Auditor-general reports a noticeable, improving trend in local government audit results

3 June 2015

CAPE TOWN – The noticeable increase in the number of municipalities and municipal entities that received financially unqualified audit opinions with no findings (commonly known as a “clean audit”) in the 2013-14 financial year is a laudable step towards wholesale good governance for South Africa’s public sector, the auditor-general (AG), Kimi Makwetu, said today.

Releasing his report on local government audit outcomes for the year under review, Makwetu said the continuing improvement in municipal audit outcomes is largely due to the political and administrative leadership, albeit limited, “starting to set the right tone and leading by example in ensuring that the basics of good governance are in place and implemented rigorously”, in line with his office’s ongoing messages of good administration in the public sector.

The AG said those municipalities and entities that progressed to, or maintained their previous year’s, clean audits had “adopted or gone back to the basics of clean governance”. These include rudimentary tasks such as:

- introducing basic accounting and daily control disciplines

- enforcing compliance with all legislation

- employing and retaining staff in accounting and financial management positions with the required level of technical competence and experience

- allowing the chief financial officer to be in charge of the financial administration function and report thereon to the municipal manager.

In its annual audits, the Auditor-General of South Africa (AGSA) examines:

- fair presentation and absence of material misstatements in financial statements

- reliable and credible performance information for purposes of reporting on predetermined performance objectives

- compliance with all laws and regulations governing financial matters.

The audited institution achieves a clean audit when their financial statements are unqualified, with no reported audit findings in respect of either reporting on predetermined objectives or compliance with laws and regulations.

The audit outcomes of 325 auditees (268 municipalities and 57 municipal entities) are included in the latest general report.

Audit outcomes

Clean audits (the overall national picture)

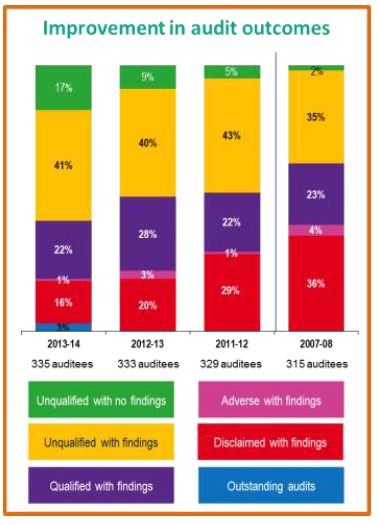

Makwetu said that the total number of municipalities and municipal entities with clean audits increased from 30 in the 2012-13 financial year to 58 in 2013-14; while there were only seven in 2007-08, the outcome that triggered the launch of operation clean audit. This represents 40 (14%) of the municipalities and 18 (32%) of the municipal entities in the country. He said it was noteworthy that 27 auditees (municipalities and municipal entities) had also received clean audit opinions in 2012-13, which is an “encouraging sign that the improvements at these auditees are sustainable”.

Makwetu noted that auditees in the clean audit category had focused on strengthening discipline and oversight in their financial management. They had adopted and consistently applied the following disciplines:

a) Produced financial statements that were free from material misstatements (material misstatements mean errors or omissions that are so significant that they affect the credibility and reliability of the financial statements).

b) Complied with key legislation.

c) Measured and reported on their performance in their annual performance report in accordance with the predetermined objectives in their integrated development plan and/or annual service delivery and budget implementation plan in a manner that was useful and reliable.

d) Had good controls and/or work on the areas that needed further attention to ensure that their clean audit status was maintained. This included:

- leadership creating an environment conducive to internal control and oversight

- senior management ensuring that controls were in place for robust financial and performance management

- implementing basic disciplines and controls for daily and monthly processing and recording of transactions.

e) Had key role players working together to provide assurance on the credibility of the financial statements and performance reports. These auditees understood that assurance on the credibility of the information in the financial statements and performance reports came primarily from the actions of management/leadership and their governance partners, namely internal audit units and audit committees.

f) Ensured that record-keeping and document control was an institutionalised discipline.

g) Ensured that vacancies in key positions were limited, with stability at the level of municipal manager/chief executive officer, chief financial officer and head of the supply chain management unit.

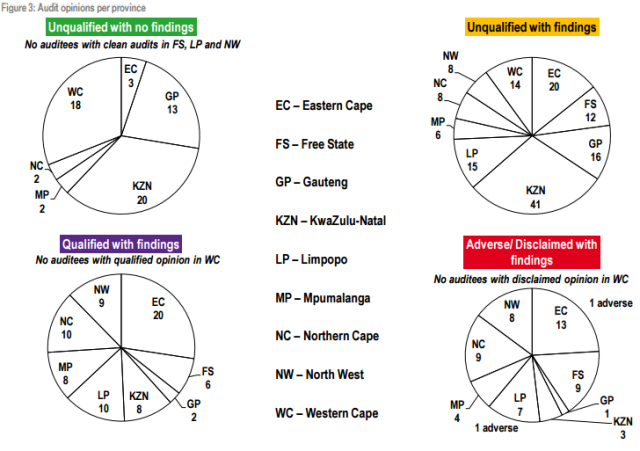

The overall provincial outcomes can broadly be categorised as follows:

1. Firstly, provinces that had fairly strong financial management and control disciplines in most municipalities. Included in this category are Gauteng, KwaZulu-Natal and the Western Cape.

