JSE Releases Third Study on Black Ownership on the Exchange

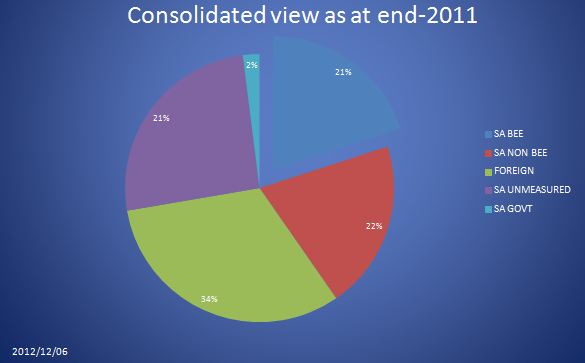

JOHANNESBURG, 06 December 2012: Black South Africans hold at least 21% of the Top 100 Companies listed on the Johannesburg Stock Exchange, with 21% of the available shares listed on the JSE still to be assessed, says Trevor Chandler of consultancy Chandler & Associates, who headed the research team appointed by the JSE (see text of presentation here).

The 21% includes 9% held directly, mostly through empowerment stakes, and 12% through mandated investments, such as pension funds and unit trusts. The figure is understated as not all shares have been analysed. The research, done in phases on behalf of the JSE, aims to demonstrate what black South Africans own in the country's largest listed corporations. Part of the 21% still to be analysed is likely to be owned by black South Africans.

"In a country undergoing economic transformation, it is important to have empirical data about black investment on the JSE," says Nicky Newton-King, CEO of the JSE. "This year's study found a similar participation level among black and white South African investors - 21% and 22% of the Top 100 by value respectively. With 21% of the equity yet to research, the ownership figures may be understated. We also think one can assume that the black economic interest will continue climb in future and that this research provides a base for future measurement."

There has been much debate about black ownership on the JSE. The purpose of the study was to present the facts in an impartial manner. The top 100 companies listed on the JSE used in the study represented 88% of the total market capitalisation of the exchange and therefore can be used as a proxy for the total market.

Last year's assessment revealed that black South Africans held slightly over 8% of the Top 100 companies through direct investment. This year, by digging deeper, researchers found that the figure has moved up to 9% through direct investment and that black South Africans also hold a further 12% of shares in Top 100 companies through mandated investments. Mandated investors do not select shares themselves, but gain exposure through life offices, pension funds, unit trusts or exchange traded funds.

The research is being done in phases due to the extremely time-consuming nature of the analysis. This year, the researchers had to go through 15 million share ownership records to assess 75% the shares owned through mandated investments. (The other 25% has not been researched, meaning that the total number of shares held by black investors through mandated funds is likely to increase in future studies.)

Given that the Department of Trade and Industry (dti) is central in the country's formulation of BEE codes, the researchers applied the dti's suggested methodology. Using the calculation method suggested in the dti BEE codes, certain categories of ownership are excluded as the investors are deemed to be neither black nor white.

"When one applies the dti methodology to the calculation of black economic interest on the exchange the 21% above rises to 33%. This is principally due to the fact that listed companies who own businesses in multiple countries are allowed to exclude the value of these foreign business operations from the calculation of Black Economic Interest" says Chandler"

The methodology was reviewed by two BEE Verification agencies (Aqrate and Empowerlogic) and one external audit firm, who found it to fairly present the results.

The researchers were cautious about the assumptions that they made during the study. In particular, black economic interest was assumed to be zero when:

- Companies did not participate in study;

- Researchers could not prove that pension schemes had black beneficiaries; or

- Researchers could not prove that black people had life insurance policies or unit trusts.

As encouraging as the data appears, much still needs to be done to achieve an equitable landscape. To this end the JSE has for many years run a number of initiatives to foster improved financial literacy and encourage retail South Africans investors to invest on the exchange:

- The JSE/Liberty Investment Challenge is an annual trading game which the two groups run to educate learners about the workings of the stock market. Teams of learners or university students are given an imaginary sum of R1,000,000 to invest in JSE-listed shares. Their performance is then tracked and measured against other teams taking part in the contest.

- The JSE reaches out to ordinary South Africans about how to begin investing, and has travelled the country with expos in major cities.

- The JSE also hosts regular investor showcase events at the exchange that are open to the general public.

Statement issued by Nicky Newton-King, CEO, JSE Ltd, December 6 2012

Click here to sign up to receive our free daily headline email newsletter