I

AGAINST ECONOMIC RECKLESSNESS I - FIVE ILLUSTRATIVE QUOTES AND THEIR IMPLICATIONS

This is the first in a series of three briefs by Charles Simkins. It considers five reactions to the dismissal of Minister Gordhan and Deputy Minister Jonas, and the consequent downgrades. The second brief outlines a framework for understanding the choices now facing South Africa and the third deals with aspects of a route forward for empowerment.

There is a widespread sense that the dismissal of Pravin Gordhan and Mcebesi Jonas and the two rating agency downgrades which followed have altered our economic prospects and policy space. There is less agreement on how. South Africans will have to grapple for some time with conceptualization of the new situation and how to cope with it. This brief will deal with five early responses, embodied in comments, and what they reveal about initial understandings.

1) Junk status is not good for our country, but we all knew it was going to come.[1] (Jessie Duarte)

In other words: Don’t blame us, the downgrade was inevitable. But this is to gloss over the clear statements by both Standard and Poor’s and Fitch that what prompted the downgrades was the actions of the President. Thus Standard and Poor’s:

The executive changes initiated by President Zuma have put at risk fiscal and growth outcomes.[2] and Fitch:

The cabinet reshuffle, which involved the replacement of the finance minister and the deputy finance minister, is likely to result in a change in the direction of economic policy.[3]

Moreover, it is not clear that the downgrade was inevitable. For sixteen difficult months, Gordhan and Jonas led a successful effort to fend off a downgrade, with the co-operation of business and labour. The comment of Mohammed el-Erian, a frequent and respected commentator on Bloomberg is apposite:

We are seeing the movie play yet again. And it’s sad because the economy was turning the corner, not only the currency, but growth after the commodity shock.[4]

2) If you look at the formulation of ‘radical economic transformation’ it’s in the preface of the ANC strategy and tactics document in 2012, there’s hardly any elaboration of what it means. The President in SONA tried a bit to give some content to it, but given that limited elaboration, it could be a contested terrain. There’s a bit of worry until we clarify for ourselves what we mean by it. I imagine once there has been robust debate and it has been clarified, people will rally behind any formulation.[5] (Enoch Godongwana)

How odd this is – to introduce a slogan without a conceptualization behind it, and then to try to give it content ex post. Consider the two ‘elaborations’ offered this year>

i. The 2017 SONA identified two components of radical economic transformation: a revision of state and infrastructural procurement policy and enhancement of competition policy. It is unusual to characterise competition policy as ‘radical’. It is a standard component of economic policy in all affluent economies and in many emerging ones.

ii. The Economic Transformation Discussion Document prepared for the ANC’s National Policy Conference in July refers to radical economic transformation, but it fails to make a clear distinction between aspirations and programme. The result is twofold: the document rehearses long-held ANC aspirations and adds a long list of policies already in place or announced, all to be achieved by a ‘developmental state [6]’.You can be rebrand existing aspirations and policies as ‘radical economic transformation’, but that merely rearranges the deck chairs.

3) Radical economic transformation can be achieved within the fiscal policy ceilings we have set. We remain unapologetic about using the state’s spending power to grow black enterprises.[7] (Malusi Gigaba)

No apologies, then, but also no explanation of the consequences. Measures designed to manipulate procurement – including those already taken – in order to create rents for preferred groups inevitably push up costs. They also result in infrastructural project delays as ESKOM’s experience has shown. Fiscal policy ceilings plus price increases must result in the procurement of a lower quantity of goods and services than would otherwise be possible. Given a ceiling the trade-off works on a one-to-one basis: a 1% price increase entails a 1% quantity decrease. Fewer school and health facilities infrastructural upgrades, fewer improvements in the network of roads and passenger transport, a lower level of community services – the list is endless.

There is a theorem in public choice analysis that, in democratic contexts, it is the preferences of the median voter which prevail. The reason is straightforward: a successful coalition of interests must capture the allegiance of the voter in the middle. This is why United States presidential contests are often so close. Initial platforms elicit public responses which can be discovered by polls and, nowadays, big data analysis of social media. Analysis of polls identify the components of the platforms which do and do not appeal to the median voter and adjustments are made accordingly. Long campaign periods allow for several rounds of adjustment. The candidate who aces it in the end is up against an opposition with formidable platform adjustment capacity, with swings in popularity as new preference discoveries are made and an outcome too close to call on the eve of the election. Donald Trump’s victory was based on the behaviour of no more than 100 00 voters in three states, with 128 million votes cast.