2. Secondly, provinces showed limited progressive positive movement in audit outcomes with significant financial management and control deficiencies. Most municipalities in the Eastern Cape, Mpumalanga and the Northern Cape fit in this category.

3. Thirdly, provinces whose municipalities had very weak financial management disciplines with significant control weaknesses in most municipalities. Included in this final category are municipalities in the Free State, Limpopo and North West.

Deficient controls, which are common in municipalities that did not achieve a clean audit, render the system vulnerable to widespread abuse and often a loss of adequate audit trails to substantiate transactions.

Provinces with fairly strong financial management and control disciplines in most municipalities

Makwetu said a number of provinces showed an improvement in their audit outcomes, with the biggest contributors to the total number of clean audits being Gauteng with 13, KwaZulu-Natal with 20, and the Western Cape with 18.

Most municipalities and municipal entities in these provinces had good internal controls or were working on the areas that needed further attention. These controls were underpinned by most positions being filled by key officials that had already achieved the prescribed competency requirements. This enabled most auditees to produce financial statements that were free from material misstatements and to comply with key legislation.

“I acknowledge the role played by internal audit units, audit committees, councils, municipal public accounts committees and coordinating institutions through exercising their oversight responsibilities in improving governance of local government in these provinces,” the AG said.

However, Makwetu was quick to caution that “even though audit outcomes improved and should be celebrated”, some of these improvements had been achieved through over-reliance on consultants and the correction of errors identified by auditors during the audit process, while the number of auditees with supply chain management findings remained high in this category of provinces.

These municipalities incurred irregular expenditure of R3,643 billion, of which R3,3 billion was incurred by those municipalities that did not get clean audits in this category. The total irregular expenditure attributable to Gauteng municipalities is R1,1 billion; KwaZulu-Natal R2,3 billion; and the Western Cape R162 million.

Provinces with limited positive movement with significant financial management and control deficiencies

The provinces with the most municipalities and municipal entities in this category are the Eastern Cape, Mpumalanga and the Northern Cape. Each of these provinces had one district municipality that attained a clean audit outcome for the first time or that had retained its clean audit status.

The quality of the financial statements submitted for auditing remains a concern in these provinces, which highlights the auditees’ continued reliance on the audit process to ultimately achieve unqualified audit opinions. This, together with over-reliance on consultants to assist with financial and performance reporting, indicates that the concerns regarding internal controls and skills gaps at these auditees have not been adequately addressed.

The AG said he is particularly concerned about the high level of supply chain management transgressions that are driven by uncompetitive or unfair procurement processes, conflicts of interest and internal control failures that have contributed to the R4,155 billion in irregular expenditure incurred by these provinces. The Eastern Cape’s portion of this expenditure is R3,36 billion; Mpumalanga R567 million; and the Northern Cape R238 million. The portion of these amounts applicable to municipalities who received clean audits is R15,4 million. All levels of leadership should set the tone by dealing decisively with transgressions of applicable legislation.

Furthermore, the results of our assessment of key controls and the level of assurance provided by the key role players indicate that there have been inadequate consequences for poor performance and a lack of decisive leadership interventions to address the previous year’s root causes.

It is encouraging to note the commitments of the political leadership of these provinces to improve the audit outcomes. Some of the interventions include harmonising the roles of the provincial departments of cooperative governance and of finance as well as capacitating district municipalities to improve their own and their local municipalities’ audit outcomes.

Provinces where financial management disciplines are very weak with significant control weaknesses in most municipalities

The auditees in this category are concentrated in the Free State, Limpopo and North West. None of the auditees attained clean audit opinions and the majority of the auditees in each province achieved qualified, adverse or disclaimed audit opinions. Overall, most auditees had deficient controls that rendered the system vulnerable to widespread abuse and often a loss of adequate audit trails to substantiate transactions.

The quality of the financial statements submitted for auditing remained poor at between 92% and 97% of the auditees in these provinces, pointing to a poor internal control environment at most municipalities. Vacancies in key positions need to continue receiving attention in the Free State and North-West, particularly the positions of head of the supply chain management unit that had vacancy rates in excess of 50%. Most of the auditees used consultants at a significant cost for financial and performance reporting but this did not improve the audit outcomes due to poor control environment.

Supply chain management remained a challenge, with the irregular expenditure incurred amounting to R3,651 billion across the three provinces. In this regard, the Free State accounted for R934 million; North West R1,899 billion; and Limpopo R818 million. The lack of consequences for transgressions continued to be the key driver of the non-compliance. The leadership has not taken any visible actions to improve this situation and address the root causes of audit findings, the AG said.

