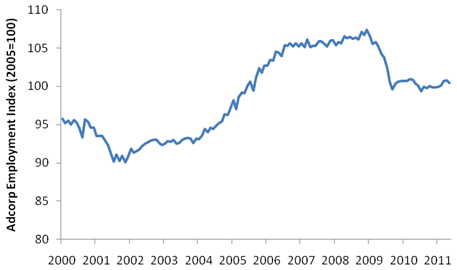

Adcorp Employment Index, May 2011

Salient features

- Employment dropped at an annual rate of 2.5% during May, the first decline in 5 months.

- The decline is attributable to a sharp drop in employment in the construction (-20.1%) and manufacturing (-11.0%) sectors, as well as a small drop in government employment following the local government elections (-2.7%).

- A sharp division occurred between high-skilled employment (which increased by 4.5%) and low-skilled employment (which declined by 3.7%). Employment of machine operators and elementary workers dropped sharply, by 14.9% and 12.9% respectively.

- Based on World Economic Forum (WEF) data, South Africa's labour market competitiveness fell by 8.1% over the past year. South Africa's labour laws and regulations are now the 7th most restrictive out of 139 countries in the world. According to a survey of the world's 1,000 largest multinationals, restrictive labour regulations are the 4th most problematic factor for doing business in South Africa.

Analysis

According to a recent report by South Africa's National Planning Commission[1], there is widespread agreement - including such authorities as the International Labour Organisation (ILO), the Organisation for Economic Cooperation and Development (OECD), and the International Monetary Fund (IMF) - that South Africa's labour laws "are not the principal cause of high unemployment. [...] These laws are not overly rigid relative to either developed or developing countries." These conclusions lead organizations such as the Congress of South African Trade Unions (COSATU) to argue that "[labour market] deregulation will neither enhance overall flexibility nor lead to a substantial improvement in employment"[2].

The problem with the conclusions is that they flow from research produced or heavily funded by government bodies. For example, two professors at the University of Cape Town - apparent experts in the field of labour law and regulation - conclude that "South Africa is not an extraordinarily over-regulated (or indeed under-regulated) labour market"[3]. However, this research programme was funded by the Department of Labour, with its close links to trade unions, in particular COSATU, which lends the possibility of bias and consequently a lack of credibility to the results.

Under the sheer volume of academic, government and trade union research, much of it funded and supported by the South African government, businesses' overall attitude toward South Africa's labour laws is relatively unknown. That is, until recently, when a raft of anti-business labour law amendments was proposed at the National Economic Development and Labour Council (NEDLAC). In response to those amendments, one of South Africa's senior business editors argued that the country's labour regulations are "designed not only to block job creation but to shed jobs by making life more difficult for business"[4].

The world's most august and powerful body of businesses, the World Economic Forum (WEF), is a foundation funded by its 1,000 member companies, typically global multinationals with more than $5 billion in turnover. As such the WEF represents the views of large, global businesses accounting on their own for more than 20% of foreign direct investment flows into developing countries. According to the WEF, in terms of global competitiveness South Africa ranks 54th overall out of 139 countries (i.e. a score of 61.1%). However, South Africa ranks 97th (30.2%) in terms of labour market efficiency.

It is possible to separate the WEF's labour market efficiency ranking into two components, i.e. regulated and unregulated. The regulated ranking refers to factors which are directly controlled or heavily influenced by government and/or legislation, such as cooperation in employer/employee relations (which is regulated by the Labour Relations Act 1995) and hiring and firing practices (which are regulated by the LRA and the Basic Conditions of Employment Act 1997). The unregulated ranking refers to factors which are primarily influenced by private sector practices and institutions, such as the professional merit of management (which is not directly regulated by any law or regulation in South Africa).

By separating the WEF's overall labour market efficiency ranking in this way, it is clear that South Africa's regulated (i.e. government-controlled or -influenced) labour market ranking is 133rd in the world (4.6%), whereas South Africa's unregulated (i.e. private sector) ranking is 64th in the world (53.6%). South Africa performs poorest against firing practices (135th), labour unrest (132nd) and wage inflexibility (131st). As ranked by the WEF, restrictive labour regulations are the 4th most problematic factor for doing business in South Africa. Alarmingly, South Africa's regulated labour market competitiveness ranking has slipped from 123rd (11.5%) in 2008 to 133rd (4.6%) in 2011 - a decline of 8.1% in just one year.

South Africa's relatively high labour market ranking among developing countries may therefore be attributed to a weighting or averaging process, whereby South Africa's high-ranking private sector labour market and low-ranking regulated labour market "cancel out" each other, presenting a highly misleading overall picture about South African labour laws and regulations. According to WEF data, South Africa's labour laws and regulations are the 7th most restrictive out of 139 countries in the world.

Additional Data

Employment by Type

|

Occupation |

Employment May 2011 |

Percentage change vs. Apr 2010* |

|

Unofficial sector |

6,155,332 |

2.16 |

|

Official sector |

12,937,805 |

-4.68 |

|

Typical (permanent, full-time) |

9,110,446 |

-6.00 |

|

Atypical (temporary, part-time) |

3,827,359 |

-1.54 |

|

- of which agencies |

996,212 |

-1.23 |

|

Total |

1,909,3137 |

-2.49 |

* Annualized

Employment by Sector

|

Sector |

Employment May 2011 (000s) |

Percentage change vs. Apr 2011* |

|

Mining |

315 |

3.82 |

|

Manufacturing |

1,407 |

-10.99 |

|

Electricity, gas and water supply |

87 |

-13.64 |

|

Construction |

529 |

-20.07 |

|

Wholesale and retail trade |

1,655 |

2.91 |

|

Transport, storage and communication |

540 |

6.70 |

|

Financial intermediation, insurance, real estate and business services |

1,611 |

1.49 |

|

Community, social and personal services |

2,621 |

-2.74 |

* Annualized

Employment by Occupation

|

Occupation |

Employment May 2011 (000s) |

Percentage change vs. Apr 2011* |

|

Legislators, senior officials and managers |

1,031 |

3.50 |

|

Professionals |

684 |

7.06 |

|

Technical and associate professionals |

1,567 |

3.07 |

|

Clerks |

1,463 |

0.00 |

|

Service workers and shop and market sales workers |

1,804 |

2.67 |

|

Skilled agricultural and fishery workers |

103 |

0.00 |

|

Craft and related trades workers |

1,450 |

-2.48 |

|

Plant and machine operators and assemblers |

1,037 |

-14.86 |

|

Elementary occupation |

2,401 |

-12.86 |

|

Domestic workers |

840 |

1.43 |

* Annualized

Statement issued by Adcorp, June 13 2011

Click here to sign up to receive our free daily headline email newsletter

[1] National Planning Commission. (2011). "The Labour Market", in Diagnostic Document and Elements of the Draft Vision Statement for 2030. Pretoria: Government Printer.

[2] Congress of South African Trade Unions. (1999). "Labour Market Policy in the Era of Transformation". http://www.cosatu.org.za/show.php?ID=819&cat=Policy

[3] Bhorat, H., and H. Cheadle. (2009). "Labour Reform in South Africa: Measuring Regulation and a Synthesis of Policy Suggestions". University of Cape Town: Development Policy Research Unit (Working Paper 09/139).

[4] Mthombothi, B. (2011). "Giving the State and Labour Enough Rope". Financial Mail (13 January).