PIC grows assets under management by R48 billion to R2. 131 trillion, declares dividend again

15 October 2019

The Public Investment Corporation (PIC), the biggest asset manager in South Africa, announced today that its assets under management (AuM) for the financial year ending March 2019 have grown to R2.131 trillion compared to R2.083 trillion the previous year. This represents a growth of R47.9 billion in the 12 month period. The growth is based on above average portfolio performance, underpinned by a sound investment strategy.

These assets are managed on behalf of Government Employees Pension Fund (86.75%), the Unemployment Insurance Fund (7.8%), the Compensation Commissioner Fund (1.97), the Compensation Commissioner Pension Fund (1.23%), other funds (1.5%) and the Associated Institutions Pension Fund (0.75%).

The portfolio is split into two broad asset classes, namely: Listed Investments (93.7 %) and Unlisted Investments, which is made up of Impact Investing, Private Equity and Properties (6.3%).

In an environment where state-owned entities are continuously seeking financial assistance from the state, the PIC is pleased that it had paid a dividend of R80 million to government as the Shareholder. This dividend is an increase from the R60 million paid in the previous financial year.

As the single largest asset manager in Africa by AUM, the PIC controls over 10% of the total JSE market capitalisation and its performance has been above its peers.

Acting Chief Executive Officer, Vuyani Hako said, “We are pleased with the results that the PIC managed to achieve when the operating environment was both challenging and complex, and characterised by slowing global and local economic conditions. These results have been made possible by two key factors. First, the highly experienced professionals that work for the PIC and secondly, the implementation of our long-term investment strategy. Backed by in-house research and tactical asset allocation, our investment strategy focuses on building a diversified portfolio that is strong enough to withstand and absorb unanticipated market shocks. This is done by carefully and diligently selecting appropriate investment opportunities. Through this strategy, we are able to achieve financial returns for our clients, whilst entrenching environmental, social and governance (ESG) principles at investee companies.”

Investment Performance

The PIC has consistently outperformed the clients’ listed investment benchmarks over the past decade. The listed Equity Portfolio, for an example, has performed above the median of its benchmark cognisant peer group, contributing to sustainable returns for clients.

|

Return Performance as at 31 December 2018 |

|||||

|

1 Year (p .a) |

3 Year (p .a) |

5 Years (p .a) |

7 Years (p .a) |

10 Years (p .a) |

|

|

Highest |

-3.13% |

7.41% |

8.37% |

10,49% |

12.56% |

|

Upper |

-4,39% |

5,40% |

6,78% |

10,30% |

12,38% |

|

Median |

-5.14% |

5.40% |

5.56% |

9.01% |

11,18% |

|

Average |

-5.55% |

4.88% |

5.09% |

8.41% |

10,65% |

|

Asset-weighted - |

-4.68% |

5.29% |

6.66% |

10.20% |

12,20% |

|

Lower Quartile |

-6.44% |

3.99% |

4.91% |

9.30% |

11,54% |

|

Lowest |

-8.78% |

1.63% |

2.78% |

7.49% |

10,26% |

|

Range |

5.64% |

5.78% |

5.59% |

2.99% |

2,30% |

|

Number of Private Sector Asset managers |

10 |

10 |

8 |

8 |

8 |

|

Public Investment Corporation |

-4.51% |

5.36% |

6.57% |

N/A |

10.78% |

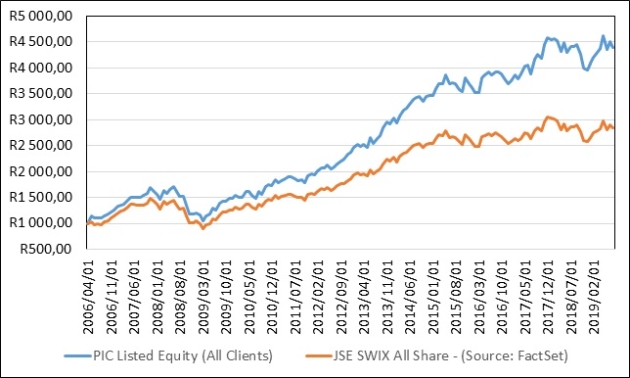

The graph below illustrates the performance* of the PIC’s listed equity portfolio in comparison to that of the JSE SWIX All share over a period of 12 years.

*The performance is based on an investment of R1000.

