Auditor-General calls on government leaders to “act now” to halt the trend of disappointing audit results

The auditor-general (AG), Kimi Makwetu, today called on government leaders to take urgent action to halt the trend of disappointing audit results, restore accountability and prevent mismanagement of public funds.

Releasing his 2018-19 general report for national and provincial government and their entities, Makwetu says political leaders, accounting officers and authorities, as well as oversight structures “must take immediate action to restore government’s accountability to the people of South Africa. This could be done by acting on the outcomes of the recent audits, dealing effectively with material irregularities (MIs) that have been identified, and implementing preventative controls to turn the tide of undesirable stewardship over public funds”.

His report – themed Act now on accountability – reveals “disappointing” audit results for 2018-19, and “slow progress” over the five previous financial years. Makwetu attributes the stunted growth towards the desired audit outcomes largely to those charged with governance being slow to implement, or totally disregarding, audit recommendations made by his office.

First status update on the implementation of the AG’s enhanced powers

For the first time, Makwetu’s general report gives a status update on the first year of implementing the enhanced powers given to the AG through the amendment of the Public Audit Act (PAA).

The amendments became effective on 1 April 2019 and the Auditor-General of South Africa (AGSA) started implementing these at 16 selected auditees. The audit office will incrementally and systematically implement these amendments at other auditees across the three government tiers in the coming years.

Briefly mapping the lapses in governance and failures in basic internal controls that led to Parliament unanimously voting to amend the PAA, Makwetu paints a picture of administrators and authorities who had largely failed to implement audit counsel and recommendations from his office.

“Our recommendations did not require more than what accounting officers and authorities were legally obligated to do by existing laws such as the Public Finance Management Act. We simply re-emphasised basic accountability measures such as proper planning and budgeting; establishing internal controls; effectively dealing with transgressions; keeping proper records; as well as credibly reporting on finances and performance,” says Makwetu.

He says, executive authorities and oversight structures did not lead by example in setting the correct tone “that would enable accountability, transparency and good governance”.

1. The audit outcomes at a glance

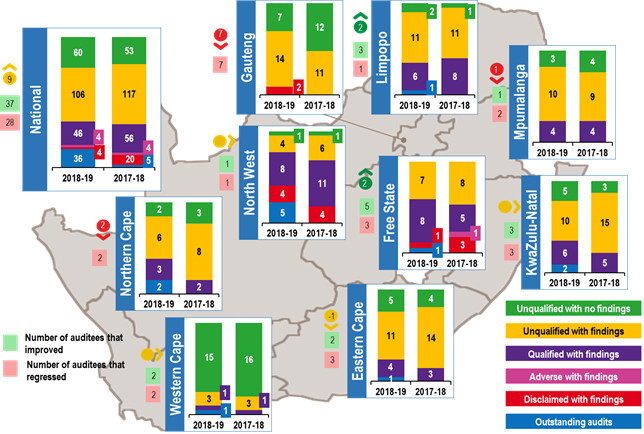

The graphic below shows a picture of audit outcomes across national and provincial government:

Audit outcomes across national and provincial government

Among its key findings, Makwetu’s report reveals the following:

Overall, the audit outcomes regressed since 2014-15 with only 80 auditees improving and 91 regressing. Only 100 (26%) of the auditees managed to produce quality financial statements and performance reports and to comply with key legislation, thereby receiving a clean audit. In 2014-15, 106 auditees had clean audits.

There were serious weaknesses in the financial management of national and provincial government that had not been addressed over the past five years.

The financial health of auditees continued to deteriorate – with departments in particular struggling to balance their finances.

Unauthorised expenditure remained high at R1,365 billion.

There was an emerging risk of increased litigation and claims against departments. Over a third of the departments had claims against them in excess of 10% of their next year’s budget.

A total deficit of R62,06 billion was incurred by the 31% of public entities whose expenditure exceeded their revenue – 90% of the total deficit related to the Road Accident Fund.