The question for South Africa is: given the trade-off between price and quantity in state procurement, what choice will the median voter make?

4) Our chance to complete the revolution.[8] (Christopher Malikane)

Malikane means it. In a single article, he proposed expropriation of white monopoly capitalist establishments, such as banks, insurance companies and mines, a state bank amalgamating all state owned financial institutions and nationalization of the Reserve Bank, expropriation of all land without compensation to the state which will then collect rentals from it. In Malikane’s view, the cornerstone of the control of the state has always been the National Treasury and the Reserve Bank.

There are just two problems with all of this. These ideas were consigned to the lumber room of history in the last decade of the twentieth century, and they have not been rehabilitated since then. This was one of the things that made the political transition possible and, in this respect, the choices made then remain valid now.

The second is that the Ministry of Finance has felt obliged to place on record that the opinion piece by the advisor to the Minister of Finance, Professor Malikane, was written in his personal capacity as an academic and an activist, and that the views expressed are not necessarily government policy. The Ministry of Finance will continue to be guided by the policies of the ANC. The nationalisation of banks is not government policy. The start of Malikane’s advisory role seems to have been inauspicious, but one must reckon with the possibility that he was appointed so that advocates of radical economic transformation would feel that they have a friend at court.

This has been a fire that Minister Gigaba has had to put out. It will not be the only one. The Minister will be busy keeping his hand on the hose. Occupied as he will be in this way, two dangers remain. The first is that the Treasury’s capacity to maintain the promised public expenditure will be sapped, and the second is that he may just have the time to sign off on damaging deals, including nuclear procurement.

5) We are welcoming the junk status. When the economy rises again, it will be held by us [9]. (Collen Maine)

So you don’t want to play with us? Fine. It leaves us free to have the domestic economic dustup we’ve always wanted. We shall emerge victorious from it, at which stage we start a new game with the global economy.

There are two issues here. For Dante, hell was not a simple place. It had nine circles, within each circle sinners are various types were to be found in each circle, and some circles had a complicated internal structure. So it is with ‘the junk status’. The third major ratings agency – Moody’s – has South Africa under review, but it has not pronounced its assessment yet. There are circles of junk. The first circle is known to Standard and Poor’s as BB+, and this is the circle we currently inhabit. Below that is BB, and BB-, all described as non-investment grade: speculative. Then comes B+, B and B-: highly speculative. After that, comes CCC+ (substantial risk), CCC (extremely speculative) and CCC-, CC and C (in default with little prospect of recovery) and D (in default with no prospect of recovery). Moreover, the ratings have several dimensions. The most commonly quoted (and the one referred to above) is the long term foreign currency sovereign credit rating. But there is also a long term local currency rating, as well as short term foreign and local currency ratings. The upshot is that South Africa has a long way it might still fall, and the fires get hotter as one descends.

The second point is that the intuition, so artlessly presented by Maine, may well command adherence in circles beyond the ANC Youth League who prefer not to make such a blunt statements.

Conclusion

It is not surprising that, at this stage, views are diverse and not properly thought through. To make progress, one needs an analytical framework to locate and debate the issues more precisely. The second brief will outline one.

___________________________________________

[1] Reported by News24 on 16 April 2017

[2] Standard and Poor’s statement on South Africa, 31 March 2017

[3] Fitch’s statement on South Africa, 7 April 2017

[4] Bloomberg Video, 28 March 2017

[5] Podcast: Interview with Stephen Grootes on Cape Talk, 10 April 2017

[6] On any definition, a developmental state cannot be reconciled with a kleptocratic state. At this level. a credibility gap remains to be bridged.

[7] Treasury 101: Malusi Gigaba, radical economic transformation and the elephant in the room, Daily Maverick, 19 April 2017

[8] Sunday Times, 16 April 2017

[9] As reported on News 24, 7 April 2017

II

AGAINST ECONOMIC RECKLESSNESS II - THE VALLEY OF TRANSITION

The approach here uses work by Adam Pzreworski, who considered the transition from capitalism to socialism in the 1980s[1] and from socialism to capitalism in the 1990s[2] . It will work for any radical change in an economic system. The argument proceeds in several stages.

1. Radical change in an economic system necessarily causes a temporary fall in aggregate consumption which can last several, or many, years [3]. Such change is socially costly and politically risky. It is likely to hurt large social groups, evoking significant opposition from important political forces. In the process, democracy may be undermined or reforms abandoned, or both.