The Unlisted Investment portfolio performance is still dragging behind the targeted exit returns as a result of broader macroeconomic headwinds and driven more specifically by a few large transactions that were impaired. The Fund I is fully invested and the portfolio has started to show improvements on valuations. The Unlisted Investment has a huge direct social impact.

Some of the highlights for the financial year, which cover PIC’s drive for transformation, impact investing and implementation of the rest of Africa strategy, include the following:

- Approval of approximately R15 billion towards private equity, property and impact investments. Impact investments are the investment strategy that is meant to generate not only financial returns, but also a positive social returns. Social returns include job creation, empowerment of historically disadvantaged individuals and transformation of investee companies and different sectors of the economy and;

- Allocation of investments to the value of US$873,7 million (approximately R13 billion) towards investments in the rest of Africa and to facilitate African regional integration;

- 100% of funds approved under Impact Investments and Private Equity were awarded to emerging and/ or established black economic empowerment (BEE) firms that are more than 51% black-owned and 30% managed and controlled by historically disadvantaged individuals (HDIs);

- 96.77% of brokerage was paid to brokers on levels 1 to 4 BEE rating;

- 75.5% of total brokerage was paid to brokers that are 51% owned and 30% management controlled by HDIs; and

- 40% of approved new property developments and acquisitions were allocated to companies owned by women.

Apart from these highlights, the PIC is pleased with its Broad-Based Black Economic Empowerment (B-BBEE) Development Manager Programme, which seeks to increase participation of black asset managers and the number of black investment professionals in the asset management industry. To date, 18 B-BBEE managers have benefited from this programme. As at 31 March 2019, R107.3 billion, representing 60% of externally-managed funds, were managed by black-owned firms.

The Chairman of the PIC Board, Dr Reuel J Khoza said, “I am pleased with the results that have been achieved by the PIC, particularly given the context within which they were accomplished. These were achieved at the time when the PIC was under public scrutiny and subjected to prolonged negative publicity arising from the work of the Commission of Inquiry that was appointed by President Cyril Ramaphosa. The staff remained resilient and focused on the task at hand, which is to generate returns for clients. The key and immediate priorities for the interim Board are to stabilise the organisation, appoint a permanent CEO, fill all vacant senior executive positions and review policies and governance procedures to help restore trust amongst the PIC’s stakeholders and the public.”

“The PIC will continue to focus on financial sustainability and delivering on its legal and investment mandates. The Board is hard at work to improve staff morale and to ensure that business is conducted with high levels of professionalism, fairness, integrity and diligence. Sharper focus will be placed on human resources in order to attract and retain highly skilled investment professionals to ensure that we continue to perform above our peers. We also seek to entrench the culture of accountability and proper governance that is expected of an asset management company. As part of this process, the PIC is reviewing all its policies, including standard operating procedures and the delegation of authority to ensure proper risk management,” said Dr Khoza.

PIC CORPORATE

During the year under review the PIC, from a company perspective, met all its financial sustainability ratios, made a profit of R290 million and declared dividend of R80 million to the Shareholder.

The PIC managed to achieve an unqualified audit opinion from the Auditor-General of South Africa (AGSA), with findings on compliance to applicable laws and regulations. This is a regression from the previous financial year’s clean audit opinion. For the first time since the PIC’s corporatisation in 2005, the AGSA audited AuM. The AGSA findings relate to non-compliance to certain laws and regulations and concerns around compliance with some policies and procedures, which might result in the breaches of the Public Investment Corporation Act of 2004. The findings identified on the annual financial statements were adjusted and resulted in enhanced presentation and disclosure of the Annual Financial Statement. PIC management remains committed to enhance the control environment, to implement the recommendations by the AGSA in full and address all the concerns raised.

The PIC is pleased with the current portfolio positioning and is optimistic about the prospects for future returns. The PIC is poised to take advantage of possible attractive opportunities in the market and will continue its unbroken trajectory of outperforming clients’ mandates.

The successful implementation of the investment strategy and corporate performance was underpinned by strong risk management and robust information technology.

A copy of the annual report can be accessed from this link: https://www.pic.gov.za/DocAnnualReports1/PIC%20Integrated%20Annual%20Report%202019.pdf

Issued by Deon Botha, Head of Corporate Affairs, Public Investment Corporation, 15 October 2019