Fruitless and wasteful expenditure continued to rise, with 223 auditees losing R849 million in the current year. Over the five-year period, R4,16 billion of government expenditure was fruitless and wasteful.

Irregular expenditure increased to R62,60 billion from the R51 billion reported last year.

2. Reporting on first year of implementing the enhanced AG powers

When accountability mechanisms are failing, as described above, the amended PAA now gives the AG the mandate to report on material irregularities (MIs) detected during audits, and to take further action if accounting officers and authorities do not appropriately deal with such MIs. A material irregularity is defined as any non-compliance with, or contravention of, legislation, fraud, theft or a breach of a fiduciary duty, identified during an audit performed under the Public Audit Act, that resulted in or is likely to result in a material financial loss, the misuse or loss of a material public resource or substantial harm to a public sector institution or the general public.

The AG can now refer the matter to a public body to investigate or include recommendations in the audit report on what should be done to address the matter. The amendments further give the AG the power to take binding remedial action if his recommendations are not implemented; and, in cases where the remedial action is not implemented, the audit office can now issue a certificate of debt so that money lost can be recovered from accounting officers or authorities.

The approach to identify material irregularities in the 2018-19 audits

An MI means any fraud, theft, breach of a fiduciary duty or non-compliance with – or contravention of – the legislation that could result in a material loss, the misuse or loss of a material public resource, or substantial harm to a public sector institution or the general public.

For the 2018-19 audits, 16 national and provincial government auditees were identified for implementation of the MI process. Makwetu says the auditees were selected based on their audit outcomes and their history of having incurred irregular expenditure.

Auditors had completed 12 of these audits by the date of this report. Makwetu gave context to this by explaining that the limited time available from 1 April 2019 – when the PAA amendments came into effect – until the finalisation of the audits, the complexity of some of the matters his office dealt with, and the time they gave accounting officers and authorities to respond to identified MIs, affected their ability to finalise most of the audits by 31 July.

Difference between material irregularity and irregular expenditure

The table below outlines the difference between an MI and irregular expenditure:

|

IRREGULAR EXPENDITURE |

MATERIAL IRREGULARITY |

|

Irregular expenditure is all expenditure where there was non-compliance with legislation in the process leading up to the payment. For example, if the procurement process for the awarding of a construction contract did not comply with legislation on supply chain management, all payments to that contractor will be irregular expenditure. When irregular expenditure is identified, the accounting officer or authority is required to perform an investigation to determine the impact by considering if the non-compliance resulted in a financial loss, whether there was any fraud involved, and if an official should be held accountable. If there was no loss or fraud, the irregular expenditure will be condoned after the necessary disciplinary action had been taken. |

As with irregular expenditure, an MI also stems from non-compliance with legislation, but it has a broader scope and can be applied to fraud, theft and a breach of fiduciary duty (which means that an official did not do what legislation requires and/or did not act in the best interest of the auditee). Another key difference is that for any non-compliance to be considered an MI, there must already be an indication that the non-compliance resulted in, or is likely to have, a material impact, in the form of a material financial loss, the misuse or loss of a material public resource, or substantial harm to a public sector institution or the general public. |

Results of the first phase of material irregularity implementation

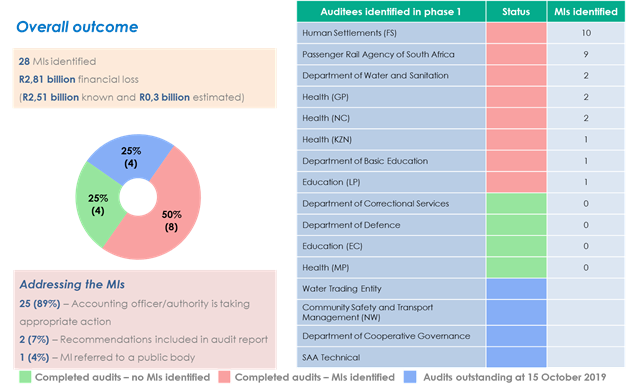

The AG’s report reveals that a total of 28 MIs was identified at eight of the auditees, which resulted in a financial loss of R2,81 billion. Of this amount, R2,51 billion is known as the accounting officer or authority quantified the loss, and the remainder is an estimate of the loss.

