The adjustment budget and beyond

30 June 2020

THE ECONOMIC CONTEXT

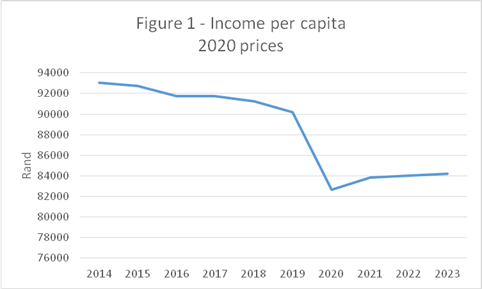

Figure 1 shows the historical and projected evolution of gross domestic product per capita from 2014 to 2023.

Sources: Historical GDP: Reserve Bank Quarterly Bulletin, March 2020

Projected GDP: 2020 Supplementary Budget Review

Population: World Population Prospect, 2019 revision

Real GDP per capita in 2020 is projected to be 11.2% lower than in 2014, improving to 9.5% lower in 2023. It will take until 2024 for real GDP to reach the 2019 level again and, assuming an average growth rate of 2.5% from 2024 onwards, it will take until 2028 for real GDP per capita to return to the 2019 level and until 2030 for real GDP per capita to reach the 2014 level again. That is our best guess at the moment of how badly the economy has been hit. It is the backdrop for any consideration of fiscal possibilities.

THE FISCAL FRAMEWORK

The main budget framework is displayed in Table 1.

Table 1: Main Budget Framework 2020/21

|

|

R billion |

|

|

|

February Budget |

Supplementary budget |

|

Main budget revenue |

1398.0 |

1099.5 |

|

Main budget expenditure |

1766.0 |

1809.2 |

|

Non-interest expenditure |

1536.7 |

1572.7 |

|

Interest expenditure |

229.3 |

236.4 |

|

Main budget balance |

-368.0 |

-709.7 |

|

Primary balance |

-138.7 |

-473.2 |

Source: 2020 Supplementary Budget Review

Note: The primary balance is main budget review less non-interest expenditure

The sharp deterioration in the fiscal position is mainly the result of the projected collapse in revenue. The new estimate is 21.4% lower than in the February budget, compared with a downward adjustment of 8.1% in GDP. Tax revenue was 26.2% of GDP in 2019/20. It is expected to drop to 22.6% in 2020/21, recovering to 25.5% in 2024/25 and to 26.2% again three years later. Increases in rates of taxation would be needed to raise the projection.

Although the COVID-19 relief package will cost R 142 billion with a further R 3 billion for the Land Bank, this allocation has been offset by downward revisions elsewhere, including national departments' baseline suspensions, repurposing of provincial equitable share, provincial conditional grant suspensions, local government conditional grant suspensions and other adjustments totaling R 109 billion.

THE TRAJECTORY OF PUBLIC DEBT

Beyond 2020/21, government has considered two scenarios: a passive approach, in which South Africa continues on its current trajectory and debt spirals out of control; and an active scenario, in which major reforms and fiscal consolidation are implemented rapidly to stabilize debt in 2023/24. Cabinet has adopted the active approach, which sees the debt to GDP ratio peaking at 87.4% in 2023/24[1]. This will require spending reductions and revenue adjustments amounting to approximately R250 billion over the next two years[2]. The adjustment will be larger if downside risks identified in the February budget materialize: a lower than projected saving in the government wage bill, further bailouts for state owned enterprises, problems with road tolls. We are watching the dance of the seven veils, and we shall have to wait until the October Medium Term Budget Policy Statement to see how the government intends to tackle that challenge. In the meantime, the following back of the envelope exercise gives an order of magnitude sense of what is involved:

|

5% increase in personal income tax burden across the board |

R 22 billion |

|

A further 5% in personal income tax burden for those with taxable income of above R 500 000 per year |

R 9 billion |

|

1% increase in VAT rate |

R 20 billion |

|

2% cut in government expenditure across all three levels |

R 31 billion |

|

Total social development budget 2020/21, including augmented grants |

R 224 billion |

It’s that brutal. The Zuma legacy and misfortune have made it so. Adjust, or be adjusted.

Charles Simkins, Head of Research, Helen Suzman Foundation.

[1] The projection of the debt to GDP ratio without the fiscal adjustment in 2023/24 is 106.1%, on its way to 140.7% in 2028/29 and still rising then.

[2] Supplementary Budget Review, 2020, p 30