The legislature and the provincial coordinating departments provided limited or no assurance in each of these provinces. The offices of the premier must strengthen intergovernmental relations in conjunction with the oversight of the coordinating departments, as they all have a direct bearing on municipal functions.

AG’s municipal visits to understand the link between clean audits and service delivery

In the first three months of 2015, the AG visited different municipalities across the country that had received clean audits. The visits included municipalities in KwaZulu-Natal, the Western Cape, Mpumalanga, Gauteng and the Eastern Cape.

Makwetu said that these visits were partly aimed at congratulating the municipalities on their clean audits, while also enabling him to understand the link between the achievement of a clean audit and the delivery of services.

“Together with the leadership of these municipalities, we had an opportunity to reflect on the importance of clean administration as a catalyst to drive service delivery. The municipalities also had a chance to showcase their governance structures as a critical area in ensuring the attainment of clean audit outcomes. The political and the administrative leadership accompanied me and my team on visits to some key projects, where they provided us with detailed information on how these projects are managed for the benefit of local communities. As part of the exercise, the projects visited were linked to the objectives of the municipality’s annual performance report as well as the key performance areas or key performance indicators in their 2013-14 annual reports. I was impressed by the sterling work that these municipalities, some in the remotest parts of our country, are doing to have a positive impact on their communities. These municipalities have shown that if you have basic good governance controls and disciplines in place, you can effectively use these to improve the lives of your residents,” the AG enthused.

Key leadership initiatives towards improving audits and ensuring good governance

The AG said his office is encouraged by national government initiatives, such as the local government back-to-basics strategy, as they are likely to have a positive impact on improving audit outcomes and good governance when fully implemented. Makwetu said that positive responses from, and the involvement of, premiers, speakers and members of the executive councils responsible for finance and local government have had a positive impact on the 2013-4 audit results.

“These leaders have thrown their weight behind the drive towards wholesale clean audits and good governance in general. Through their championing of the implementation of basic disciplines at their municipalities, the future audit results can only move to the desired space – wholesale clean administration. Our office will continue to work closely with these leaders by drawing from their experiences and sharing our knowledge towards improved financial management and performance reporting in local government,” Makwetu concluded.

Other significant audit observations

Further improvements in timeous submission of financial statements

The AG’s report shows that in total, 323 auditees (96%) submitted their financial statements for auditing by 31 August 2014 (or by 30 September 2014 in the case of consolidated financial statements), as required by legislation. Ten reports were outstanding at the cut-off date for inclusion of reports in the general report, nine of which have been finalised to date.

Improvement in the management of consultants

The report shows that 84% of the auditees used consultants to assist them with either financial reporting or the preparation of performance information, or both these areas (an increase from the 80% in the previous year).

The estimated cost of consultancy services was R821 million, which includes the amounts spent by treasuries and departments of cooperative governance. The amount increased from R725 million in the previous year, and represents only a portion of the estimated R3 151 million spent on consultancy services by local government.

Overall, 55% of the assisted auditees received financially unqualified audit opinions – a significant improvement compared to the 46% in 2012-13. Similarly, 58% avoided material findings on the quality of their annual performance reports – an improvement from 55% in 2012-13.

Makwetu said his office’s audits of the management of consultants at 293 auditees revealed weaknesses at 184 (63%) of them, which is a significant improvement compared to the 197 (79%) in 2012-13. “Our findings included skills not being transferred, poor performance management and monitoring, and inadequate planning processes,” the AG said.

Reduction in irregular as well as fruitless and wasteful expenditure; but increase in unauthorised expenditure

Irregular expenditure of R11 473 million was incurred by 264 auditees – an improvement from the R12 226 million incurred by 270 auditees in 2012-13. The AG said that non-compliance with procurement process requirements was the main contributor to the irregular expenditure.

“We did not perform any investigations into irregular expenditure, as that is the role of the council. Through our normal audits we did determine that goods and services were received for R6 598 million (58%) of the supply chain-related irregular expenditure despite the normal processes governing procurement not having been followed. However, we cannot confirm that the goods and services had been delivered at the best price and that value was received,” explained the AG.

Fruitless and wasteful expenditure of R687 million was incurred by 250 auditees – an improvement from the R860 million incurred by 222 auditees in the previous year. Unauthorised expenditure of R11402 million was incurred by 190 municipalities (71%) – a significant increase compared to the R8 502 million incurred by 175 municipalities in the previous year. In total, 61% of the unauthorised expenditure related to non-cash items, meaning accounting estimates such as impairments and provisions.

Financial health of municipalities

Makwetu concluded that “there’s considerable pressure on the finances at municipal level, as shown by this report”. “The combination of financial health risks and the weak controls should be enough to elevate this situation to the level where our local government can be improved urgently,” the AG cautioned.

Statement issued by the Auditor-General of South Africa, June 3 2015.