Of the known loss, R2,2 billion is the money expected to be lost as a result of the irregularities in the purchase of locomotives by the Passenger Rail Agency of South Africa.

The most MIs (10) were identified at the human settlements department in the Free State, followed by the Passenger Rail Agency of South Africa (9).

The graphs below summarise the phase 1 MI implementation outcomes:

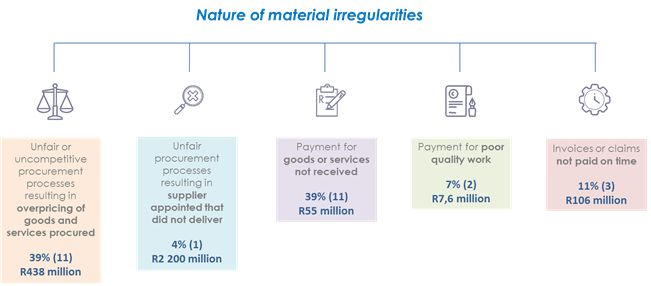

The graph below lists the nature of the MIs identified during this phase:

What happens with the identified material irregularities?

An MI is only fully resolved if:

1. the loss (or further losses) is prevented and/or any losses incurred have been recovered or all possible steps have been taken to recover the losses; and

2. appropriate steps have been taken against the person or party responsible for the loss.

The MIs and the progress made in resolving them will be reported in the audit report of the auditee and in general reports until they have been fully resolved to enable accountability and oversight.

3. Financial health of auditees

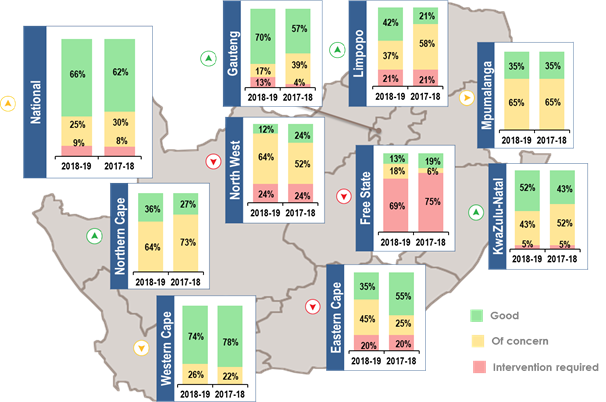

The graph below indicates national and provincial financial status movements:

The financial health of auditees in most provinces either improved or remained unchanged, with the Eastern Cape, Free State and North West showing a regression. There are still a significant number of auditees in the Free State that need urgent attention.

The financial health of departments showed a further slight regression in 2018-19 – continuing on a downward spiral since 2014‑15. The departments with a good financial health status represented only 15% of the expenditure budget of departments.

Included in the 57 departments with a good financial health status in the current year, are 26 departments that were able to maintain their good financial health status from the previous year and when compared to 2014-15. These departments are most prevalent in Gauteng (eight), Western Cape (five) and national government (five).

Overall, 13 of the 15 departments that we identified as requiring urgent intervention disclosed in their financial statements that they might find it difficult to continue to operate.

4. Irregular expenditure increases

Irregular expenditure increased to R62,60 billion from the R51 billion reported last year. This total includes the irregular expenditure of those auditees where the AGSA had completed the audits after the cut-off date of this report (R19,76 billion).

It is worth noting that the amount could be even higher, as 34% of the auditees were qualified because the amount disclosed was incomplete and/or disclosed that they had incurred irregular expenditure but that the full amount was unknown. In addition, the AG notes, “we could not audit R2,33 billion worth of contracts due to missing or incomplete information”.

5. Unauthorised expenditure decreases

Makwetu said it was encouraging to report that unauthorised expenditure decreased by 23% from the previous year, but said the increase in the number of departments incurring this type of expenditure remains concerning.