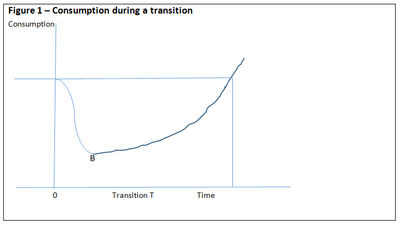

Figure 1 presents the situation graphically, based on the optimistic assumption that the new system will support growth. If not, the lower level of consumption (point B in Figure 1) will continue or decline further.

Figure 1 – Consumption during a transition

In South Africa, we are already in a valley, with real per capita income currently below the 2014 level, and a recovery to the 2014 level is not expected until after 2022[4] . The existing situation is stressing the social fabric, and a radical transition will make things much worse.

2. Transitional costs may include inflation, high interest rates, increased unemployment, capitaldestruction, adverse distributive consequences, budget deficits and balance of payments crises.

The precise mix depends on circumstances. Populist policies, for instance, usually lead to inflation, fiscal deterioration and balance of trade difficulties, especially if the central bank is rendered unable to implement appropriate monetary policy. Under these circumstances, consumption may actually rise for a short period, only to crash harder as economic conditions become unsustainable.

Mexico made a different type of mistake by pegging its currency to the dollar, while failing to reduce inflation to the United States level. By 1994, the Mexican peso was overvalued to the point where housewives crossed the border to shop in Texas. The balance of payments could not be sustained, and the Mexican government found itself issuing shorter and shorter term bonds at ever increasing interest rates. At the end of 1994, the Mexican government defaulted and real GDP per capita dropped by more than 7% in 1995, while inflation rose from 7% to 35%. It took the entire United States currency stabilization fund to deal with the situation. Leaps in inflation always produce adverse distributional consequences: the most economically marginal are the least able to protect themselves against it.

Capital destruction has been most apparent in the countries comprising the former Soviet Union and communist Eastern Europe. The collapse of communism meant that the economies now had to cope with world prices and a very large number of enterprises could not survive the change. Thousands and thousands of ruined factories blight the landscape. But capital destruction can occur in subtler ways. As output declines, expectations become more pessimistic and share prices decline, destroying financial capital in the process. Investment in new projects ends and existing projects may shut down in part as a whole.

Usually matters are brought to head by a balance of payments crisis, which occurs when a nation is unable to pay for essential imports or service its debt repayments. In a floating exchange rate world, this is accompanied by a rapid depreciation of the currency. Foreign investors become concerned about the level of debt their inbound capital is generating, and pull out their funds[5] . The can raise interest rates, but such a move further depresses the economy. This is the point at which help from the International Monetary Fund is sought and it comes with structural adjustment conditions. Of course, a country can decline IMF assistance, but this will result in a further downward spiral.

In the first ten or fifteen years after 1994, the government was anxious to avoid any situation where IMF help would be needed, as it inevitably means loss of policy control. It was this anxiety which prompted GEAR in 1996, and a reduction in public debt as a proportion of gross domestic product up to 2007. This caution seems to have evaporated in recent years, with general government gross debt has risen from 27% in 2008 to 50% in 2016. The most recent IMF country debt assessment for South Africa in 2016 found that, on base line assumptions, our debt position was sustainable, but that risks were rising. They have just risen again.

What would radical economic transformation look like in South Africa, and how would it move us down the curve shown in Figure 1? Two components can be identified. The first is loss of macroeconomic balance, occasioned by weak leadership at the Treasury. Given very low economic growth, spending ministries are champing at the bit for a while, and some departments and state owned enterprises are forcing transfers to themselves. In addition, weaknesses at the South African Revenue Service are becoming apparent, and the risk of signoff on economically damaging projects is rising. The result must be loose fiscal policy and an increase in the rate at which government debt rises. The Reserve Bank can offset the effects to a degree, but there are limits on the extent to which interest rates can rise, even assuming continuing Reserve Bank independence, which is far from assured. This is the trajectory of macroeconomic populism.

At the same time, contention against ‘white monopoly capital’ implies an assault on property rights, which can be expected to become increasingly disorderly as the economy moves down the curve. This will affect domestic and international confidence alike, choking off investment, making the capital account of the balance of payments more precarious and resulting in the destruction of financial and physical capital and rising unemployment [6].

3. Radical economic changes unleashes new political dynamics between government and people which can have several and often destructive outcomes.

