Economic Update: Expropriation committee, weak offshore growth weigh down business sentiment – Sakeliga report

19 November 2018

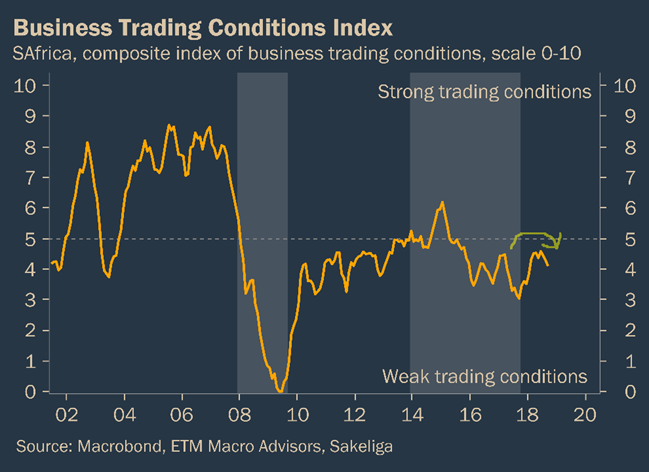

A host of indicators signalled ongoing weakness in business conditions in South Africa up to November 2018, a result of mounting regulatory uncertainty around property rights, high taxes, an investment slump, and weaker growth in Europe and China.

This is according to the November 2018 edition of the ETM-Sakeliga Quarterly Economic Update, which highlights relevant macroeconomic and policy trends that affect the operating conditions of South African businesses.

Gerhard van Onselen, senior analyst at Sakeliga, describes trading conditions up to November as challenging, noting that, “The recovery which started in September 2017 has dwindled in 2018. A range of indictors show employment conditions are probably at their weakest levels since the 2009 recession.”

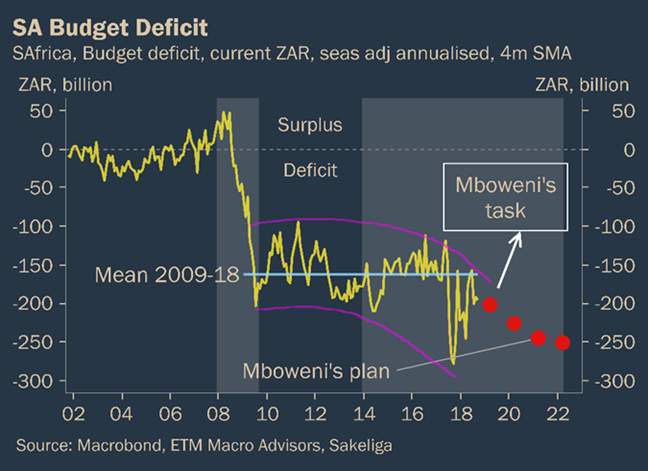

“In our view, the state’s haphazard contemplation of expropriation without compensation – a growing concern, especially given the questionable conduct of the joint constitutional review committee – has been a major impediment to business investment and revenues. Slowing European and Chinese economic activities are further weighing down the South African economy. Unfortunately, government’s deteriorating finances means fuel price and income tax hikes are likely to be announced next April,” Van Onselen added.

The report notes that the overall inflation risk does not seem sufficient to cause SARB rate hikes in the next six months. It also discusses economic risks in China and Europe and offers brief insights for importers and exporters.

The latest report contains a 1-page business and economic dashboard, which provides a summary of the local business operating environment and broad considerations for corporate strategy. It also devotes 1 page each to key South African and global economic insights. Charts are included to visualise the analysis.

The complete report is accessible at the following link.

Issued by Gerhard van Onselen, Senior Analyst, Sakeliga, 19 November 2018