Four of the 18 departments that incurred unauthorised expenditure in the current year, also incurred this type of expenditure for the past three years. The two departments in the Free State, namely Education as well as Police, Roads and Transport, have incurred this type of expenditure for the past five years.

The AG said the high unauthorised expenditure “paints a picture of departments unable to operate within their budgets – resulting in deficits and overdrafts”. In total, 108 departments (74%) technically had insufficient funds to settle all liabilities that existed at year-end if the unpaid expenses at year-end were also taken into account. This means that these departments started the 2018-19 financial year with part of their budget effectively pre-spent.

6. Fruitless and wasteful expenditure increases

The number of auditees with fruitless and wasteful expenditure remained the same as in the previous year. A total of 184 auditees incurred fruitless and wasteful expenditure in both the current and the previous year, 158 of which had incurred such expenditure for the past three years.

Makwetu cautioned that “government cannot afford to lose money because of poor decision-making, neglect or inefficiencies; however, we continue to see a rise in fruitless and wasteful expenditure”. This expenditure, which is effectively money lost, increased by 7% from the previous year. The overall increase was mostly as a result of the loss of R110 million by the national Department of Energy and R101 million by the Free State Department of Health. These losses relate to additional storage costs for solar water heater geysers manufactured and stored by suppliers beyond the agreed storage period and remedial work done on infrastructure projects, respectively.

7. State-owned entities require urgent attention

The AG’s report indicates that the results of the audited state-owned entities (SOEs) continued to regress from the previous year. None of the SOEs managed to obtain a clean audit opinion, with the South African Post Office slipping back to a qualified audit opinion and the Development Bank of Southern Africa regressing from a clean audit in 2017-18 to a financially unqualified opinion with findings in the year under review.

A number of the SOE audits had not been completed by the 30 September cut-off date. The AG, however, reports that this “situation has improved slightly when compared to this time last year”. He says the delays were mainly “due to financial statements and audits that were delayed because of SOEs struggling to demonstrate that they were going concerns”.

The financial health of SOEs has “remained under significant pressure”. He reports that there was significant doubt about whether some of the SOEs can continue with their operations in future without financial assistance. There were weaknesses in the performance reporting processes and an increase in non-compliance at the 14 SOEs and their significant subsidiaries audited by the AGSA. These entities also disclosed R1,4 billion in irregular expenditure, although the amount could be even higher as four SOEs – Denel, the South African Broadcasting Corporation, South African Express Airways and the South African Forestry Company – were qualified on the completeness of their irregular expenditure disclosure.

The irregular expenditure of the SOEs the AGSA did not audit amounted to R57 billion, which included R49,9 billion at Transnet and R6,6 billion at Eskom.

The report highlights the fact that the 10 departments responsible for overseeing SOEs did not have consistent oversight practices and the majority did not adequately plan for their oversight function and report on it in their performance reports.

“As the audit office, we recommend that the SOEs be directed by stabilising their leadership tasked to operationalise the action plans designed to improve the strategic direction and internal controls of the SOEs. Those tasked with the oversight of SOEs should set clear responsibilities to periodically evaluate the SOEs’ actual performance against the predetermined performance targets and to implement consequences when such targets are not met,” counsels Makwetu.

8. AG calls for action to improve provincial audit outcomes

The AG has called on the provincial leadership and provincial legislatures to pay attention to improving the audit outcomes in the provinces.

Western Cape continues to produce best results

The Western Cape continued to produce the best results with 79% clean audits and the lowest irregular as well as fruitless and wasteful expenditure. At 74%, the province also had the highest number of auditees with a good financial health status and there were no auditees with unauthorised expenditure. Makwetu says over the five years, “there has been a solid and consistent pattern of good audit outcomes” in the province. He says this can be attributed to the provincial leadership and accounting officers and authorities “instilling a culture of accountability and good governance”.

