all of Solidarity's members.

A very small number of South African taxpayers bear almost the entire weight of the South African state on their tired shoulders. In analysing recent income tax statistics, the first figure that stands out is the 13,7 million people who were registered as taxpayers for the 2011/12 tax year. However, as can be seen on the graph below, only a small number of those registered actually paid significant amounts of income tax. Of the 13,7 million people registered in 2011/12, 3,3 million taxpayers paid almost 99% of all income tax; 2,3 million paid 93%; and 1,5 million paid 84%.

There aren't many people in the effective tax base, Chairman. And this shines through in public sentiment.

A case in point is the ongoing e-toll saga, which - while ostensibly about the tolling of public roads - really draws its greatest strength from the general disillusionment with government's failure to deliver on what people expect for their tax.

Solidarity has a strong mandate in this forum. From our information on our members' income levels, Solidarity estimates that its 130 000 members were responsible for a minimum of 5% of the personal income tax paid to the South African Revenue Service in the 2012/13 tax year.

While our 130 000 members belong to us so that they may derive personal benefit in the form of improved labour relations, they also belong to us in order to support our work from which they stand to derive no direct benefit. Without commercialisation and without maximising profit, Solidarity, through the generosity of its members, has created numerous other non-market organisations. These organisations include a technical training college with almost a thousand students per year, a charity, bursary schemes, and more. Incidentally, it was Solidarity and its family of organisations who provided the primary emergency food and other aid to the BEE trap of misery that was the Aurora mine disaster, and not government, which was responsible for the legislative framework that made Aurora possible.

The bulk of Solidarity's achievements has been accomplished with the aid of monthly membership fees from hard-working, salaried South Africans. Solidarity's members opted for a voluntary "tax" of around R10 per month, from their after-tax income to finance these philanthropic "public benefit" activities.

When our members compare what we achieve, with the small monthly contributions they entrust us from their after-tax income, with what government achieves with the incomparably more money taxed from our members, they become disillusioned. They might want to reallocate more money to us and to other charitable organisations to make up for government's shortcomings, but they find it very hard to do once income tax - their single largest item of expenditure - has been subtracted from their salaries.

Additionally, all of Solidarity's members - and most South Africans - perform for their own expense many services typically thought of to be a function of government. For example, in February Solidarity pointed out how much suburban South Africans may have to pay, out of their after-tax income, for their own safety and security, because of government's inability to curb crime. Solidarity remains committed that South Africans should become eligible for tax rebates for private provision of so-called government services where government fails to provide such services. In particular, Solidarity maintains - as it did in February - that South Africans should be eligible for tax rebates for personal security expenditure in the same way that they are eligible for tax rebates on personal medical expenditure.

Solidarity was happy to receive a commitment from Treasury in February this year that they will engage us on this proposal of tax rebates for personal security expenditures. However, we are even more so disappointed that, in spite of their earlier commitment, we have since not received answers on our repeated letters to the minister and his spokesperson about such engagement. Nor have we had a reply on our request to have our proposal considered by the Davis commission tasked with the review of the tax system. It would be a major comfort to taxpayers if this rebate proposal does somehow find its way into February 2014's budget speech.

Solidarity wishes to alert the Standing Committee on Finances that although South Africans - including Solidarity's members - are willing to pay tax if they feel that it contributes to social well-being, they are increasingly dissatisfied with the weight of the current tax burden and the way taxes are spent and wasted and used against them.

They notice how an inefficient welfare state is crowding out market and civil society initiatives which they feel could mitigate the effects of poverty more efficiently than the welfare state does, if taxpayers had more funds to devote to such causes. They are frustrated with having to pay tax for government services they then do not get - services like security and education which they then have to provide for themselves with their after-tax income. A first step to ameliorate the burden of this "double taxation" would be granting tax rebates on taxpayers' personal security expenditure, in the same vein as the medical aid tax rebate, for services which taxpayers perform for themselves without relying on inadequate state services.

In short, Solidarity - whose members contribute 5% of annual personal income tax receipts - is concerned that taxpayers are being taken for granted.

Source: Solidarity Research Institute

Click here to sign up to receive our free daily headline email newsletter