WAGE NEGOTIATIONS FOR THE GOLD INDUSTRY 2015

AngloGold Ashanti – Harmony – Sibanye – Evander Gold Mines

FREQUENTLY ASKED QUESTIONS

FACT SHEET 3 AUGUST 2015

Q - What is the current status of wage negotiations?

A - Producers presented a final offer to the unions on Thursday, 30 July. The unions have met and will meet with their members to communicate the offer. A meeting is scheduled between the employers and AMCU for Tuesday, 4 August and with the NUM, Solidarity and UASA for Friday, 7 August.

The offer has been made on the basis that it is accepted by all unions. We hope the unions accept it so that we can move forward together to confront the challenges the industry faces.

Q - What is your offer?

A - In line with the companies’ differing economic and operational circumstances, offers in respect of wages are differentiated as follows:

AngloGold Ashanti and Sibanye (which together employ around 70% of employees), have made the following offers:

To Category 4 to 8 employees and B-lower officials, an amount of R1,000 per month in years 1, 2 and 3, as well as a R100 per month increase in living-out allowance in year 1. (This payment does not attract the normal company contributions to benefits as the focus of the unions has been on improving disposable income).

To Miners, Artisans and Officials, a 6% increase on standard rate of pay in year 1, and 6% or CPI (whichever is the greater) in years 2 and 3.

Evander Gold Mines has made the following offers:

To Category 4 to 8 employees and B-lower officials, an additional payment of R750 per month in years 1, 2 and 3, as well as a R100 per month increase in living-out allowance in year 1. (This payment does not attract the normal company contributions to benefits as the focus of the unions has been on improving disposable income).

To Miners, Artisans and officials, a 6% increase on standard rate of pay in year 1, and 6% or CPI (whichever is the greater) in years 2 and 3.

Harmony has made the following offers:

To Category 4 to 8 employees and B-lower officials, an additional payment of R500 per month in years 1, 2 and 3, as well as an increase in living-out allowance of R100 per month in year 1.

To Miners, Artisans and officials, a 4.6% increase on standard rate of pay in year 1, and 4.6% or CPI (whichever is the greater) in years 2 and 3.

Furthermore, Harmony has offered a gain share of 5% from the first rand of profit on a quarterly basis. (Profit will be defined as revenue in South Africa minus all South African costs, excluding dividends).

In addition, the companies have made a number of non-wage concessions in response to union demands, including:

An increase in medical incapacity benefit from R40,000 to R55,000 over three years.

Extension of the 2011-2013 concession of the medical aid contribution rates to 60% for employers and 40% for Cat 4-8 employees for three years from the date of the wage agreement.

Increase in the current guaranteed minimum severance pay of R20,000 to R30,000 over three years.

Extension of retirement age for surface workers from 60 to 63 years as from 1 July 2015, subject to meeting company medical examinations and fitness-to-work assessments as required.

Employees who wish to retire at 60 or before 63 shall be entitled to do so.

The companies propose that a task team be established to investigate the extension of the retirement age for underground employees from 60 to 63 years of age. The task team must complete a written report on its findings and recommendations within six months.

Q - What will happen now that AMCU has indicated that they will not accept the offer?

A - AMCU has not formally accepted or rejected the producers’ final offer. A meeting has been scheduled for Tuesday, 4 August. If the offer is not accepted, we will continue to engage with the union, but there will be no further offer.

Q - AMCU says it’s the majority at Sibanye and AngloGold Ashanti? Is that true?

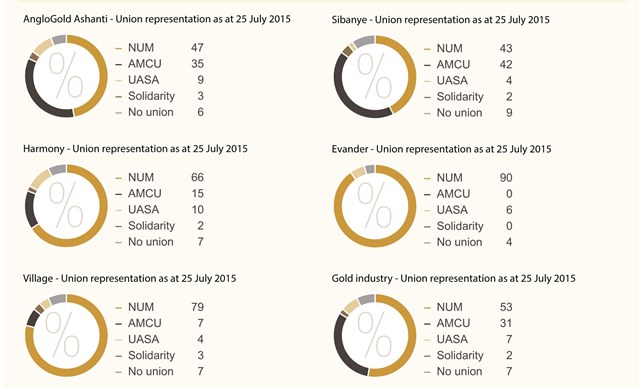

A - Union representation at the end of July 2015 was as follows:

Q - Why have you indicated that all unions have to accept the offer? Doesn’t this prejudice those unions who want to accept?

A - It is not possible for companies to have different wage agreements with employees based on the union which represents those employees as it would be unfair to employees, and it would be logistically impossible for the companies to have a portion of their employees not included in the wage agreement. It would be an unfortunate situation for those unions who wish to accept the offer if there is a union or unions that does not accept the offer.

Q - Can we expect a strike? Are the producers ready for that?

A - It is premature to talk about a strike. Companies and unions are still engaging with each other. No party has declared a dispute. At this point in time, the companies are focusing on engaging with the unions to ensure that an agreement is reached and that a strike does not occur.

Q - Have you just given up on the social and economic sustainability compact? And what about job guarantees?

A - We have not lost sight of our proposed compact and are still intent on pursuing this over the next three years. The producers have asked the unions to commit to the shared goal of maintaining a sustainable industry capable of securing employment and delivering returns to all stakeholders for the longest time possible.

Q - Why is the Harmony offer different from the others?

A - The offers were made based on the economic position of each of the companies. The offers were the best offers each company could make to ensure sustainability in their operations.

Q - Just how bad a state is the South African gold industry in?

A - The gold companies’ share prices are at multi-year lows, reflecting investors’ bearish outlook on gold price and growing uncertainty around the viability of South African production given its spiralling cost base.

The industry faces significant challenges as a result of falling dollar gold prices, aging infrastructure and depleting ore bodies, rapidly rising costs, electricity-related constraints and disruptions and greater distances to working faces which affect productivity. As a result, company margins are under severe pressure, placing the sustainability of many mines and shafts under threat.

In fact, when we tabled our first firm offer based on the companies’ economic models, the gold price was $1,200 per ounce. The gold price has subsequently declined by nearly $100 per ounce to around $1,100 – the lowest gold price in more than five years.

Statement issued by Charmane Russell, Spokesperson acting on behalf of the gold producers, Chamber of Mines, August 3 2015