KwaZulu-Natal results remained unchanged

Overall, the outcomes in KwaZulu-Natal remained unchanged with three auditees improving and three regressing – there are now five clean audits as opposed to three in the previous year. The AG noted that there are recurring trends visible in the province, but said “greater effort is required to trigger stronger outcomes”.

At R12,4 billion, the irregular expenditure of the province is the highest of all the provinces and more than that of national government. Its closing balance of R41,9 billion is also the highest of all the provinces – this despite the AGSA’s ongoing recommendations to leadership to take steps to avoid the abuse of supply chain management legislation.

Eastern Cape results progressed; greater effort is required for sustainability

The Eastern Cape’s audit results progressed since 2014-15, but greater effort is required for sustainability. The province’s audit outcomes regressed slightly in 2018-19. The AG says this is due to “the slow pace of addressing the root causes of the findings we raise every year in spite of commitments from accounting officers and authorities”.

He said the culture of non-compliance – especially in the area of supply chain management – continued as a result of leadership’s tolerance for deviations from legislative requirements. “We again raised our concerns about the financial health of the auditees in the province – specially the commitments by and claims against departments – which could potentially have a negative impact on provincial funding.”

Limpopo’s improved outcomes encouraging; more work needed to sustain these

The improvement in the audit outcomes of Limpopo (three auditees improved and one regressed) is an encouraging trend, “but more work needs to be done before we can say that the improvement is sustainable”, says the AG. He says to facilitate sustainable change, the lack of discipline in controls needs to be addressed and a decisive commitment must be made to effect consequences.

The province’s irregular expenditure increased to just over R2 billion as a result of widespread non-compliance with supply chain management legislation, “fed by a blatant disregard for legislation and officials not being held accountable for these transgressions”.

Mpumalanga results regressed

Mpumalanga’s audit outcomes regressed after an improvement in the previous year. The AG’s report reveals that the province’s results have been erratic over the past five years – with auditees not sustaining their outcomes. This is largely due to a failure to institutionalise strong internal controls, which has in turn resulted in unstable internal control environments.

Makwetu says Mpumalanga’s audit outcomes “should be observed closely to see whether the leadership can effectively address the warning signals we reported”.

After years of obtaining 100% unqualified audits, Gauteng results show a concerning trend Makwetu says his office has noticed a concerning trend emerging from the audit outcomes in Gauteng. After years of obtaining 100% unqualified audit opinions, two of the province’s auditees obtained disclaimed opinions. The clean audits have decreased from 12 to seven. Irregular expenditure increased and his office again reported deficiencies in the management and delivery of key projects in the province. “Accounting officers and authorities did not respond timeously to the findings we raised in prior years, especially on the need to strengthen the supply chain management processes and reporting on performance.”

“We were encouraged by the tone set by the premier upon engagement with the outcomes. Firm steps are already being taken to give attention to the matters raised in the audit.”

Northern Cape audit results regress further

As in the previous year, the Northern Cape made no major strides to improve its audit outcomes. The audit results regressed – registering two regressions and no improvements – as was the case in the previous year.

The province’s leadership remained slow to address the audit office’s continued calls for improved controls and consequences for transgressions and poor performance. The AG says the provincial leadership made numerous commitments in the past but the impact was minimal, as very little was done to implement and monitor these.

Free State results improved overall but accountability is still a concern

While the audit outcomes improved overall in the Free State – five improvements and three regressions – and there was “a notable effort towards reducing disclaimed and adverse opinions, the overall accountability in the Free State is still a concern,” says the AG.

It is the only province with no clean audit and its financial health is in a very bad state with 69% of the auditees requiring urgent intervention. It also has the highest unauthorised as well as fruitless and wasteful expenditure of all the provinces.

“A culture of no consequences prevails, and the political leadership is involved in the decision-making at some auditees. The continued disregard for procurement processes resulted in irregular expenditure at all auditees and created an environment vulnerable to the abuse of state funds. Our audits revealed poor planning, management and monitoring of infrastructure and other projects. The completion of these projects was often delayed, resulting in the quality of work being compromised and project costs being exceeded. This had a negative impact on the delivery of services, as funds were not always used effectively and efficiently to provide sustainable services.”