One issue is the speed of the transition: a radical approach might entail a deeper drop in consumption and a more rapid recovery (‘shock treatment’) while a more gradual approach would entail a smaller drop but recovery over a longer period. Voters may prefer a radical approach if they are confident about the longer term future making up for shorter term deterioration. Less confident voters are more likely to prefer the gradual strategy and voters with no confidence will choose the status quo. Governments, on the other hand, would like to see the economy moving upwards by the next election, giving them an incentive to adopt a radical strategy.

Political conflict will in any event emerge as social costs are experienced and a radical strategy will intensify opposition. This may force vacillation: the radical strategy may have to be modified under pressure, or even abandoned. Should this happen, public confidence may turn to scepticism. Under these circumstances, governments face a choice between co-operation with a broad set of social partners, or destroying them. The latter strategy undermines democracy. A second form of vacillation may then occur: first an attempt by the government to ram through a programme, followed by reversion to ‘bargaining’ in order to orchestrate support for policies already chosen, increasing distrust in the process. In this way, radical transformation may destabilize democracy.

4. How deep can the valley of transition be and how long can it last?

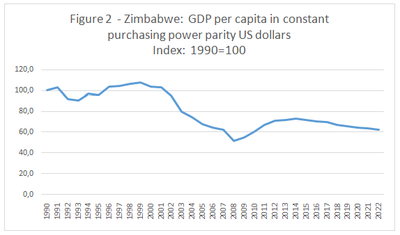

Figure 2 graphs GDP per capita in constant purchasing power parity dollars for Zimbabwe, based on an index of 100 in 1990.[7]

Freedom House rates Zimbabwe at 5 on its political rights scale and 5 on its civil liberties scale (1 is best and 7 is worst) in 2017. It is at the bottom of the “partly free” range.

So the valley of transition can be very deep (the projected 2022 level is 40% below the 2000 level) and very long (more than twenty years without an upturn if the sharp drop between 2008 and 2010 in response to the global financial crisis is not taken into account). The country also has poor political rights and civil liberties indicators, as the theory suggests.

Conclusion

So the question must be asked: can the government impose a valley of transition on an economy in which average living standards have been dropping without undermining our democracy? The prospects do not look good. Public confidence in ‘radical economic transformation’ is not promoted when there is such weak definition of its elements, and when there is widespread suspicion that it is a cover for further elite enrichment. The level of conflict within the tripartite alliance and the division among the trade unions are indicators of a concentration of power and the construction of faits accomplis within which everyone is expected to work.

Does the argument in this brief and the preceding one rule out progress within a democratic framework? By no means, and the final brief in this series will explain why not.

Footnotes

___________________________________________

[1] Adam Przeworski, Capitalism and social democracy, Cambridge University Press, 1984

[2] Adam Przeworski, Democracy and the market: political and economic reforms in Eastern Europe and Latin America, Cambridge University Press, 1991

[3] As an illustration, Argentina’s real per capita GDP in 1980 was not reached again until 1997, Brazil’s until 1987 and Mexico’s 1981 level until 1999. Venezuela, under Chavez and now Maduro, is in free fall. Its projected real GDP per capita in 2022 is 39% below the 1992 level. The inflation rate in 2016 was 255% and is projected to increase much further. The unemployment rate tripled between 2015 and 2016.

[4] International Monetary Fund, World Economic Outlook Data Base, April 2017

[5] Capital controls might be imposed, but invariably they are least effective when they are most needed.

[6] In the fourth quarter of 2016, there were 5.8 million unemployed people and a further 2.3 million discouraged workers.

[7] The information is based on estimates and projections in the IMF World Economic Outlook data base, April 2017

III

AGAINST ECONOMIC RECKLESSNESS III - IT’S NOT ON TOP, IT’S INSIDE

May 04, 2017

Introduction

Since 1994, empowerment initiatives have focused heavily on conditions at the top of South African society. First to happen was the rapid and very great enrichment of a number of politically well- connected individuals, inciting envy and high expectations to this day. Yes! That’s what we want! – not a modest car and a mortgage. Ad hoc deals were replaced with a broader framework when the Broad-Based Black Economic Empowerment Act was passed in 2003, and amended in 2013. Under these Acts, an extensive and complex system of regulation has emerged [1].

