Only two out of ten businesses were operating at full capacity under early Level 3 restrictions – Sakeliga Business Impact Survey

3 July 2020

Only about two out of ten businesses who participated in business group Sakeliga’s business impact survey for June indicated that they could resume their activities at full capacity in June. The survey was taken among Sakeliga members and their broader network.

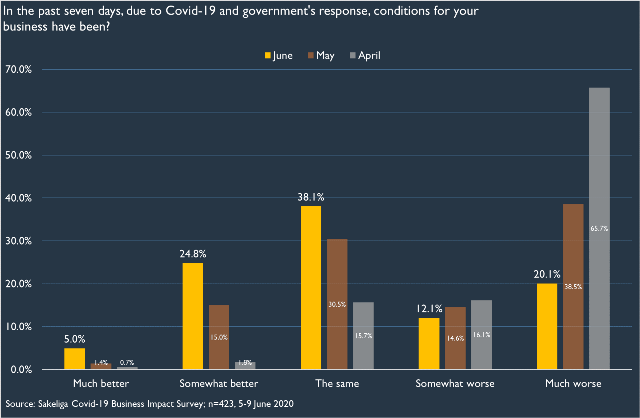

In addition, respondents indicated that damage to consumers’ wallets because of Covid-19 and the regulatory response to it has had the biggest negative impact on sales. In June, conditions improved compared to the previous surveys in April and May. This was due to the less stringent restrictions. Although the additional easing of regulations later in June should further improve prospects, there are still major challenges ahead for many businesses.

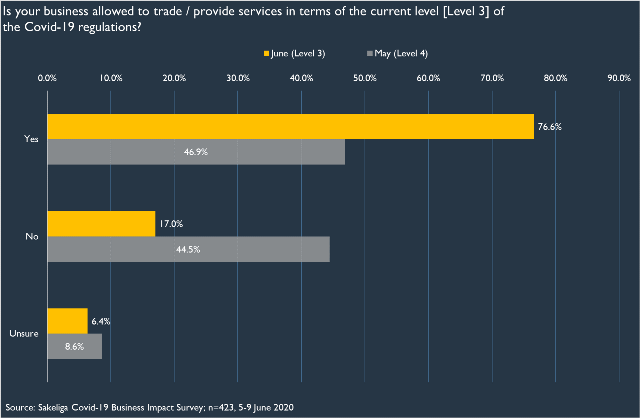

“In June, nearly eight in ten (77%) of respondents indicated that their company was allowed to trade. That was proportionately much better than only nearly five in ten of respondents in May’s survey. However, nearly 17% of respondents still indicated in June that their company was not allowed to trade, while 6,4% were unsure about this,” says Gerhard van Onselen, senior analyst at Sakeliga.

“Only slightly more than two out of every ten of the participants indicated that at the beginning of June their company was operating at full capacity. An additional about five out of ten indicated that their businesses were trading with limited operations. About 16% of respondents indicated that their company wasn’t operating because it didn’t yet make financial sense to open.

***

“Moreover, almost seven out of every ten of the respondents who were allowed to trade in early June (324 out of 423 participants in June) indicated that it was more difficult to obtain the necessary inputs for operations than before the Covid-19 restrictions. This may indicate that supply chains for many of the respondents’ companies are still being hampered to some extent.”

Many of the respondents regard the damage inflicted by Covid-19 and the restrictions as lasting damage. According to Piet le Roux, CEO of Sakeliga, two critical principles should now be applied to put the economy on the road to recovery: “First the government should learn from their mistakes and not return to irrational and even unconstitutional restrictions. Secondly, restructuring must take place – not in the economy, but rather the state.”

Van Onselen adds: “In June, nearly 40% of the participants believed that little could be done to ultimately counter the damage due to Covid-19 (as opposed to 48% in May). Huge declines in total sales continue to be expected for 2020 as a whole. Although the actual impact on sales will only come to light later on, participants’ feedback likely illustrates persistent negative sentiment about sales in 2020.

“In June, slightly more than a third of the participants expected their business to be able to survive just three more months under the Level 3 restrictions (from early June). With problems such as unemployment already reaching new record heighs in the quarter before lockdown, it paints a bleak picture for sales. In addition to that, fears about new restrictions and the impact of existing restrictions on business models will likely continue to strain businesses’ spending and investment plans.”

More information about the survey

In the June survey, the participants were as follows:

Participation: 423 respondents participated in the survey. As in the past, Gauteng (45%) and Western Cape (18%) were the most representative of the respondents. Nearly 20% of respondents indicated that they form part of an existing business chamber.

Number of employees: Businesses with fewer than 50 employees accounted for 96% of respondents. Approximately 75% of the respondents indicated ten or fewer employees in their companies. Smaller companies were once more strongly represented.

Description of activities: Accommodation, tourism and restaurants; Building and construction; Sales of products and services to the public; Financial services; and Engineering, lawyers and professional services were some of the themes that stood out most strongly in the descriptions of business activities in the June survey.

Statement issued by Gerhard van Onselen, Senior Analyst: Sakeliga, 3 July 2020