North West requires greater effort and focus to shift the audit outcomes

The premier has led by example in setting the tone for accountability in the province and this has been embraced by members of the executive council. It resulted in a stagnation of the overall poor audit outcomes for the first time in four years. This is an indication of a turnaround, which requires greater effort and focus from the new political leadership to shift the audit outcomes.

Following the intervention by the inter-ministerial task team to place five departments under administration during July 2018, certain improvements in the control environment of departments were noted, and these should be sustained and replicated in the province. This encouraging trend and effort were not substantive enough to have an impact on the overall audit outcomes of the province.

The irregular expenditure remained high at R3,2 billion and the closing balance was one of the highest of the provinces at R18,8 billion.

“We urge the new political leadership together with the inter-ministerial task team to continue setting the right tone for accountability and consequences, including efforts to fully restore governance in the province.”

1. Preventative measures required to improve governance systems

Preventing poor-quality financial statements and performance reports, non-compliance and MIs is more effective than having to deal with the consequences thereof. A proactive approach aimed at identifying risks and requiring assurance from accounting officers and authorities that these risks are being mitigated through preventative controls will have a positive impact on the control environment of auditees.

Says Makwetu: “My message over the years has been that a strong control environment and processes are key to achieving strategic objectives, addressing risks, ensuring compliance with legislation, and managing public funds to the benefit of citizens. I acknowledge that it takes time to institutionalise good preventative controls, especially in large and complex environments, but the accounting officers and authorities need to build their institutions towards accomplishing this in a deliberate manner.”

The in-year status of records reviews that the AGSA performs and engages on with accounting officers and authorities provide an early warning system whereby accounting officers and authorities are alerted to matters that can potentially lead to undesirable audit outcomes.

AGSA reports and briefings will be a good source of information in this regard, but the AG also strongly encourages engagement with the chair of the audit committee and the head of the internal audit unit on their perspective, as they have a key responsibility to assess risk and control.

He says Parliament and legislatures – through the portfolio committees and standing committees on public accounts – can also play a pivotal role in strengthening preventative controls.

10. Conclusion

Makwetu is encouraged by the enthusiasm displayed by the sixth administration’s leadership towards improving the governance lapses his office has been flagging for years now.

He says after extensively engaging with the new leadership at provincial and national level (both administrative and oversight) “to prepare them for the introduction of the MI process and the urgency for accountability, the opportunities for progressive and sustainable change are evident to us based on the enthusiasm and commitment by this new leadership. If we can turn this into tangible action by acting on accountability, we can go a long way in turning the current state of undesired audit outcomes.”

“Accounting officers and authorities reacted positively to the notifications of the MIs we identified, and most of them are taking appropriate action to address these. They had already started taking action in some cases by the time we formally notified them of the MI. At some, preliminary investigations were done within the 20 working days we gave them to respond to our notification. This demonstrates that they understand what they are required by legislation to do when they become aware of irregularities and that they are willing and able to take on these responsibilities.”

There has been a similar positive response to Makwetu’s emphasis on the value of preventative controls to proactively manage public resources.

“We are also encouraged by the decision taken by the Committee of Chairs in the National Assembly upon presentation of these overall national audit outcomes. They have already decided to review and workshop the parliamentary oversight model to ensure that they deliberately incorporate some of the matters we have elevated. This is to help strengthen the focus of portfolio committees. This interaction is planned for January/February 2020 as part of a comprehensive national response to these audit outcomes.”

Makwetu concludes: “As the audit office we remain committed to working tirelessly within our new mandate to strengthen financial and performance management in national and provincial government, emphasising the need for accountability and doing the basics right. We encourage Parliament and the provincial legislatures as well as the political and administrative leadership to play their part effectively and without fear or favour to ensure accountability for government spending and improvement in the lives of the citizens of this country.”

Issued by the Auditor-General South Africa, 20 November 2019