At the heart of the system is a scorecard weighted as follows: ownership (25%), management control (15%), enterprise and procurement development (40%), skills development (20%) and socio-economic development (5%). The first two elements are directed at the top of enterprises, the last two have broader implications, while enterprise and procurement development seeks to extend BEE to producers of intermediate inputs, and are primarily directed to the top of these intermediate enterprises. Alongside this legal system there is a shadier world of use of public position for private gain, by means of both extortion and collusion, now reaching epic proportions.

The system has two costs. First, it directs resources upwards, which might have been used to spread benefits and transform conditions more widely among the poor and excluded, consolidating democracy rather than engendering cynicism about it. Secondly, it has created a ‘state within the state’, which resists democratic pressure rather than accommodating it. A responsive government, seeing the country enter a period of very weak growth, would have formulated a strategy to support the poor through it and made an effort to communicate the circumstances and its responses to the population at large. Apart from some aspects of taxation in the 2016 and 2017 Budgets, we have seen nothing of the kind.

Empowerment reform, then, not only can be, but must be, a plank in the pro-democracy platform.

An example of re-orientation: measures to improve the position of young people

As an example of what might be done in one of many fields, this brief suggests three related initiatives to improve the situation of the twenty million people between the ages of 15 and 34. Attention to issues facing them is both spotty and not sustained, even though there is widespread agreement that the current situation of many young people is a ticking time bomb. The initiatives are:

1. Do more to integrate youth socially. There is, on average, a long period between leaving the educational system and entry into employment. Employment improves prospects for marriage and cohabitation among young men. High youth unemployment means late marriage.

The little information we have indicates that late marriage has been common for a very long time. Historian Jeff Guy argued that the Zulu practice of organizing young men into age regiments dissolved and allowed to marry only at the king’s command was not only a source of royal power, but also a means of controlling fertility in an ecologically difficult environment. In less centralized systems, young adults could also add value to agricultural production in their household of origin. All that is a dead duck now. Just 85 thousand young people reported themselves as employed in agriculture in the tribal areas and a further 242 thousand on the commercial farms, together constituted 5.2% of total youth employment.

With most of the young living in urban or quasi-urban settlements, low productivity employment has changed into open unemployment. Approximately six million young people not in education or employment spend a long time sleeping and watching TV or listening to music and, particularly in the case of young women, spend little time outside their homes .What they need is accessible sites for activities and interaction, including advice. In the end, time is the scarcest resource: the task is to improve its use. Entry into paid employment is not the only activity which should be promoted.

2. Develop the Expanded Public Works Programme so that young people can provide services to young people. In so far as physical facilities need to be constructed, young people should be involved in their construction as far as possible, and paid for it. Advisors and activity facilitators should also be drawn from the young, with appropriate training provided. The general objective should be to add layers of activity continuously.

3. Develop export processing zones as a source of new employment opportunities for the young. As part of its proposed growth agenda, the Centre for Development and Enterprise has proposed establishing an export processing zone in the Nelson Mandela Bay metro [3].

Firms locating in the EPZ would enjoy the following benefits:

- Duty-free imports, rapid customs and export clearance formalities.

- Subject to certain basic safeguards on employment practices such as working conditions, plant safety etc., firms would be free to negotiate wages and working hours in-house with their employees.

- Subject to certain safeguards, firms would be able to expand and contract their workforces as market and demand conditions change and/or rely on piece-work contracts for the remuneration of their staff.

There would be two restrictions on firms locating in the EPZ:

- Production would be solely for export. Firms located in the EPZ would be required to export 100 per cent of their output.

- Only new firms and/or new activities would be permitted. Firms with operations in South Africa would not be permitted to move any existing operations to the EPZ.

The general objective would be the capture of new international demand, rather than substituting existing supply to meet domestic demand. The opportunities for youth in EPZs would complement the effect of the wage subsidy for young employees.

Conclusion

A transition from top-heavy to bottom-heavy empowerment offers the opportunity for greater consolidation of democracy and more widespread social inclusion. Such a transition is not compatible with the domination of narrow and highly extractive interests within the state. Pro-democratic mobilization will be needed before progress can be made.

______________________________

[1] Aspects are discussed in Charles Collocott,Radical Socio-Economic Transformation, State Procurement and Broad-Based Black Economic Empowerment, HSF Brief, 4 April 2017

[2] On this see Charles Simkins, What do young people do with their time I and II? HSF briefs, 14 February 2017

[3] CDE, Growth Series Report 7, 2016

Charles Simkins is Head of Research at the Helen Suzman Foundation.

These articles first appeared as HSF Briefs.